Home Office Deduction For Employee

What is home office deduction for employee?

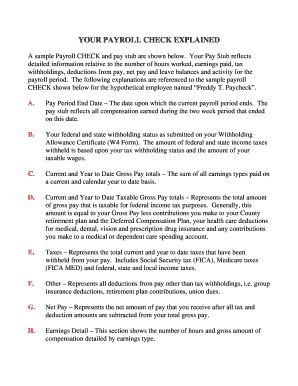

The home office deduction for employees is a tax benefit that allows certain employees to deduct expenses related to their home office. It is designed to help offset the costs of maintaining a home office space for work purposes.

What are the types of home office deduction for employee?

There are two types of home office deductions for employees: 1. Regular method: This method allows employees to deduct a portion of their home expenses, such as rent, mortgage interest, utilities, and insurance, based on the percentage of their home used for work. 2. Simplified method: This method allows employees to deduct a standard amount for each square foot of their home office, up to a maximum of 300 square feet. It simplifies the calculation process and is a good option for those who have a small home office.

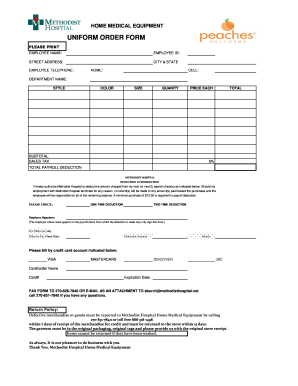

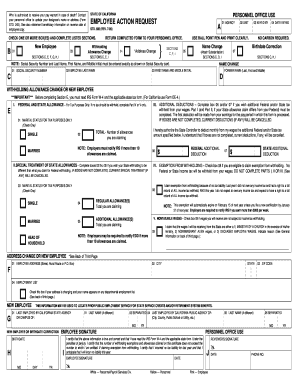

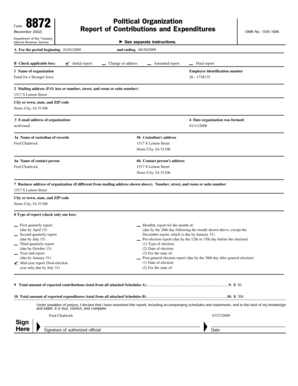

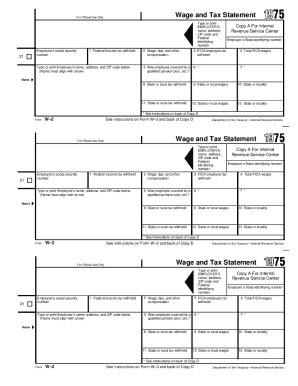

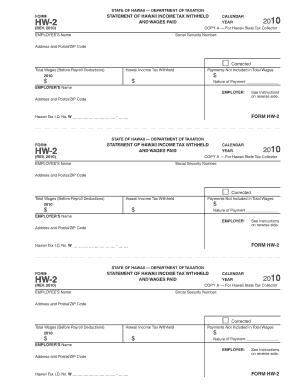

How to complete home office deduction for employee

To complete the home office deduction for employees, follow these steps: 1. Determine if you qualify: Make sure you meet the requirements set by the IRS to claim a home office deduction. 2. Gather necessary documentation: Collect all relevant documents and receipts to support your claim, such as receipts for home office expenses and proof of regular and exclusive use of the home office. 3. Calculate your deduction: Depending on the method you choose, calculate the deduction using the appropriate formula. 4. Report the deduction on your tax return: Fill out the necessary forms and include the home office deduction on the appropriate section of your tax return. 5. Maintain records: Keep copies of all documents and records related to the home office deduction in case of an audit.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.