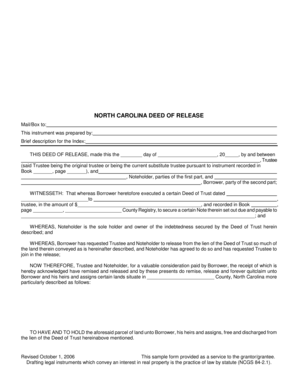

How To Write A Deed Of Trust

What is how to write a deed of trust?

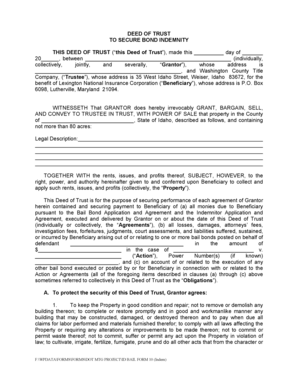

A deed of trust is a legal document used in many real estate transactions. It is a type of security instrument that allows a borrower to transfer interest in their property to a trustee, who holds the property until the borrower repays the loan. It is an important document that helps protect the rights of both the lender and the borrower in a real estate transaction.

What are the types of how to write a deed of trust?

There are several types of deeds of trust that can be used depending on the specific circumstances of the real estate transaction. Some common types include: 1. First Deed of Trust: This type of deed of trust is usually used when a borrower is obtaining a primary loan on a property. 2. Second Deed of Trust: This type of deed of trust is used when a borrower is obtaining a secondary loan on a property, such as a home equity loan or a line of credit. 3. Wraparound Deed of Trust: This type of deed of trust combines an existing loan with a new loan, allowing the borrower to take advantage of a lower interest rate without refinancing. 4. Assignment of Deed of Trust: This type of deed of trust is used when a lender transfers their interest in a property to another party, often as part of a loan sale or foreclosure proceedings.

How to complete how to write a deed of trust

To complete a deed of trust, follow these steps: 1. Identify the parties involved: The deed of trust will typically involve the borrower, the lender or beneficiary, and the trustee. Identify these parties and their roles in the transaction. 2. Describe the property: Provide a detailed description of the property that will be encumbered by the deed of trust. 3. Specify the loan terms: Outline the terms of the loan, including the principal amount, interest rate, repayment terms, and any additional provisions. 4. Sign and notarize the deed of trust: All parties involved should sign the deed of trust in the presence of a notary public. 5. Record the deed of trust: File the deed of trust with the appropriate county recorder's office to make it a public record. 6. Notify the borrower and lender: Provide copies of the recorded deed of trust to the borrower and lender for their records.

pdfFiller is an online platform that empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done quickly and efficiently.