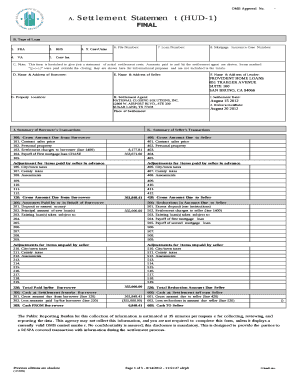

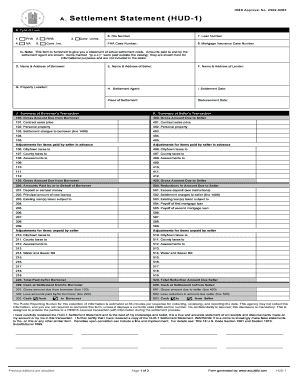

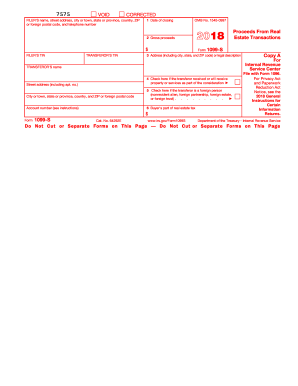

Hud-1 Form 2016

What is hud-1 form 2016?

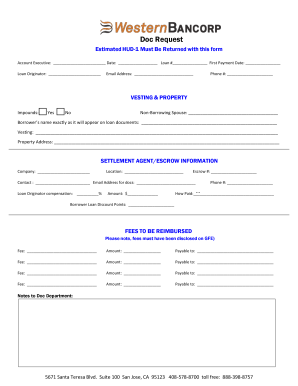

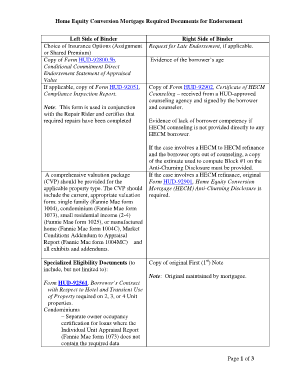

The HUD-1 form 2016 is a standard form used in real estate transactions in the United States. It is also known as the Settlement Statement and is required by the Department of Housing and Urban Development (HUD) for all transactions involving federally related mortgage loans. This form provides a detailed breakdown of the closing costs and expenses associated with the purchase or sale of a property.

What are the types of hud-1 form 2016?

There are no specific types of HUD-1 form 2016. However, the form may vary slightly depending on the nature of the transaction. For example, there may be differences in the sections related to buyer and seller information, loan terms, and financial calculations based on whether it is a purchase, refinance, or assumption transaction.

How to complete hud-1 form 2016

Completing the HUD-1 form 2016 requires careful attention to detail. Here is a step-by-step guide to help you:

It is important to note that the HUD-1 form 2016 may be revised or updated periodically, so it is essential to use the latest version available. As a helpful resource, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.