What is hud statement for taxes?

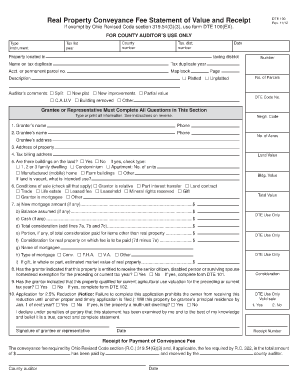

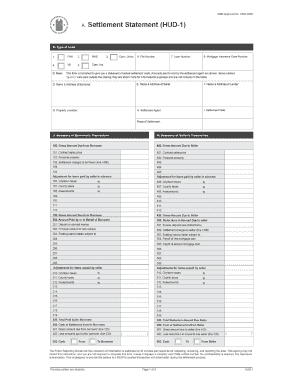

A HUD statement, also known as a HUD-1 Settlement Statement, is a document that provides an itemized list of the fees and charges associated with a real estate transaction. It is typically used in the United States during the purchase or sale of a property. The HUD statement for taxes specifically includes information related to taxes, such as property taxes and other tax-related expenses.

What are the types of hud statement for taxes?

There are several types of HUD statements for taxes that can be encountered during a real estate transaction. These may include:

HUD-1 Settlement Statement: This is the most common type of HUD statement used for taxes and provides a comprehensive breakdown of all fees and charges.

Closing Disclosure: This document includes information about the loan terms, closing costs, and the amount of money that the buyer and seller must bring to the closing.

ALTA Settlement Statement: This type of HUD statement is used when a transaction involves title insurance and provides details about the premiums and fees associated with the insurance.

CD-This document provides a summary of the charges and credits related to a real estate transaction.

How to complete hud statement for taxes

Completing a HUD statement for taxes involves several steps. Here is a step-by-step guide to help you:

01

Gather all the necessary information and documents related to the real estate transaction and taxes.

02

Carefully review and double-check all the figures and calculations on the statement.

03

Ensure that all the relevant fees and charges are properly listed and accounted for.

04

Include any additional tax-related expenses that may be applicable to the transaction.

05

Verify the accuracy of the tax amounts and ensure they match the applicable tax laws and regulations.

With pdfFiller, users are empowered to easily create, edit, and share HUD statements and other important documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the go-to PDF editor for completing and managing all your document needs.