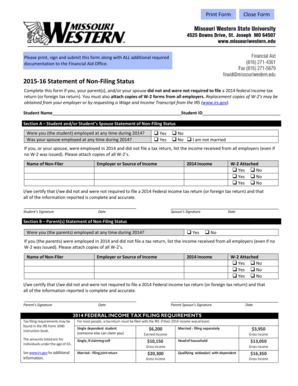

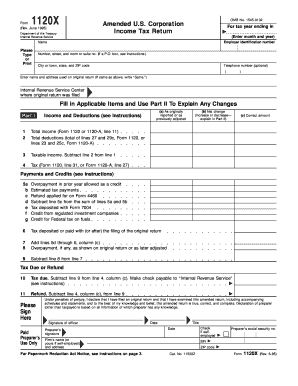

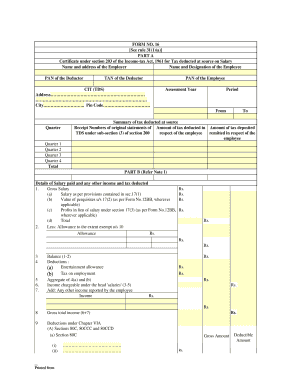

Income Tax Return Form 2015-16

What is income tax return form 2015-16?

The income tax return form 2015-16 is a document that individuals and businesses need to fill out and submit to the tax authorities to report their income and pay their taxes for the financial year 2015-16. It is a crucial form for ensuring compliance with the tax laws and fulfilling tax obligations.

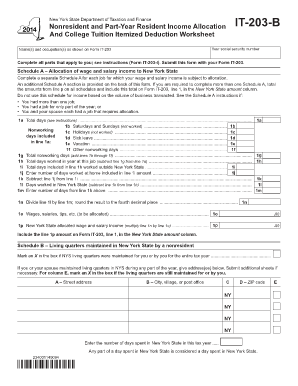

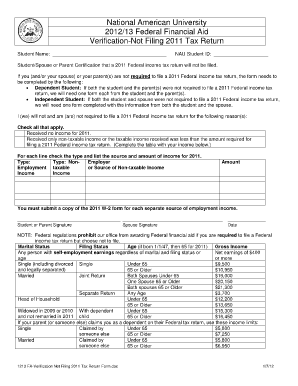

What are the types of income tax return form 2015-16?

There are different types of income tax return forms for individuals and businesses for the financial year 2015-16. The types of forms vary based on the source and nature of income, such as ITR-1 for individuals with salary income, ITR-2 for individuals with income from house property or capital gains, ITR-3 for business owners, and so on. It is important to select the appropriate form based on your income sources to accurately report your earnings and claim deductions.

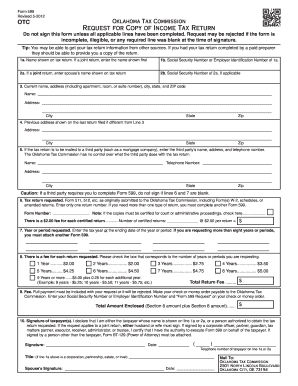

How to complete income tax return form 2015-16

Completing the income tax return form 2015-16 requires attention to detail and accurate information. Here are the steps to complete the form:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.