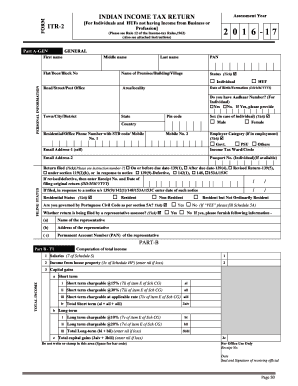

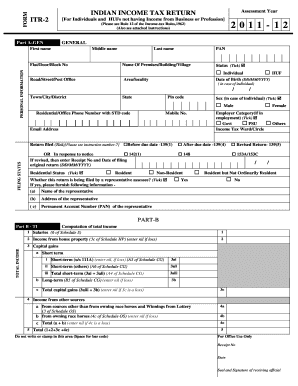

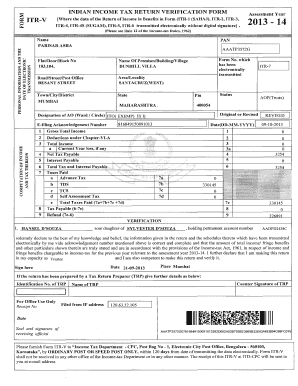

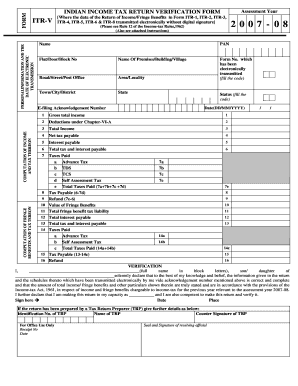

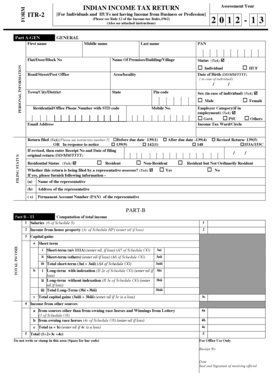

Itr 2

What is itr 2?

itr 2 is a form that is used for filing income tax returns in India. It is applicable to individuals and Hindu Undivided Families (HUFs) who do not have income from business or profession. This form helps taxpayers to report their income from various sources such as salary, house property, capital gains, and other sources.

What are the types of itr 2?

There are no specific types of itr 2, as it is a single form used for a particular category of taxpayers as mentioned above. However, taxpayers may have different sources of income which they need to report in itr 2.

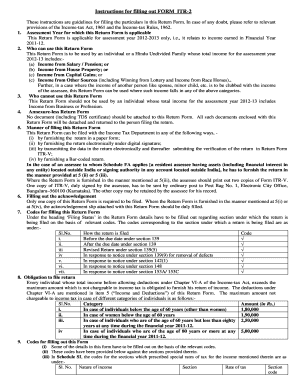

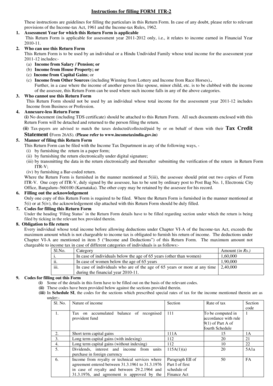

How to complete itr 2?

Completing itr 2 is a simple process if you follow these steps:

Remember, using pdfFiller can make the process even easier. With powerful editing tools and unlimited fillable templates, you can quickly and accurately complete itr 2. pdfFiller empowers users to create, edit, and share documents online, ensuring a hassle-free experience.