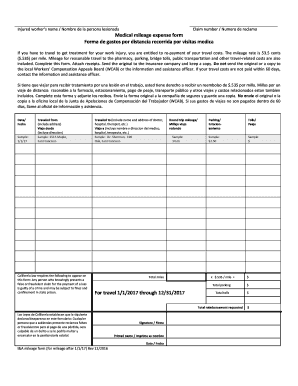

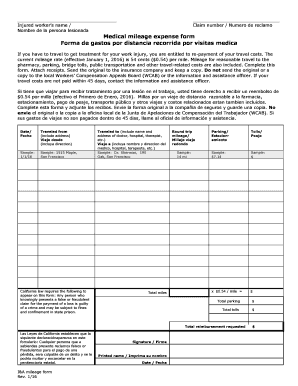

What is medical mileage expense form 2017?

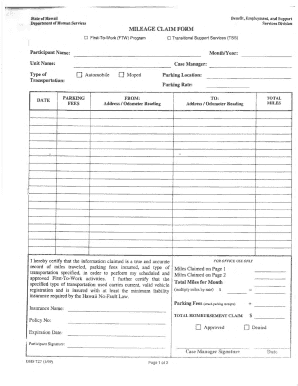

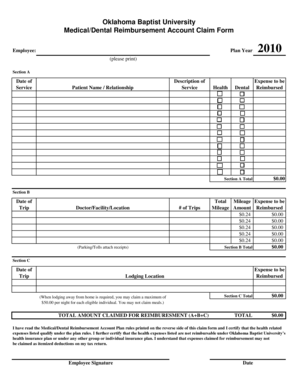

The medical mileage expense form 2017 is a document used to record and claim reimbursement for mileage expenses incurred while traveling for medical purposes. It includes important information such as the purpose of the trip, date of travel, starting and ending locations, and the number of miles traveled.

What are the types of medical mileage expense form 2017?

There are two main types of medical mileage expense forms in 2017:

Standard Medical Mileage Expense Form: This form is used when individuals are tracking and claiming mileage expenses for medical purposes on their own. It is typically used for personal reimbursement purposes.

Business Medical Mileage Expense Form: This form is used when individuals are seeking reimbursement for mileage expenses incurred while traveling for medical purposes as part of their job or business. It is usually used for employer reimbursement purposes.

How to complete medical mileage expense form 2017

Completing the medical mileage expense form 2017 is a straightforward process. Here are the steps to follow:

01

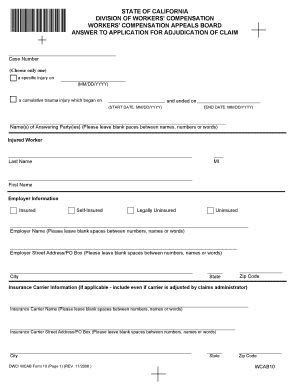

Enter your personal details such as name, address, and contact information in the designated fields.

02

Provide the purpose of your trip, whether it is for medical treatment, consultation, or any other medical-related reason.

03

Indicate the date of travel, starting location, and ending location. Make sure to provide accurate information to avoid any discrepancies.

04

Record the number of miles traveled for each trip.

05

Provide any additional information or supporting documentation required, such as receipts or doctor's notes, as per the guidelines provided.

06

Review the completed form for accuracy and make any necessary corrections.

07

Sign and date the form to validate your submission.

With pdfFiller, completing the medical mileage expense form 2017 is easier than ever. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.