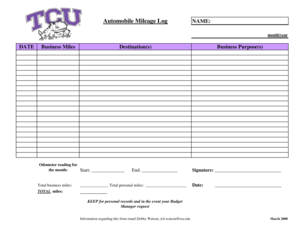

What is a mileage log app?

A mileage log app is a tool that helps individuals and businesses track and record their mileage for various purposes, such as for tax deductions or reimbursement. By using a mileage log app, users can easily keep track of their trips, record important details like date, time, and purpose of the trip, and generate accurate mileage reports.

What are the types of mileage log app?

There are various types of mileage log apps available on the market, each with its own features and functionalities. Some popular types include:

Standalone mobile apps - These are standalone applications that can be downloaded and installed on mobile devices, offering features like GPS tracking and automatic mileage calculation.

Web-based mileage log apps - These apps can be accessed through web browsers on computers or mobile devices, and offer features like real-time syncing across multiple devices and integration with other software systems.

Integrated mileage log apps - These apps are integrated with other business or financial management systems, allowing users to directly import and export mileage data to and from other software systems.

AI-powered mileage log apps - These apps leverage artificial intelligence technology to automatically detect and record trips, eliminating the need for manual entry and making mileage tracking even more convenient and accurate.

How to complete a mileage log app

Completing a mileage log app is easy and straightforward. Here's a step-by-step guide:

01

Download and install a mileage log app of your choice from a trusted source.

02

Sign up or create an account within the app.

03

Set up your profile and enter relevant information, such as your name, address, and vehicle details.

04

Familiarize yourself with the app's features and settings.

05

Start recording your trips by manually entering trip details or using the app's GPS tracking feature.

06

Make sure to accurately record each trip's date, time, starting and ending locations, purpose, and any additional notes.

07

Regularly review and update your mileage log to ensure accuracy.

08

Generate mileage reports as needed, and export or share them with the necessary parties.

09

Keep your mileage log app updated to benefit from any new features or improvements.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.