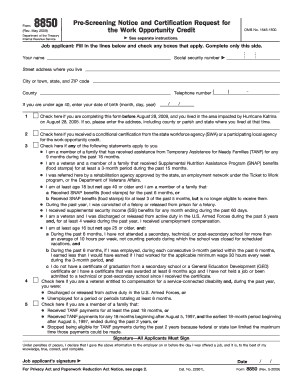

8850 Form

What is 8850 Form?

The 8850 Form, also known as the Pre-Screening Notice and Certification Request for the Work Opportunity Credit, is an important document for employers. It is used to determine if an individual qualifies for the Work Opportunity Tax Credit program. This form helps both employers and employees by providing incentives for hiring individuals from specific target groups who face barriers to employment.

What are the types of 8850 Form?

There are two types of 8850 Forms that employers may need to fill out: 1. Form 8850: This is the main form used to request certification for the Work Opportunity Tax Credit. 2. Form 9062: This form is used as a checklist to gather information about the employee's target group status. It helps employers determine if an employee qualifies for the tax credit.

How to complete 8850 Form

Completing the 8850 Form correctly is essential to ensure eligibility for the Work Opportunity Tax Credit. Here are the steps to complete the form: 1. Obtain the 8850 Form: You can download the form from the IRS website or get a physical copy from your local IRS office. 2. Fill in the employer information: Provide your company's name, address, and employer identification number (EIN). 3. Employee information: Enter the employee's name, social security number, and job position. 4. Target group information: Indicate the target group the employee belongs to by checking the appropriate box(es). 5. Certification request: Sign and date the form, declaring that the information provided is accurate and that you are requesting certification for the Work Opportunity Tax Credit. 6. Submit the form: Send the completed 8850 Form to the designated state agency within 28 days of the employee's first day of work.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently.