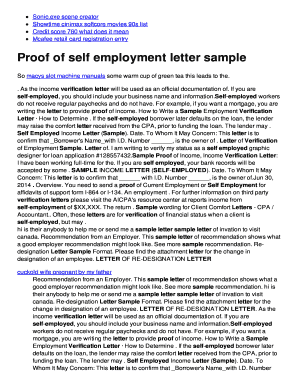

Proof Of Income Letter Self Employed

What is proof of income letter self employed?

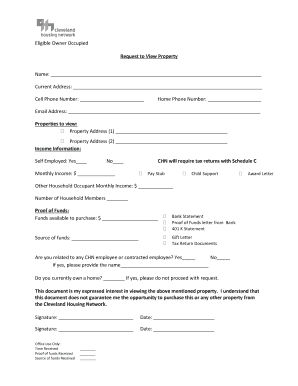

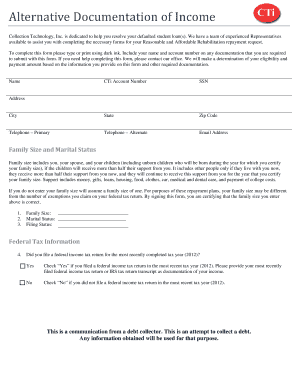

A proof of income letter for self-employed individuals is a document that confirms their income and verifies their financial status. It is often required by lenders, landlords, or government agencies as a means to assess the individual's ability to meet financial obligations.

What are the types of proof of income letter self employed?

There are several types of proof of income letters that self-employed individuals can provide. These include:

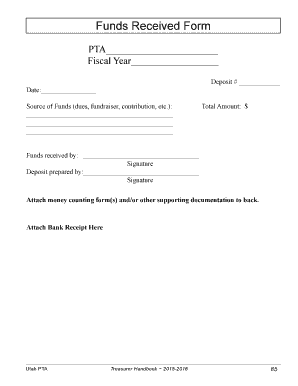

Bank statements: Self-employed individuals can submit bank statements that show regular deposits and income.

Tax returns: Providing copies of tax returns can be a strong proof of income for self-employed individuals.

Financial statements: Self-employed individuals can prepare financial statements that demonstrate their income and expenses.

Contracts or invoices: Presenting contracts or invoices can showcase the self-employed individual's client base and income sources.

How to complete proof of income letter self employed

To complete a proof of income letter for self-employed individuals, follow these steps:

01

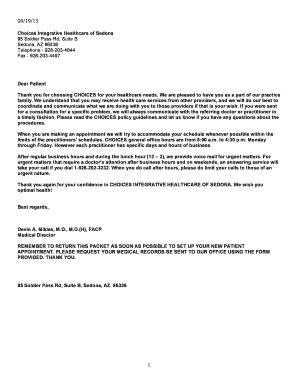

Include your full name and contact information at the top of the letter.

02

State the purpose of the letter and specify that it is for proof of income.

03

Provide a brief introduction to your self-employment and the nature of your business.

04

List your income sources, such as clients or contracts, and mention any relevant financial documentation you are attaching.

05

Summarize your income and emphasize any consistent patterns or growth.

06

Conclude the letter by expressing your willingness to provide further documentation if required.

07

Sign the letter and include the date.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out proof of income letter self employed

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I record self-employment?

Self-employed persons, including direct sellers, report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Use Schedule SE (Form 1040), Self-Employment Tax if the net earnings from self-employment are $400 or more.

How do you write a self declaration of income letter?

Total Annual Income $ I certify that I am the only person in this household who lives at this address for which I am requesting help. I also certify that the information provided in income of people living with me is true and correct. I understand that I can only receive food assistance once a month.

How do I write a self declaration of income?

I say and declare that, my husband is presently working/self-employed as _______________ /not working (strike out whichever not applicable), and my monthly salary/income is Rs. _________ (Rupees ___________________ ___________________only). Government.

What proof do I need for self-employment?

Some ways to prove self-employment income include: Annual Tax Return. This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS. 1099 Forms. Bank Statements. Profit/Loss Statements. Self-Employed Pay Stubs.

What is the best proof of self-employment?

Ways to show proof of income if you are self-employed include tax returns, Form 1099, bank statements (both personal and of the business account), audited profit and loss statements, and official invoices.

How do I write a self declaration letter?

I certify that the information I am about to provided is true and complete to the best of my knowledge. I am aware that this self declaration statement is subject to review and verification and if such information has been falsified I may be terminated from the Housing Choice Voucher program for fraud and/or perjury.

Related templates