Property Analysis Definition

What is property analysis definition?

Property analysis definition is the process of evaluating and assessing various aspects of a property to determine its value, potential, and suitability for a particular purpose. It involves analyzing factors such as location, condition, market trends, and financial considerations to make informed decisions about the property.

What are the types of property analysis definition?

There are several types of property analysis definition that can be used depending on the specific goals and needs. Some common types include:

Market analysis: This type of analysis focuses on understanding the current market conditions and trends to determine the potential value and demand for a property.

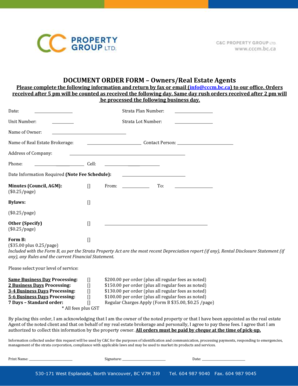

Financial analysis: Involves assessing the financial aspects of a property, such as its income potential, expenses, and return on investment.

Comparative analysis: This type of analysis involves comparing the property to similar properties in the area to determine its value and market position.

Feasibility analysis: Involves evaluating the practicality and viability of a proposed project or investment in a property.

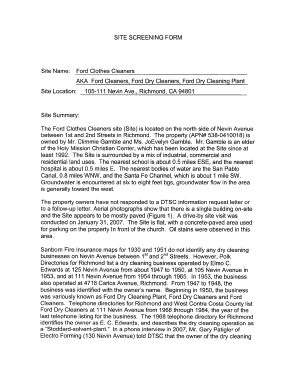

Risk analysis: Assessing the potential risks and uncertainties associated with a property, such as environmental hazards or legal issues.

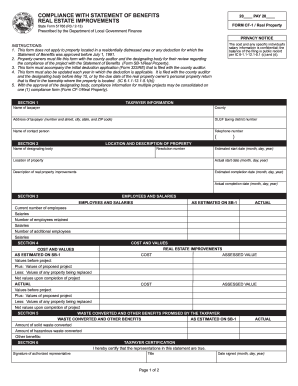

How to complete property analysis definition

To complete a property analysis definition, follow these steps:

01

Define the purpose: Determine why you need to analyze the property and what specific information or insights you are seeking.

02

Gather relevant data: Collect information about the property, such as its location, physical condition, market data, financial records, and any other relevant details.

03

Conduct research: Use the gathered data to conduct thorough research and analysis. This may involve comparing similar properties, studying market trends, and assessing financial indicators.

04

Evaluate the data: Analyze and evaluate the collected data to gain a comprehensive understanding of the property and its potential.

05

Make informed decisions: Based on the analysis and evaluation, make informed decisions about the property, such as whether to invest, sell, or make improvements.

06

Stay updated: Continuously monitor and update your analysis as market conditions and circumstances change.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you write a property analysis?

6 Key Steps to Real Estate Market Analysis Research neighborhood quality and amenities. Obtain property value estimates for the area. Select comparables for your real estate market analysis. Calculate average price of comparable listings. Fine-tune your market analysis with adjustments to your comparables.

Does the 1% rental rule still apply?

With currently inflated home prices, the 1% rule no longer applies. If you were to follow it now, you'd likely make no deals at all. Neighborhood comps and cap rate are better metrics to use to analyze a potential rental property.

What is the 1 rule in real estate?

The 1% rule of real estate investing measures the price of the investment property against the gross income it will generate. For a potential investment to pass the 1% rule, its monthly rent must be equal to or no less than 1% of the purchase price.

What information do you need in order to complete a financial analysis on a property?

Your Mortgage Payment. Down Payment Requirements. Rental Income to Qualify. Price to Income Ratio. Price to Rent Ratio. Gross Rental Yield. Capitalization Rate. Cash Flow.

How do you evaluate property?

5 ways to find out what your house is worth Enter your address into a home value estimator. Ask an agent for a free comparative market analysis. Check your county or municipal auditor's website. Identify trends with the FHFA House Price Index calculator. Hire a professional appraiser.

Is the 1% rule realistic in real estate?

Is the 1% Rule Realistic in the Current Market? The 1% rule may not be realistic for investors buying rental property in the current market. According to a recent Forbes article, median housing prices have risen to $450,000 in many areas, nearly 17% higher than the highest recorded average.

Related templates