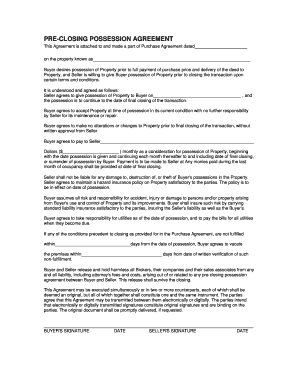

What is a purchase agreement for a house?

A purchase agreement for a house is a legally binding contract between a buyer and seller that outlines the terms and conditions of the sale. It includes details such as the purchase price, closing date, and any contingencies or conditions that need to be met for the sale to be finalized. This agreement serves as a safeguard for both parties and ensures that both buyer and seller understand and agree to the terms of the transaction.

What are the types of purchase agreements for a house?

There are several types of purchase agreements for a house, including:

Standard Purchase Agreement: This is the most common type of purchase agreement. It covers all the essential terms and conditions of the sale, such as the purchase price and closing date.

As-Is Purchase Agreement: This agreement states that the buyer accepts the property in its current condition, without any warranties or guarantees from the seller regarding its condition.

Lease-Option Purchase Agreement: This type of agreement combines a lease agreement with an option for the tenant to purchase the property at a later date.

Installment Purchase Agreement: In this agreement, the buyer pays the purchase price in installments over a specified period of time.

Contingent Purchase Agreement: This type of agreement is contingent upon certain conditions being met, such as the buyer securing financing or the seller making certain repairs.

How to complete a purchase agreement for a house

Completing a purchase agreement for a house involves several steps. Here is a step-by-step guide to help you:

01

Gather the necessary information: Collect all the relevant details about the buyer, seller, property, purchase price, closing date, and any contingencies or conditions that need to be included in the agreement.

02

Draft the agreement: Use a template or consult a real estate attorney to create a legally valid purchase agreement. Include all the essential terms and conditions, and ensure that it complies with local laws and regulations.

03

Review the agreement: Carefully review the agreement to make sure all the details are accurate and complete. Check for any errors or omissions that may need to be corrected.

04

Negotiate and make revisions: If necessary, negotiate with the other party to make any desired changes or amendments to the agreement. Ensure that both parties are satisfied with the terms before proceeding.

05

Sign the agreement: Once both parties are in agreement, sign the purchase agreement along with any required witnesses or notaries. Keep a copy of the signed agreement for your records.

06

Execute the agreement: Fulfill any conditions or contingencies outlined in the agreement, such as securing financing or completing inspections. Work towards the closing date outlined in the agreement.

07

Close the sale: On the closing date, complete the final paperwork, transfer ownership of the property, and exchange funds as specified in the purchase agreement.

08

Keep a record: After the sale is complete, keep a copy of the signed purchase agreement and any other relevant documents for future reference or legal purposes.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.