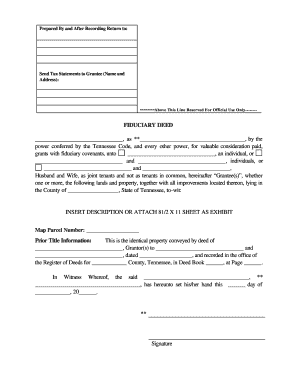

Sample Deed Of Trust Form

What is a sample deed of trust form?

A sample deed of trust form is a legal document that outlines the terms and conditions of a loan secured by real property. It establishes a three-party agreement between the lender, borrower, and a trustee who holds the property title until the loan is fully repaid. This document serves as evidence of the borrower's commitment to repay the loan and protects the lender's interests in case of default.

What are the types of sample deed of trust forms?

There are several types of sample deed of trust forms, including: 1. Fixed-rate Deed of Trust: This type of form is used when the loan has a fixed interest rate throughout its term. 2. Adjustable-rate Deed of Trust: This form is suitable for loans with an adjustable interest rate that can change over time. 3. Wraparound Deed of Trust: This form is used when there is an existing loan on the property, and a new loan is created that wraps around the original loan. 4. Subordinate Deed of Trust: This form is used when there are multiple loans on the property, and it establishes the priority of repayment in case of foreclosure. 5. Release of Deed of Trust: This form is used when the loan has been fully repaid, and the lender needs to release their interest in the property.

How to complete a sample deed of trust form

Completing a sample deed of trust form is a straightforward process. Here are the steps to follow: 1. Download or obtain a sample deed of trust form. 2. Read the instructions carefully and gather all the required information. 3. Fill in the details of the lender, borrower, and trustee, including their names, addresses, and contact information. 4. Specify the loan amount, interest rate, and repayment terms. 5. Describe the property being used as collateral, including its address and legal description. 6. Include any additional provisions or conditions agreed upon by the parties. 7. Review the completed form for accuracy and make any necessary corrections. 8. Sign the form along with the lender, borrower, and trustee. 9. Keep a copy for your records and provide copies to all parties involved.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.