What is SBA Personal Financial Statement?

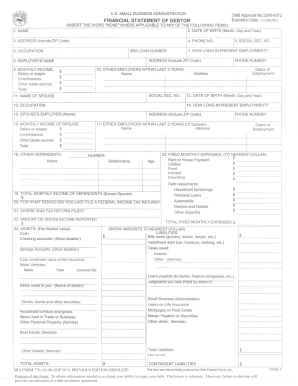

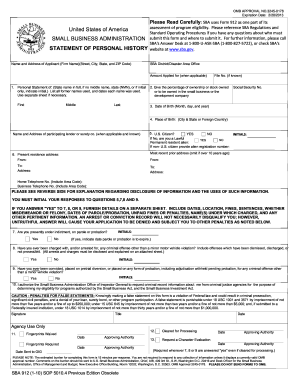

SBA Personal Financial Statement refers to a document that outlines an individual's financial situation. It includes details such as income, expenses, assets, and liabilities. This statement is often required by the Small Business Administration (SBA) for loan applications or evaluating the financial health of individuals.

What are the types of SBA Personal Financial Statement?

There are two main types of SBA Personal Financial Statements:

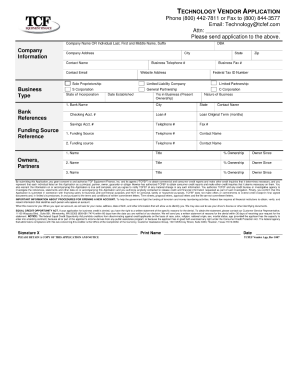

SBA Form This form is used by individuals applying for SBA loans and requires detailed information about their personal finances, including personal assets, liabilities, income, and expenses.

SBA Form 413D: This form is specifically designed for individuals who are applying for SBA Disaster Loans and focuses on gathering information about their personal financial losses and expenses resulting from the disaster.

How to complete SBA Personal Financial Statement?

Completing an SBA Personal Financial Statement can seem overwhelming, but by following these steps, you can make the process easier:

01

Gather all necessary financial documents, including bank statements, tax returns, pay stubs, and investment statements.

02

Download the appropriate SBA form (either Form 413 or Form 413D) from the SBA website or use a reliable online platform like pdfFiller.

03

Fill out the form accurately, providing detailed information about your personal finances. Be sure to double-check all entries before submitting.

04

If using pdfFiller, take advantage of the powerful editing tools available to ensure your statement is clean, organized, and easy to read.

05

Once completed, review the entire form one last time to ensure accuracy and completeness.

06

Save a copy of the SBA Personal Financial Statement for your records.

07

Submit the form to the appropriate entity, whether it's the SBA or your lender.

With its unlimited fillable templates and powerful editing tools, pdfFiller empowers users to seamlessly create, edit, and share their SBA Personal Financial Statements online. Whether you're applying for an SBA loan or a Disaster Loan, pdfFiller is the only PDF editor you need to efficiently complete your financial statement.