Weekly Household Budget Template - Page 2

What is Weekly Household Budget Template?

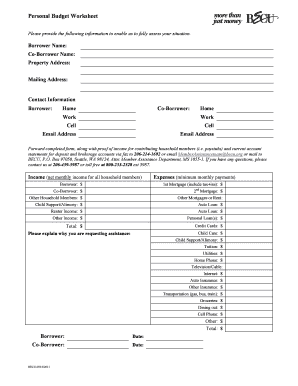

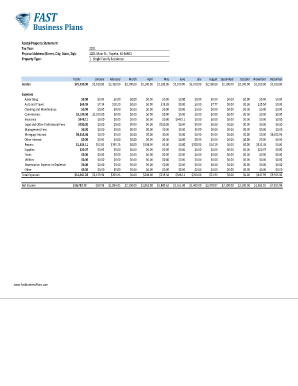

A Weekly Household Budget Template is a tool that helps individuals and families keep track of their expenses and income on a weekly basis. It allows them to effectively manage their finances and plan their spending based on their available resources.

What are the types of Weekly Household Budget Template?

There are various types of Weekly Household Budget Templates available to cater to different needs and preferences. Some common types include:

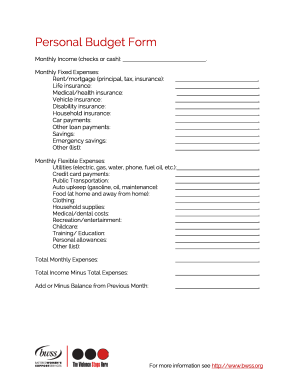

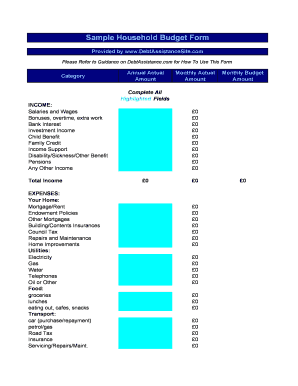

Basic Weekly Budget Template: This template provides a simple and straightforward way to track income and expenses on a weekly basis.

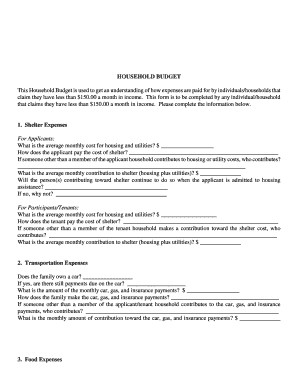

Detailed Weekly Budget Template: This template offers more comprehensive features, allowing users to allocate funds to specific categories and track expenses in detail.

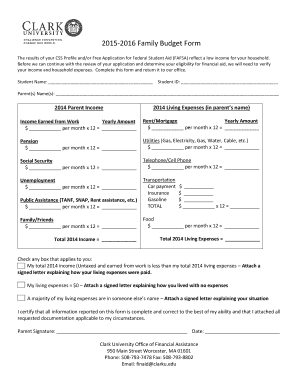

Family Weekly Budget Template: Specifically designed for families, this template enables tracking of expenses related to different family members and overall household expenses.

Monthly Budget Template: Although not weekly, this template can also be used to plan and budget on a monthly basis, offering a broader perspective on personal finances.

How to complete Weekly Household Budget Template

Completing a Weekly Household Budget Template is a simple process. Here are the steps to follow:

01

Gather your financial information: Collect all your income sources and expense details for the week.

02

List your income: Add up all your income sources, such as salary, side jobs, or rental income.

03

Track your expenses: Categorize your expenses, including bills, groceries, transportation, and entertainment.

04

Calculate the difference: Subtract your total expenses from your total income to determine if you have a surplus or deficit.

05

Adjust your budget: If you have a deficit, identify areas where you can reduce expenses or find ways to increase your income.

06

Review and update: Regularly review your budget and make necessary adjustments based on changing circumstances and financial goals.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What should a weekly budget include?

25 Things to Include in Your Budget Rent. Food and Groceries. Daily Incidentals. Irregular Expenses and Emergency Fund. Household Maintenance. Work Wardrobe and Upkeep. Subscriptions. Guests.

How do you create a simple budget plan?

The following steps can help you create a budget. Step 1: Calculate your net income. The foundation of an effective budget is your net income. Step 2: Track your spending. Step 3: Set realistic goals. Step 4: Make a plan. Step 5: Adjust your spending to stay on budget. Step 6: Review your budget regularly.

How do I create a weekly budget in Excel?

How to Make a Budget in Excel from Scratch Step 1: Open a Blank Workbook. Step 2: Set Up Your Income Tab. Step 3: Add Formulas to Automate. Step 4: Add Your Expenses. Step 5: Add More Sections. Step 6.0: The Final Balance. Step 6.1: Totaling Numbers from Other Sheets. Step 7: Insert a Graph (Optional)

What are the 7 steps in creating a budget?

7 Steps to a Budget Made Easy Step 1: Set Realistic Goals. Step 2: Identify your Income and Expenses. Step 3: Separate Needs and Wants. Step 4: Design Your Budget. Step 5: Put Your Plan Into Action. Step 6: Seasonal Expenses. Step 7: Look Ahead.

How do I make a weekly budget plan?

Creating a weekly budget How much do you earn? How much are you spending? Split your outgoings into mandatory and lifestyle. Remove your outgoings from your income, and look for ways to cut spending. Think about the future. Choose goals you can meet. Schedule monthly check-ins.

How do you budget on a weekly basis?

The best way to budget weekly is to work out your total outgoings for the year (e.g. multiplying monthly bills by 12) and then dividing by 52. Then you'll know how much you need to put away each week to cover your bills and expenses.

Related templates