What Is Direct Debit Form

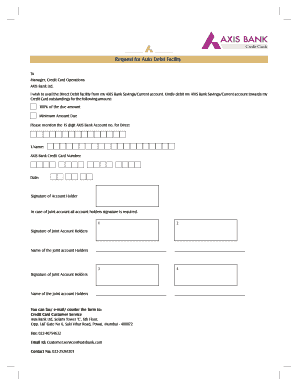

What is a direct debit form?

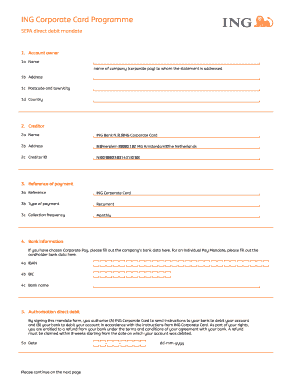

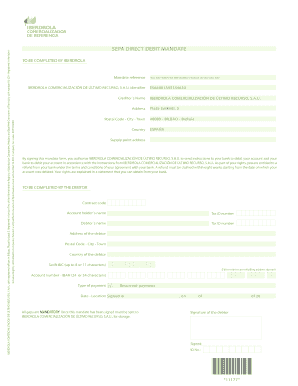

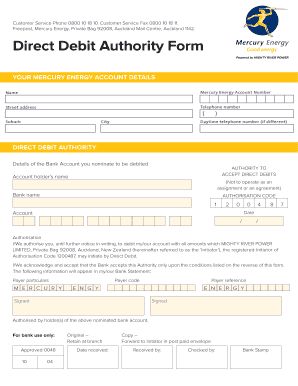

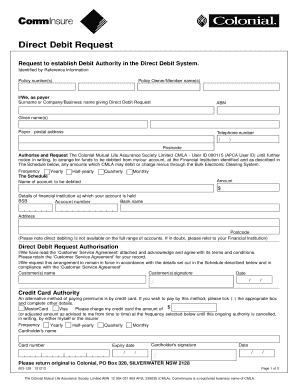

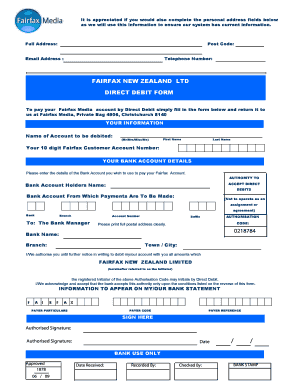

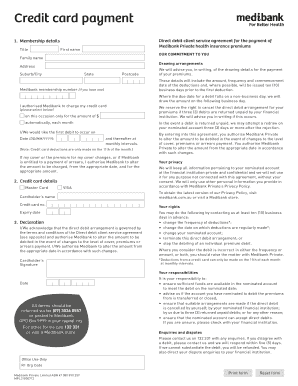

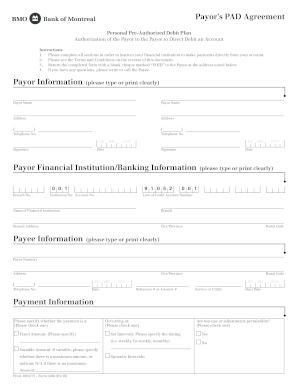

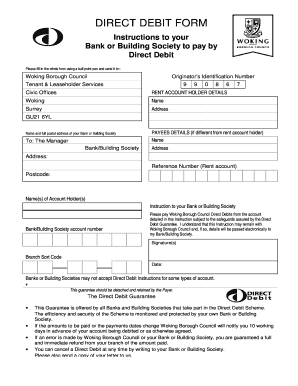

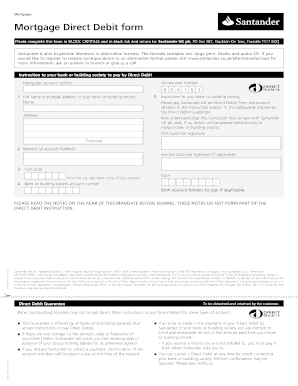

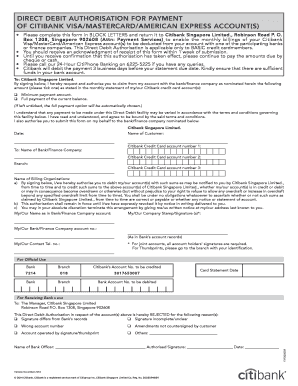

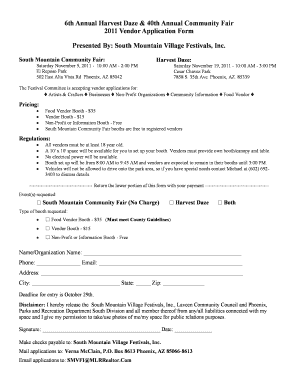

A direct debit form is a document commonly used for automating recurring payments. It grants permission to a company or organization to collect money directly from your bank account on a regular basis. This form ensures that payments are made on time and eliminates the need for manual transactions.

What are the types of direct debit forms?

There are two main types of direct debit forms:

Direct debit authorization form: This form is typically used by businesses to set up automatic payments for services or products. It requires your personal and banking information, as well as your consent for the company to debit your account.

Direct debit cancellation form: This form allows you to revoke the authorization for a direct debit. It is used when you no longer wish to make automatic payments to a particular company or organization.

Please note that the specific requirements and formats of direct debit forms may vary depending on the country and financial institution.

How to complete a direct debit form?

Completing a direct debit form is a straightforward process. Here are the steps to follow:

01

Obtain the direct debit form from the company or organization requesting it. It is often available on their website or can be obtained by contacting their customer service.

02

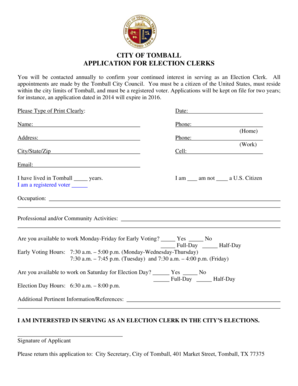

Fill in your personal information, including your name, address, and contact details.

03

Provide your banking information, such as your bank account number, branch code, and account holder's name.

04

Read and understand the terms and conditions of the direct debit agreement.

05

Sign and date the form to authorize the direct debit transactions.

06

Submit the completed form to the company or organization as instructed.

07

Keep a copy of the form for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out what is direct debit form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a Direct Debit form?

A Direct Debit Instruction is an authorisation from your customer to collect future payments. The details of each authorisation are standardised: All future payments are authorised so you can collect any amount at any time from your customer. Your customer must be notified of each payment before it is collected.

Does a Direct Debit mandate need to be signed?

A Direct Debit mandate gives service providers written permission to take payments from their customers bank accounts. Payments cannot be collected until the mandate has been signed and agreed by the customer.

How do I complete a Direct Debit form?

In order to fill in a Direct Debit mandate, customers require their name, bank name, sort code and account number. Once they have filled out their information, the mandate will need to be sent to Bacs, who will then transfer it onto the banks.

Do I need anything for Direct Debit?

You don't need to tell your bank when you set up a Direct Debit. To set up your Direct Debit, you'll need to provide the recipient with your account information. You can usually provide these details over the phone, online or through the post.

How do I fill out a Direct Debit form?

In order to fill in a Direct Debit mandate, customers require their name, bank name, sort code and account number. Once they have filled out their information, the mandate will need to be sent to Bacs, who will then transfer it onto the banks.

What do you need to fill out for direct deposit?

Each employee needs to provide the following information: bank name, account type, account number and routing number. Some states also require employees to sign a consent form before their employer can switch them to direct deposit.