Cosign Signature Request For Free

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Upload your document to the PDF editor

Type anywhere or sign your form

Print, email, fax, or export

Try it right now! Edit pdf

Users trust to manage documents on pdfFiller platform

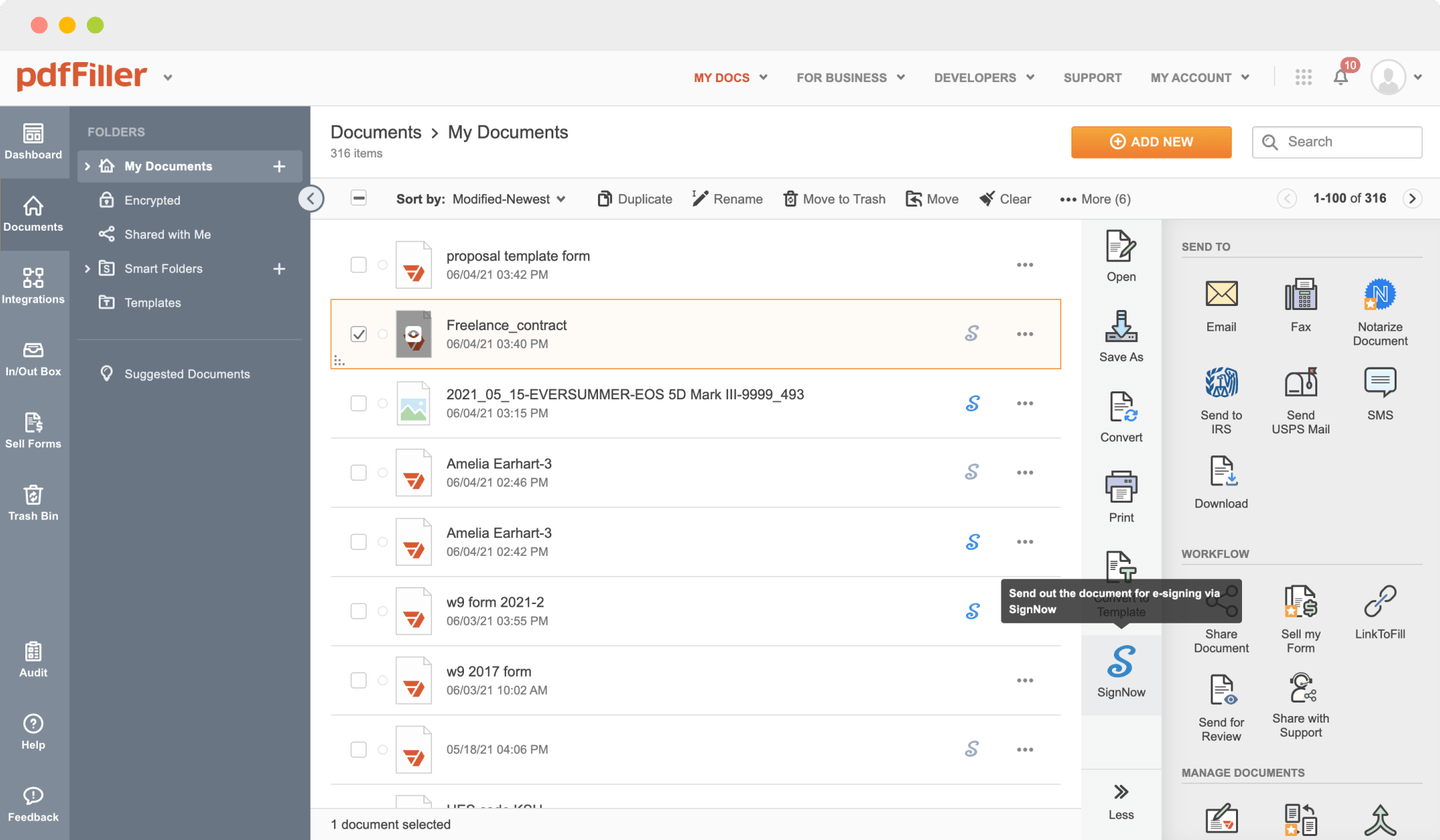

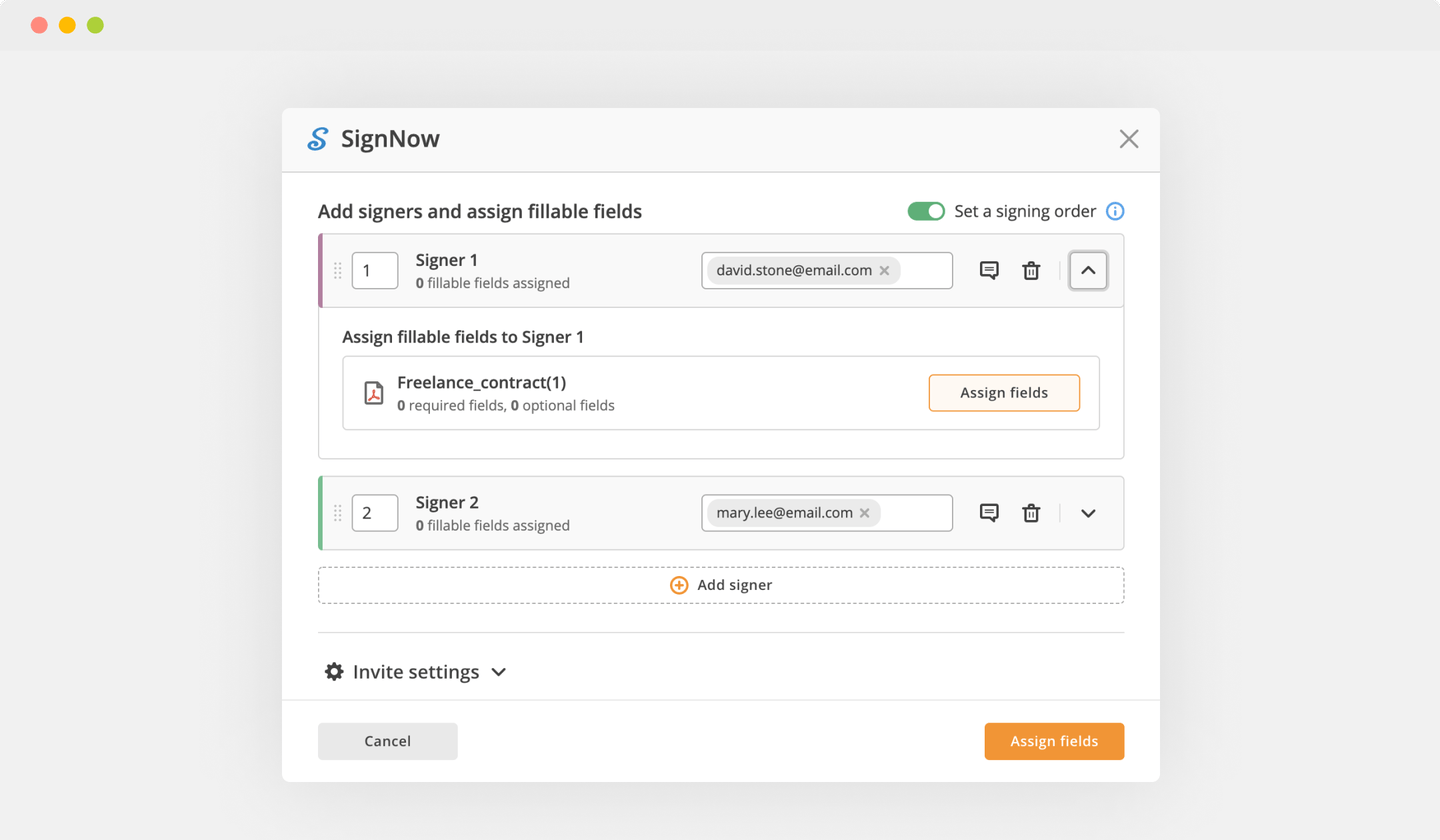

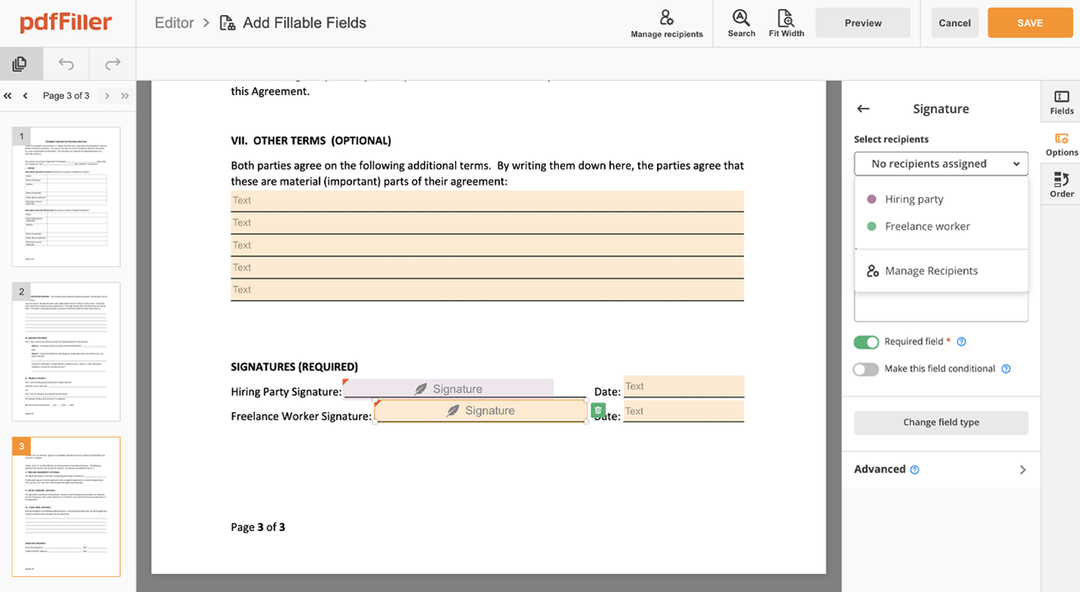

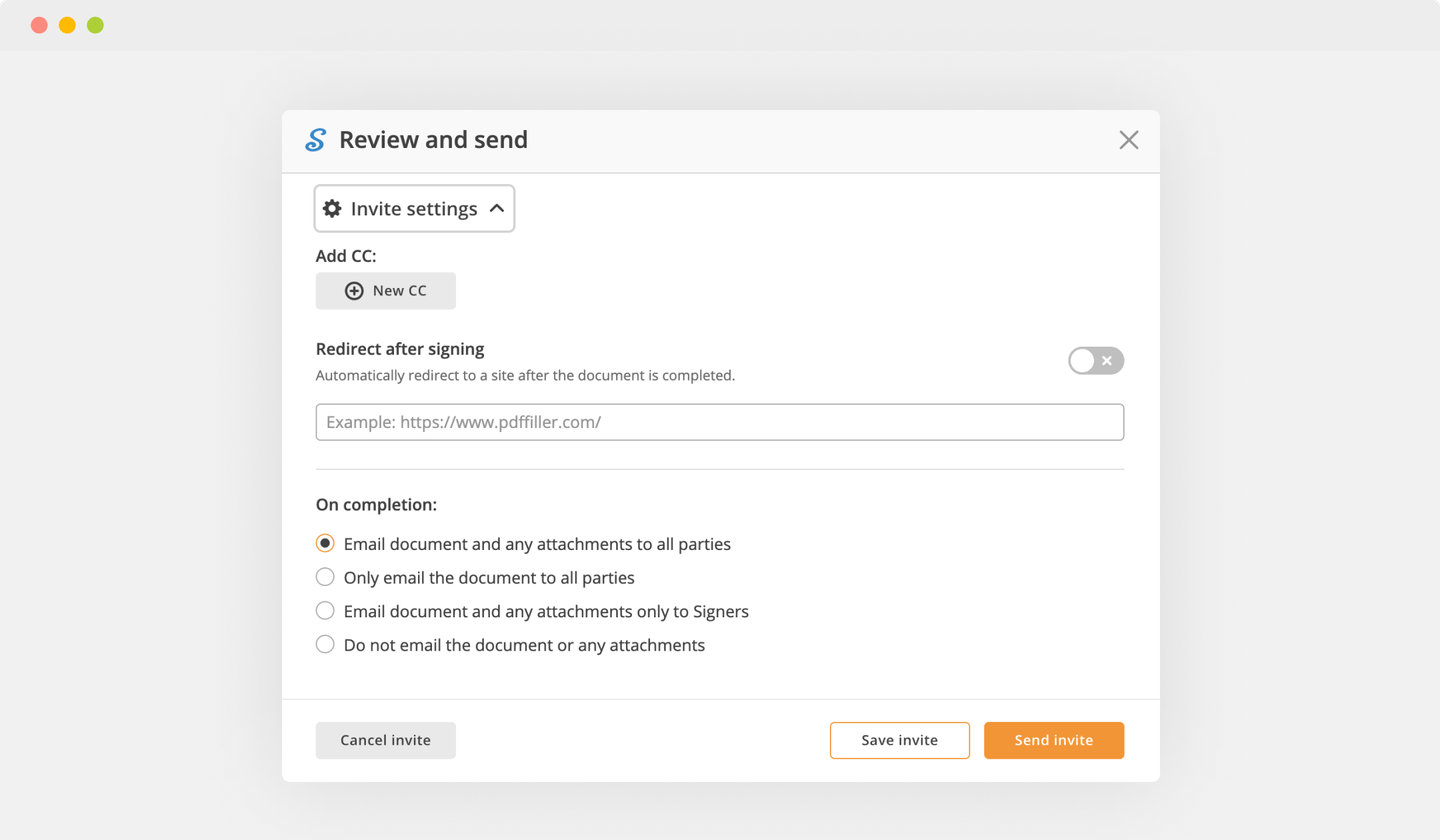

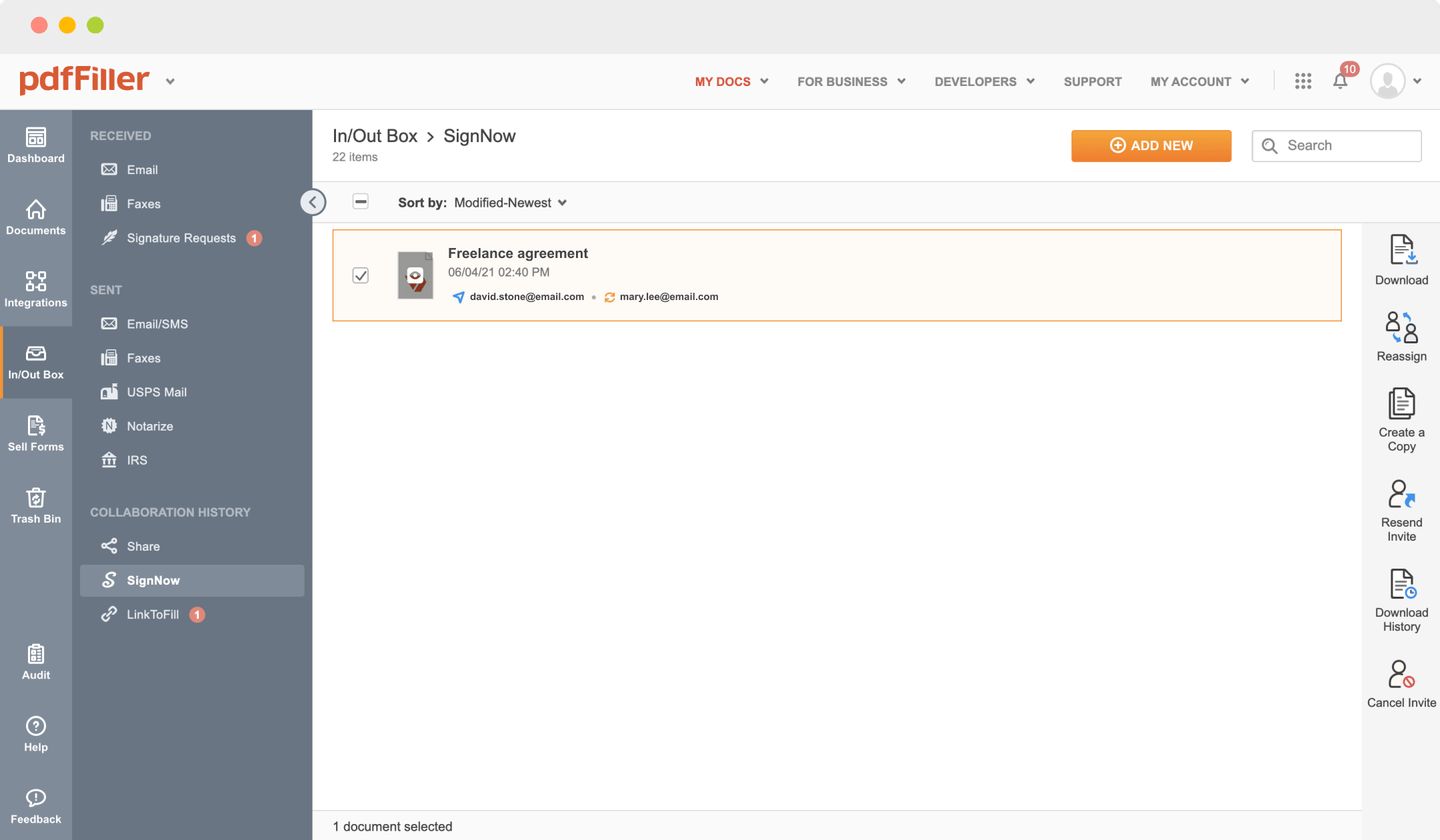

Send documents for eSignature with signNow

Create role-based eSignature workflows without leaving your pdfFiller account — no need to install additional software. Edit your PDF and collect legally-binding signatures anytime and anywhere with signNow’s fully-integrated eSignature solution.

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.

pdfFiller scores top ratings in multiple categories on G2

How to Cosign Signature Request

Are you stuck working with multiple applications for managing documents? We've got the perfect all-in-one solution for you. Use our document management tool for the fast and efficient process. Create document templates on your own, modify existing forms and more useful features, within one browser tab. You can Cosign Signature Request with ease; all of our features are available to all users. Get a major advantage over other applications. The key is flexibility, usability and customer satisfaction. We deliver on all three.

How-to Guide

How to edit a PDF document using the pdfFiller editor:

01

Drag & drop your document to the uploading pane on the top of the page

02

Find the Cosign Signature Request feature in the editor's menu

03

Make all the required edits to your document

04

Click “Done" orange button to the top right corner

05

Rename your template if it's necessary

06

Print, download or share the template to your computer

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Michelle Grace Gabriel

2019-07-03

I had a really excellent experience…best app ever

I had a really excellent experience with this company and will definitely use them always! Great customer service and prompt reply- Anna from customer service was really fast and great! Best app ever!!

Verified Reviewer

2019-03-12

PDF FIller was an answer to many questions.

Our business is an industrial maintenance business. We have had to use PDF filler several times with applications and insurance documents. PDF filler made it easier.

We liked how they explained everything we needed to know to fill in applications and other papers online without having to scan and download everything separately. I always thought it was my computer that was the problem, but with PDF filler, it doesn't matter what software is already on your laptop, you can work with any documents.

Sometimes I would go duplicate a step in saving the document, but after a couple of documents, it was easy to figure out what I should do.

Get a powerful PDF editor for your Mac or Windows PC

Install the desktop app to quickly edit PDFs, create fillable forms, and securely store your documents in the cloud.

Edit and manage PDFs from anywhere using your iOS or Android device

Install our mobile app and edit PDFs using an award-winning toolkit wherever you go.

Get a PDF editor in your Google Chrome browser

Install the pdfFiller extension for Google Chrome to fill out and edit PDFs straight from search results.

List of extra features

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who gets the credit on a cosigned loan?

If you are the cosigner on a loan, then the debt you are signing for will appear on your credit file as well as the credit file of the primary borrower. It can help even a cosigner build a more positive credit history as long as the primary borrower is making all the payments on time as agreed upon.

What happens when you cosign for a loan?

A cosigner is someone who applies for a loan with another person, and legally agrees to pay off their debt if they aren't able to make the payments. But with a cosigner, the lender will be more likely to give someone a loan because the cosigner can step in and make the payments if the other person cannot.

Can you be a cosigner with bad credit?

That cosigner must have good credit because their credit gets run to make sure that they are in good standing. Only if they are deemed acceptable can someone with bad credit get their loan. The process is not reversible. You cannot switch the process around and have the person with bad credit try and cosign the loan.

Can a cosigner hurt your chances?

In a strict sense, the answer is no. The fact that you are a cosigner in and of itself does not necessarily hurt your credit. However, even if the cosigned account is paid on time, the debt may affect your credit scores and revolving utilization, which could affect your ability to get a loan in the future.

Does Cosign build credit?

Yes, being a cosigner on a car loan will help you build your credit history. The primary loan holder and cosigner share equal responsibility for the debt, and the loan will appear on both your credit report and hers.

Does a co-signer's credit matter?

Why Lenders Require a Co-Signer Borrowers need sufficient income and acceptable credit history to qualify for a loan. In some cases, a borrower can't qualify individually. For example, the borrower might not have an income that's high enough to cover monthly debt payments (at least from the lender's point of view).

How do you use a cosigner?

Suggested clip

Signing PDF's with CoSign - YouTubeYouTubeStart of suggested clipEnd of suggested clip

Signing PDF's with CoSign - YouTube

What if I can't find a cosigner?

Consider Prequalification If your potential cosigner is hesitant to commit because a credit check could negatively impact their credit score, look for a lender who offers a prequalification option. Through prequalification, a person can check to see if they would be approved without a hard credit inquiry or commitment.

Can anyone be a cosigner?

In a nutshell, a cosigner is someone who guarantees that they will be legally responsible for paying back a debt if the borrower cannot pay. Some of the best people to consider reaching out to are a trusted friend or family member with a good credit history and a solid income history.

Will my credit score go up if I have a cosigner?

In a strict sense, the answer is no. The fact that you are a cosigner in and of itself does not necessarily hurt your credit. However, even if the cosigned account is paid on time, the debt may affect your credit scores and revolving utilization, which could affect your ability to get a loan in the future.

Can you co-sign electronically?

1 attorney answer “Digital" signatures by the signor or co-signor are allowed on most loans and contracts, including auto loans. Federal law passed in 2000 (the Electronic Signatures in Global and International Commerce Act) made electronic contracts, and Thank you very much for your informative answer.

Does a cosigner need to live in the same state?

Your cosigner on a car loan doesn't have to live in the same state as you. Some lenders may ask your cosigner to sign the loan contract in person, but as long as they qualify to be a cosigner, it doesn't matter where they live.

Can you find a cosigner online?

Short answer: you can't find a co-signer online. If you do, it's a sure bet it's a scammer looking to separate you from your money. A co-signer is someone who is willing to take responsibility for your loan payments should you default.

Can you pay for a co-signer?

You can choose to pay your cosigner out-of-pocket with what you can afford. If you are applying for a loan, you could offer to pay your cosigner with a part of the loan you receive after your application is approved.

Do you have to be present to cosign?

In the event that your cosigner isn't someone that can accompany you to the dealership, a lender may allow them to submit signatures on the required documents via fax, but most require an original signature. When a cosigner isn't present with you, they're going to be required to have their signature notarized.

eSignature workflows made easy

Sign, send for signature, and track documents in real-time with signNow.