Expect Electronically Signing Request For Free

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Upload your document to the PDF editor

Type anywhere or sign your form

Print, email, fax, or export

Try it right now! Edit pdf

Users trust to manage documents on pdfFiller platform

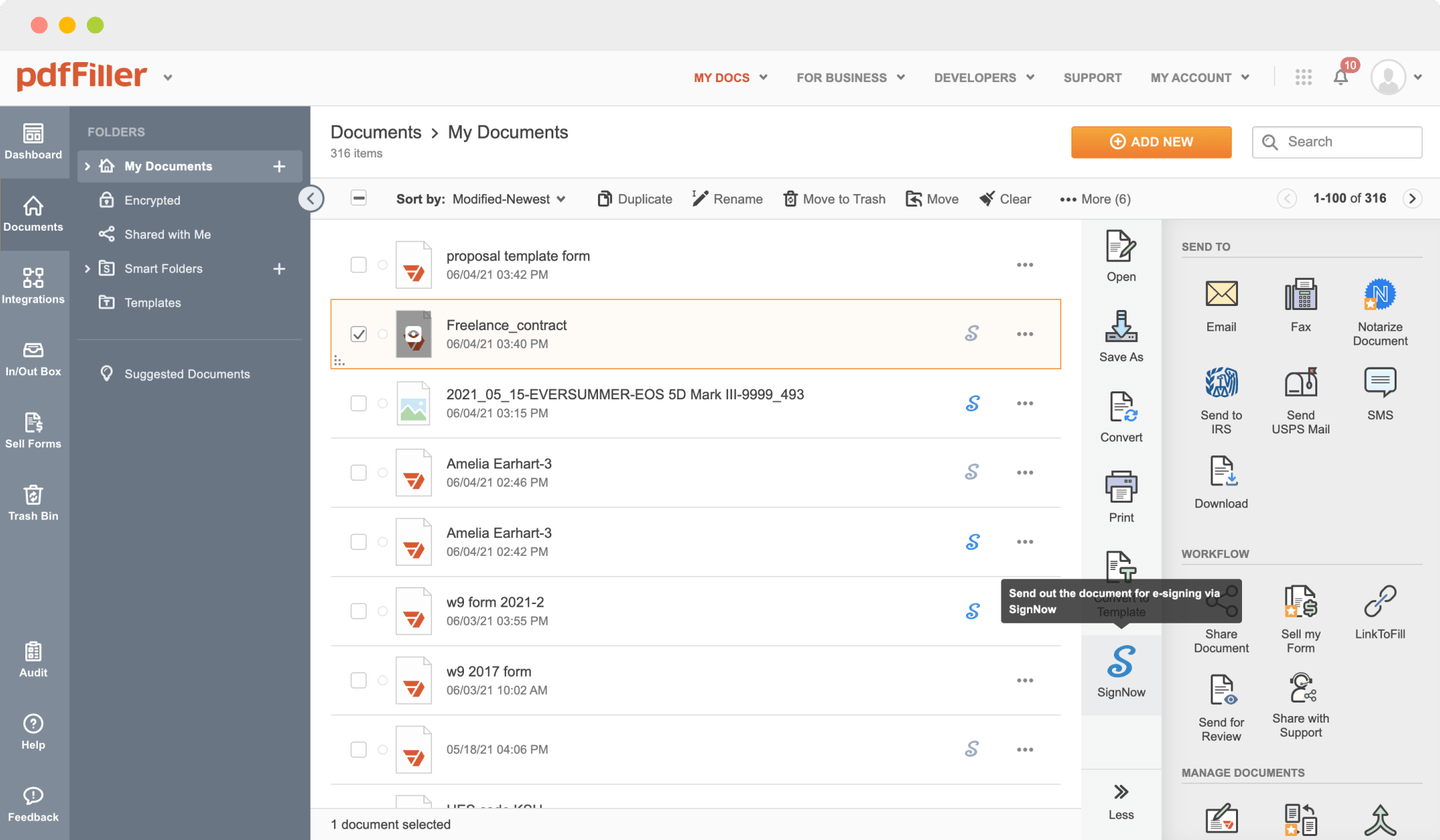

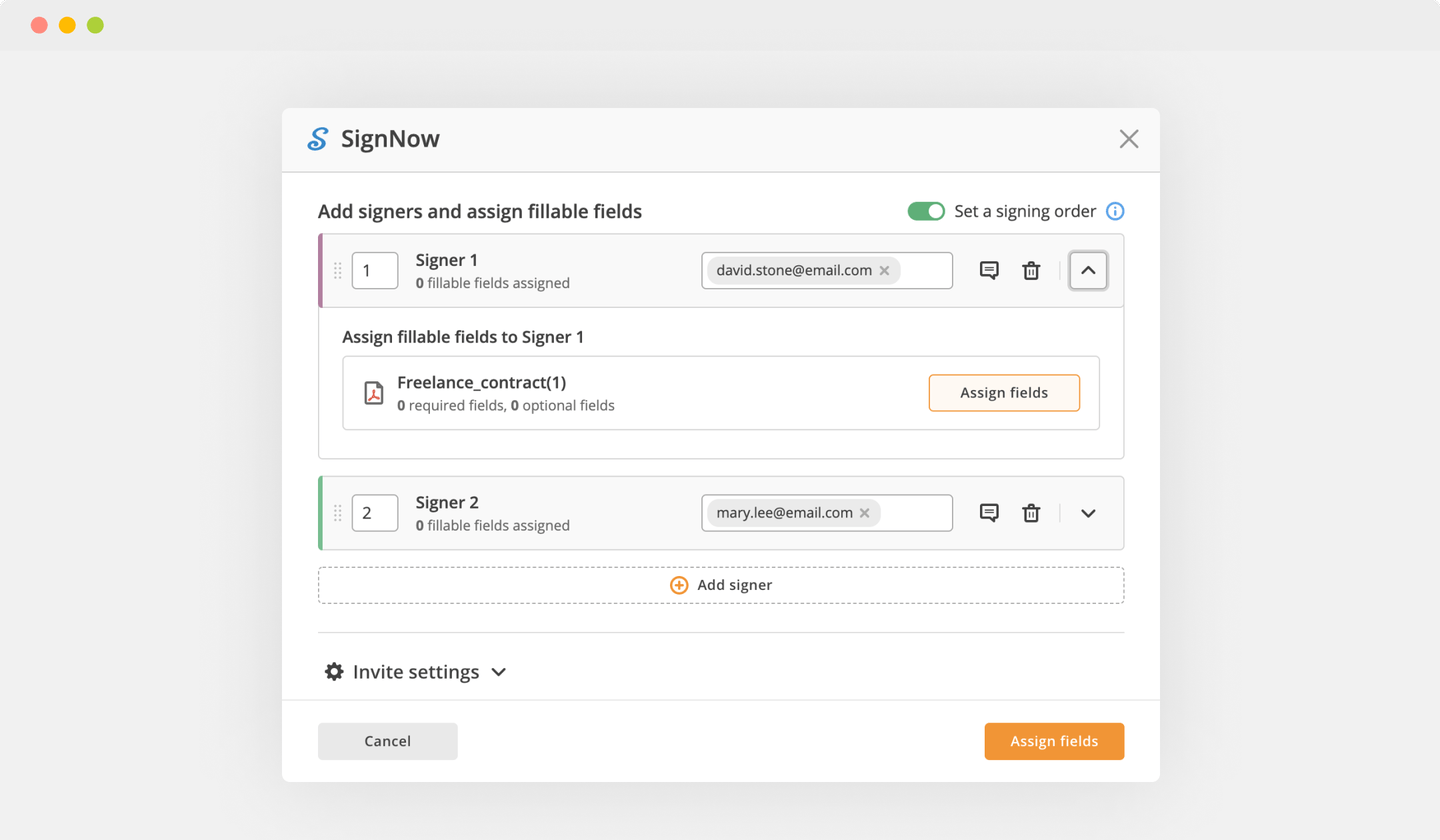

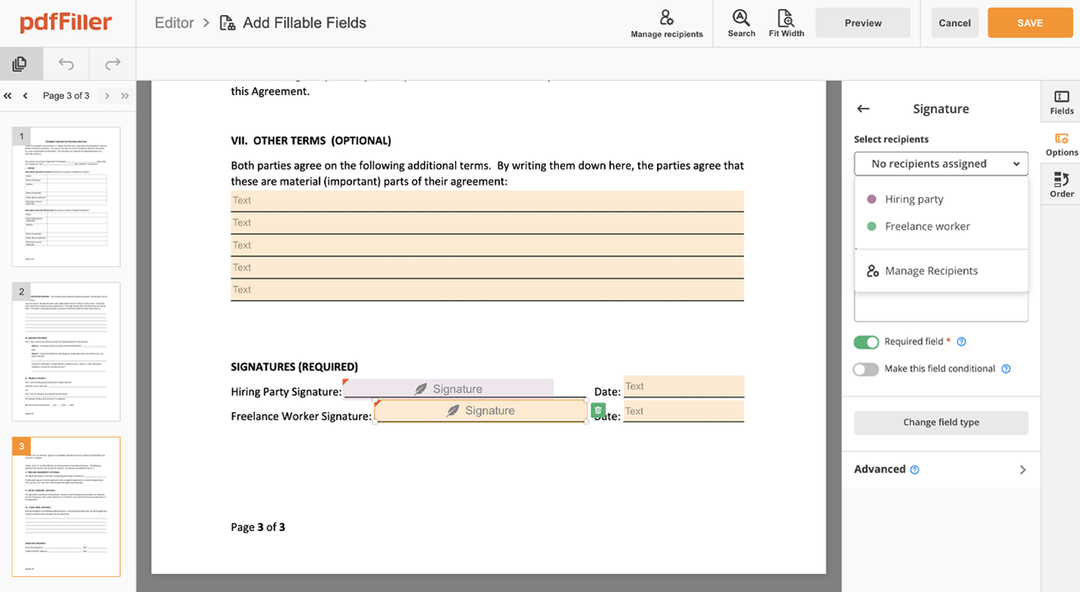

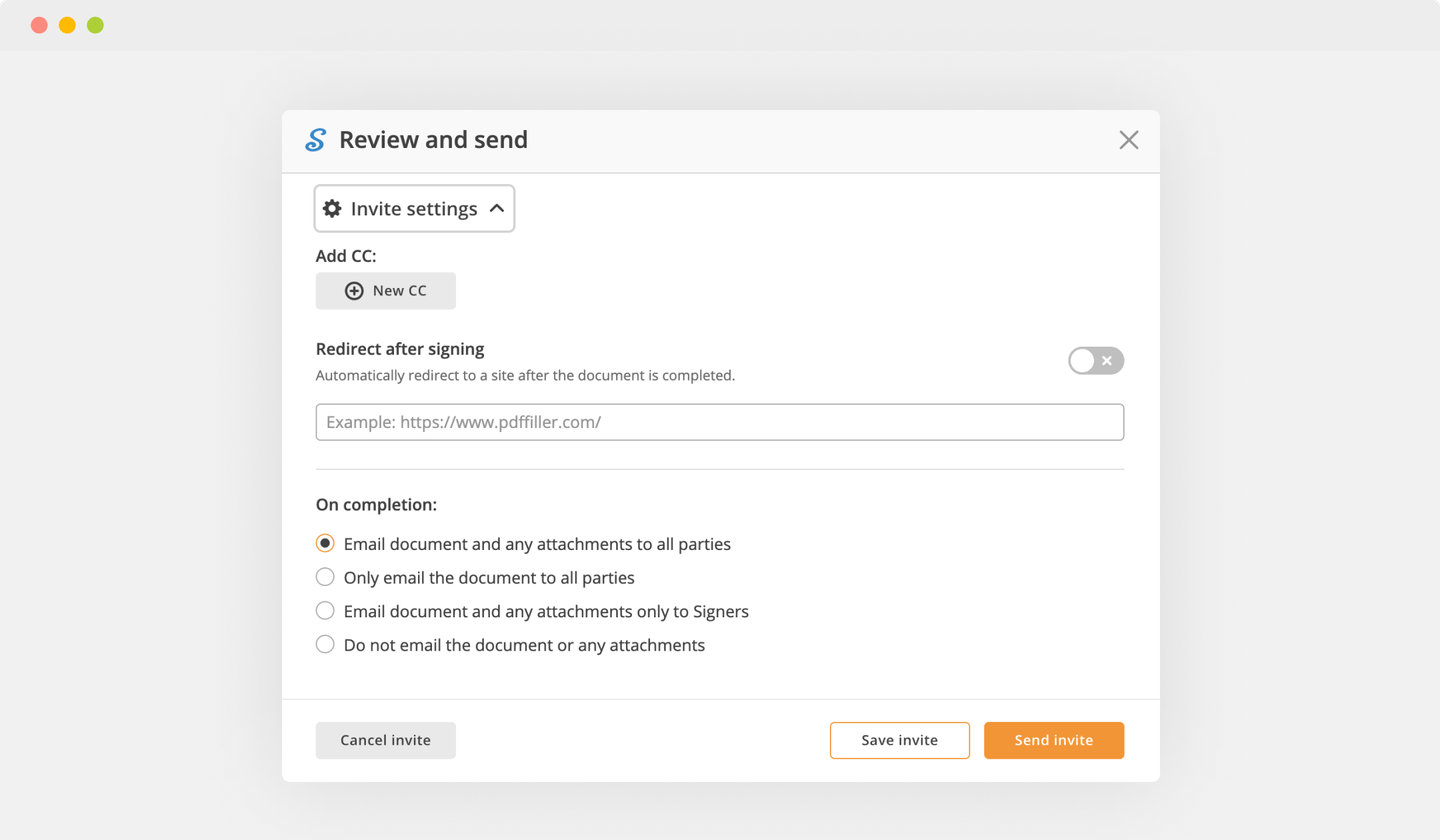

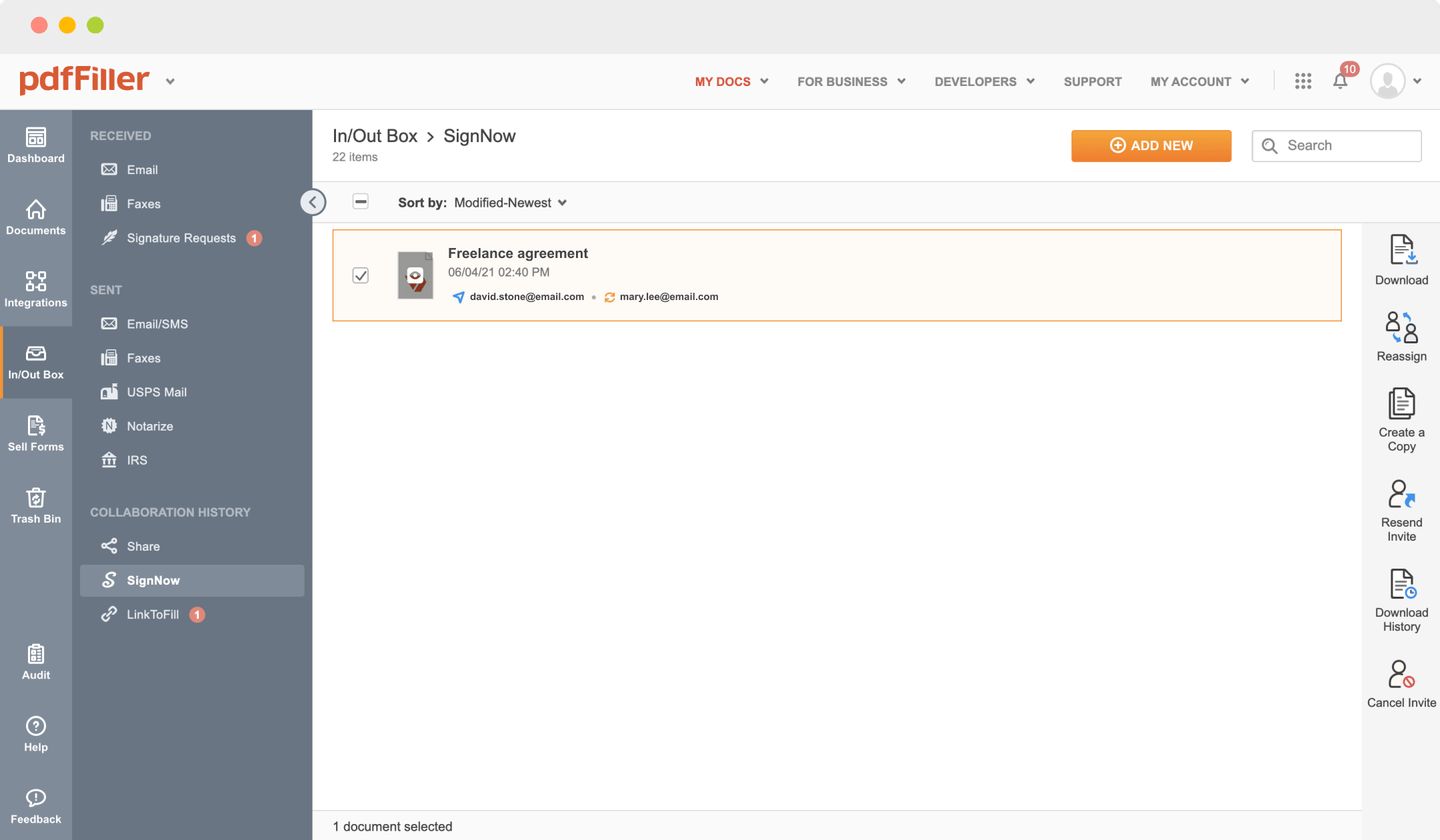

Send documents for eSignature with signNow

Create role-based eSignature workflows without leaving your pdfFiller account — no need to install additional software. Edit your PDF and collect legally-binding signatures anytime and anywhere with signNow’s fully-integrated eSignature solution.

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.

pdfFiller scores top ratings in multiple categories on G2

How to Expect Electronically Signing Request

Still using different programs to manage and sign your documents? Try our solution instead. Use our document management tool for the fast and efficient work flow. Create forms, contracts, make templates, integrate cloud services and utilize many more features within your browser. Plus, the opportunity to Expect Electronically Signing Request and add other features like orders signing, reminders, attachment and payment requests, easier than ever. Have an advantage over those using any other free or paid tools. The key is flexibility, usability and customer satisfaction.

How-to Guide

How to edit a PDF document using the pdfFiller editor:

01

Upload your document to pdfFiller

02

Select to Expect Electronically Signing Request feature in the editor's menu

03

Make the required edits to your document

04

Click the orange “Done" button in the top right corner

05

Rename the document if it's needed

06

Print, save or share the template to your desktop

How to Expect Electronically Signing Request - video instructions

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Brian B.

2018-10-03

Outstanding Tool To Fill Out PDFs.

Enjoy it.

Pdf filler does exactly what it says. It allows you to fill out that important PDF without having to print or use old school tactics (namely pen and ink) to get work done.

No cons whatsoever. It delivers and I definitely downloaded it at some point in life and was satisfied with whatever reason I did.

Louie F.

2018-05-15

THE BEST IN THE INDUSTRY

Very good product for the price. I highly recommend the annual membership.

I have used PDF Filler for many years now, it is easy to use and there are many features that it does have that I don't use. If you use this tool to the max, it will benefit any company.

Nothing really to mention about that is bad about this program....I know there are a lot of features that I don't use, that I would like to learn how to integrate into my company.

Get a powerful PDF editor for your Mac or Windows PC

Install the desktop app to quickly edit PDFs, create fillable forms, and securely store your documents in the cloud.

Edit and manage PDFs from anywhere using your iOS or Android device

Install our mobile app and edit PDFs using an award-winning toolkit wherever you go.

Get a PDF editor in your Google Chrome browser

Install the pdfFiller extension for Google Chrome to fill out and edit PDFs straight from search results.

List of extra features

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What happens if you forgot to sign your tax return?

If you submitted your return without signing it, all is not lost. In all likelihood, the IRS will simply send you a letter requesting your signature. And once they receive your signature, they'll go ahead and process your return. If you choose not to do this, then you will have to complete and sign IRS Form 8453.

Can electronically sign tax documents?

You can sign your tax return electronically by using a Self-Select PIN, which serves as your digital signature when using tax preparation software, or a Practitioner PIN when using an Electronic Return Originator (ERO).

Can I electronically sign my tax return?

You can sign your tax return electronically by using a Self-Select PIN, which serves as your digital signature when using tax preparation software, or a Practitioner PIN when using an Electronic Return Originator (ERO). If you're filing a joint return, each spouse uses his or her own PIN.

Can you do signature online?

Use our online signature tool to quickly capture a free electronic signature. You can sign the document yourself, or capture a digital signature from up to 2 persons. Upload a document you would like to sign using your local file storage or one of the cloud services below.

Is an e-signature legally binding?

Electronic Signatures in Global and National Commerce (DESIGN) Act. For an electronic signature to be legally binding under the DESIGN Act, it is recommended that all electronic signature workflows include: Intent to sign. Similar to ink signatures, a signer must show clear intent to sign an agreement electronically.

Do you have to sign an electronic tax return?

When you file your individual tax return electronically, you must electronically sign the tax return with a personal identification number (PIN) using the Self-Select PIN or the Practitioner PIN method.

What does form 8879 mean?

Form 8879 is an electronic signature document that is used to authorize e-filing. It is generated by the software using both the taxpayer's self-selected PIN and the Electronic Return Originator's (ERO's) Practitioner PIN. Form 8879 does not need to be mailed to the IRS, but instead is retained by the ERO.

How do I get Form 8879?

It is generated by software that utilizes the taxpayer's self-selected PIN and returns filed by an electronic return originator (ERO). Form 8879 is kept by the electronic return originator (ERO) and it is not required to be sent to the IRS unless it is requested.

eSignature workflows made easy

Sign, send for signature, and track documents in real-time with signNow.