Underwrite ESign Request For Free

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Upload your document to the PDF editor

Type anywhere or sign your form

Print, email, fax, or export

Try it right now! Edit pdf

Users trust to manage documents on pdfFiller platform

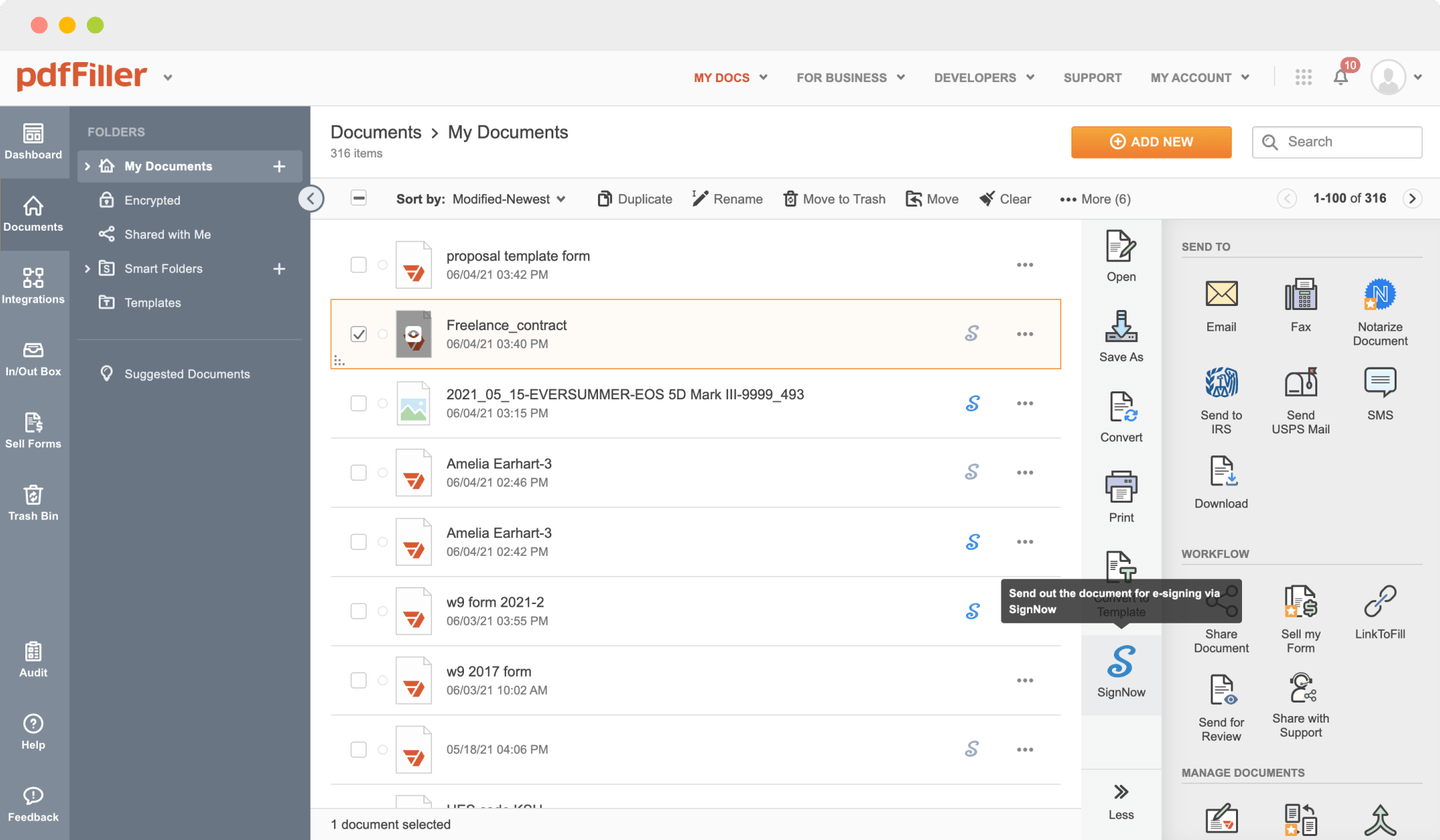

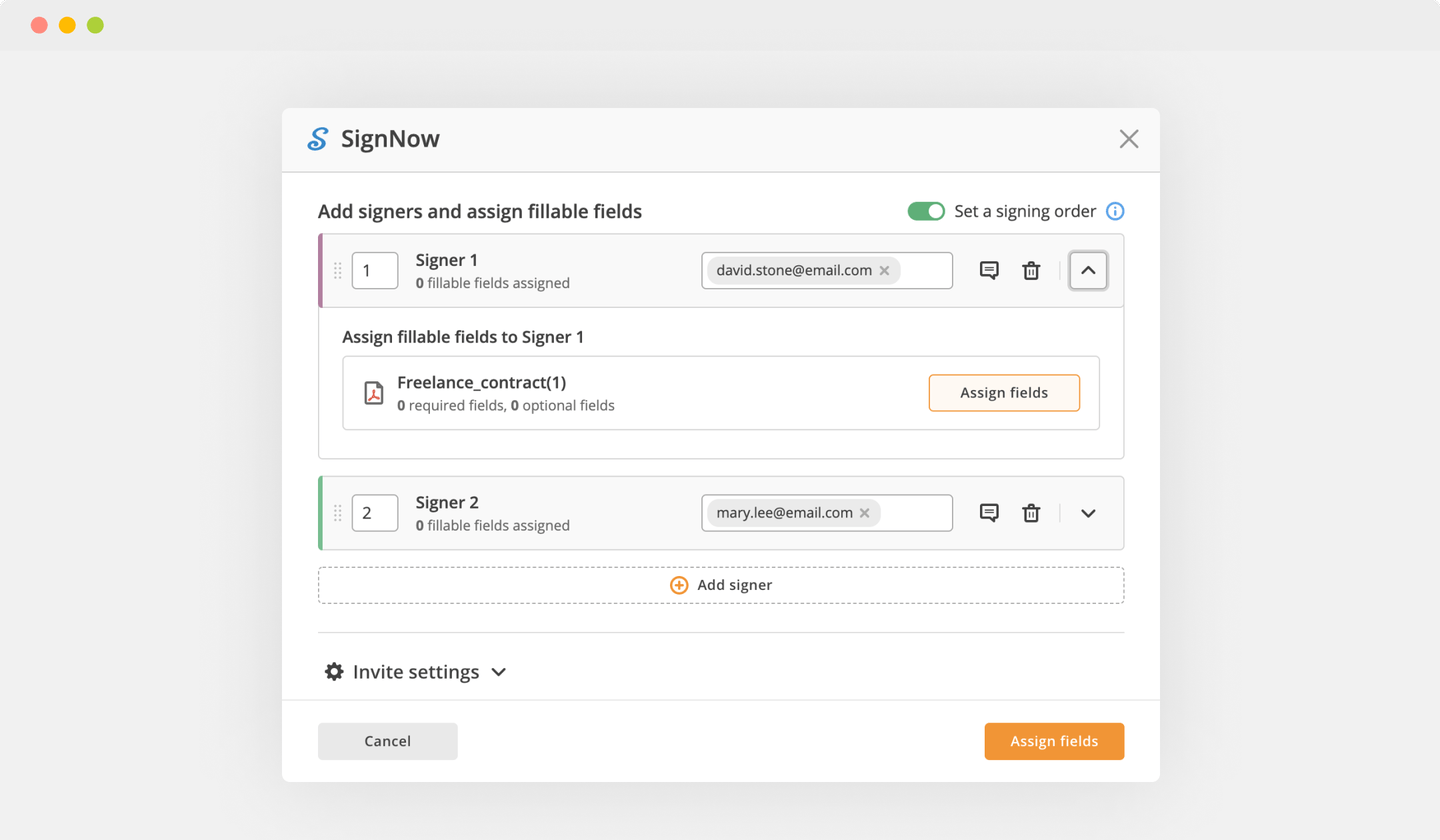

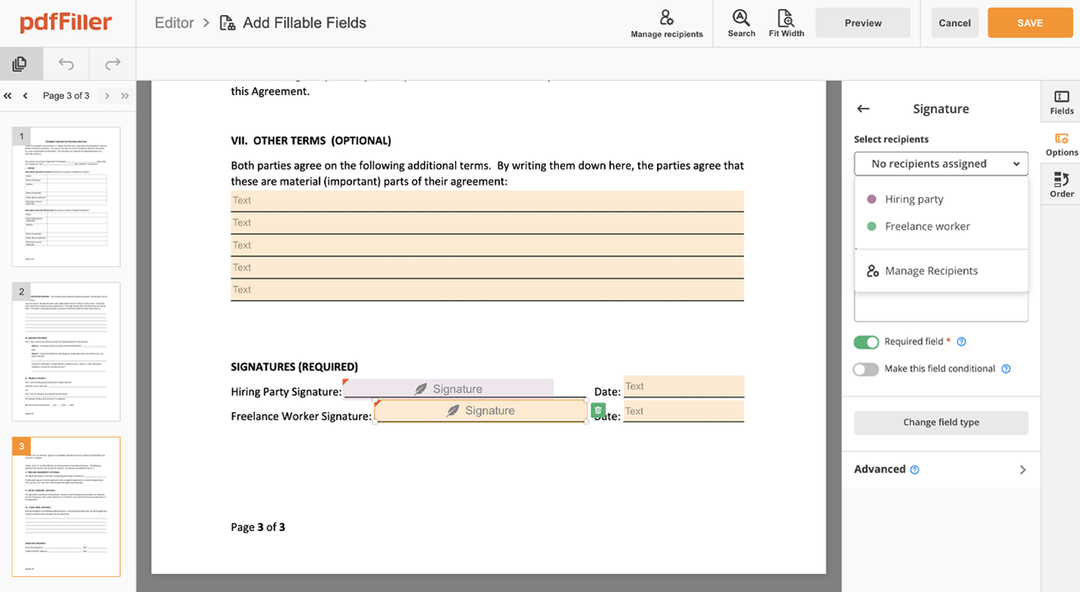

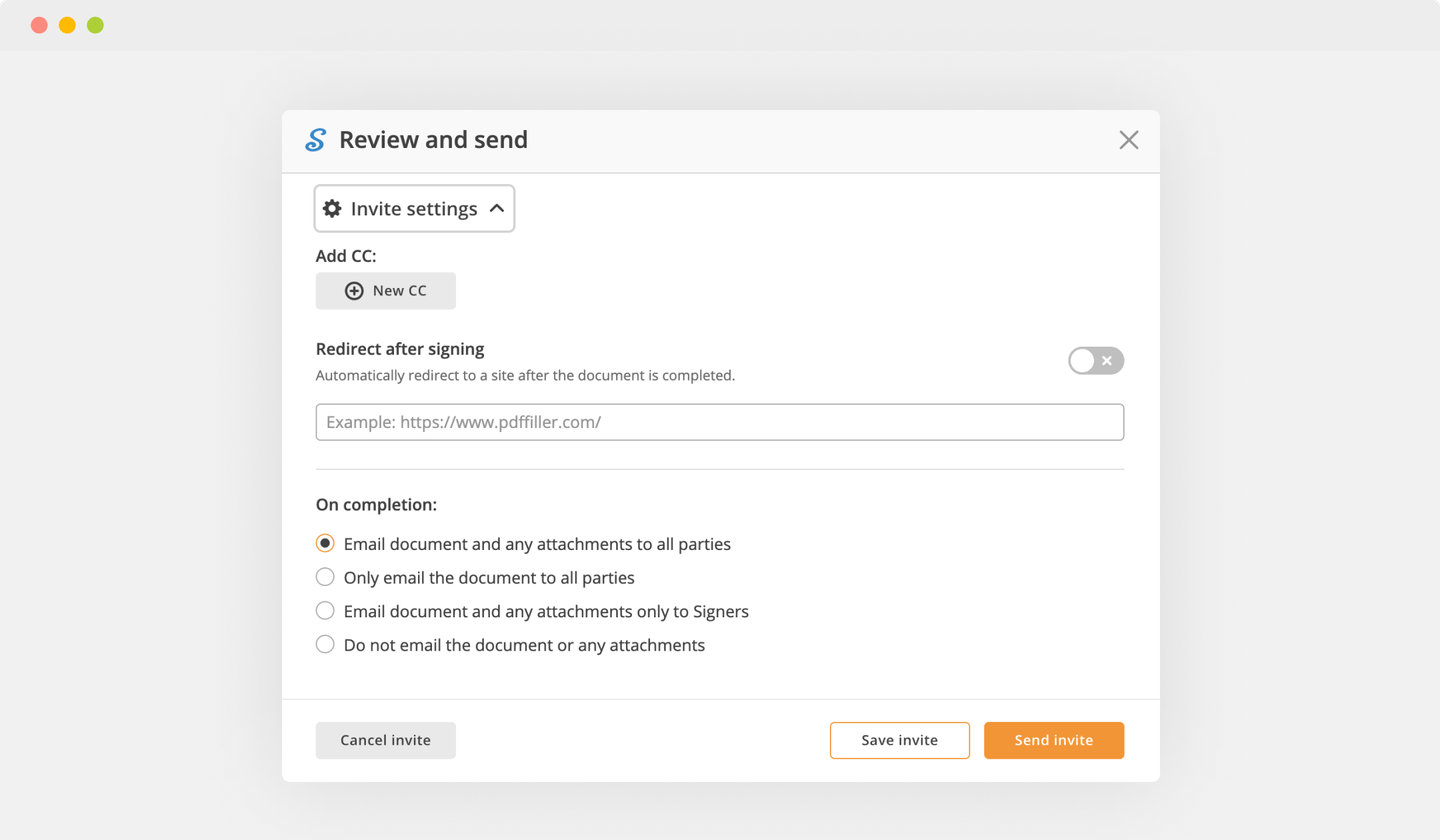

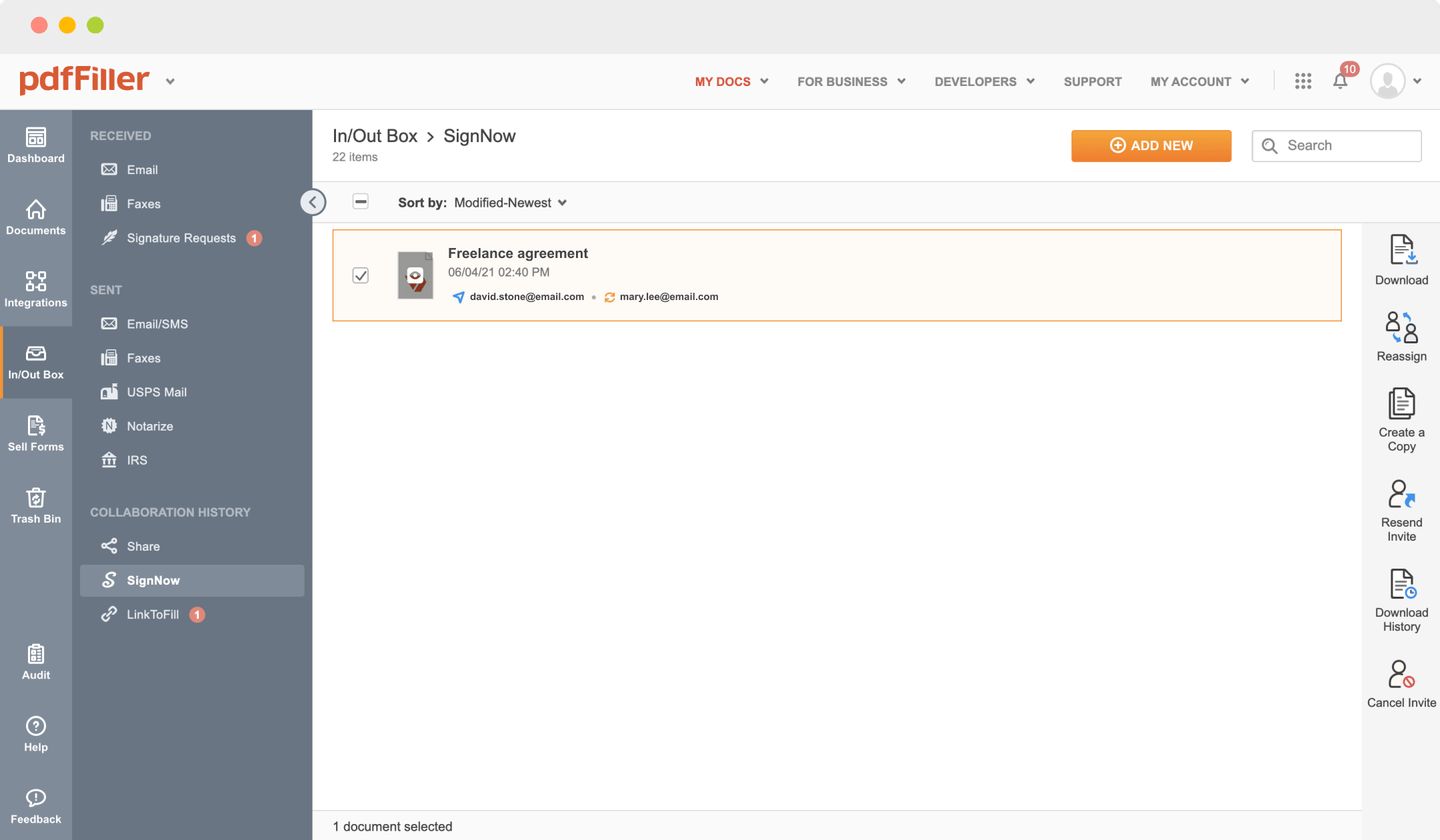

Send documents for eSignature with signNow

Create role-based eSignature workflows without leaving your pdfFiller account — no need to install additional software. Edit your PDF and collect legally-binding signatures anytime and anywhere with signNow’s fully-integrated eSignature solution.

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.

pdfFiller scores top ratings in multiple categories on G2

How to Underwrite design Request

Are you stuck working with different applications for editing and signing documents? Use this all-in-one solution instead. Document management becomes simple, fast and efficient with our editing tool. Create forms, contracts, make document templates and more features, without leaving your account. Plus, you can Underwrite eSign Request and add high-quality features like signing orders, alerts, attachment and payment requests, easier than ever. Have the value of full featured platform, for the cost of a lightweight basic app.

How-to Guide

How to edit a PDF document using the pdfFiller editor:

01

Download your form to the uploading pane on the top of the page

02

Find and select the Underwrite design Request feature in the editor`s menu

03

Make the needed edits to your file

04

Push the orange “Done" button to the top right corner

05

Rename the file if it's needed

06

Print, download or email the document to your desktop

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Deborah F

2017-03-21

Mostly good - had a little difficulty when the app decided I could only answer 1 category when I needed to respond to all 5 subcategories of a question. Also, messed with the date - it changed to a different format.

Ann M

2019-01-27

Really easy to use once you get the hang of it. I am using it frequently, especially on State government forms that I previously would have done by hand before. Thank you.

Get a powerful PDF editor for your Mac or Windows PC

Install the desktop app to quickly edit PDFs, create fillable forms, and securely store your documents in the cloud.

Edit and manage PDFs from anywhere using your iOS or Android device

Install our mobile app and edit PDFs using an award-winning toolkit wherever you go.

Get a PDF editor in your Google Chrome browser

Install the pdfFiller extension for Google Chrome to fill out and edit PDFs straight from search results.

List of extra features

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Why is underwriting taking so long?

Underwriters often request additional documents. Underwriting is the most intense review. Underwriters often request additional documents during this stage, including letters of explanation from the borrower. It's another reason why mortgage lenders take so long to approve loans.

How long does it take for underwriters to approve a VA loan?

Under normal circumstances, your purchase application should be underwritten within 72 hours of underwriting submission and within one week after you provide your fully completed documentation to your loan officer.

What does the underwriter look for?

An underwriter is a financial expert who takes a look at your finances and assesses how much risk a lender will take on if they decide to give you a loan. More specifically, underwriters evaluate your credit history, assets, the size of the loan you request and how well they anticipate that you can pay back your loan.

What does it mean when a loan is in underwriting?

The term “underwriting" refers to the process that leads to a final loan approval or denial, which is determined by a professional underwriter. Many factors are at play in a lender's final decision on a mortgage loan. These factors are all analyzed during the underwriting process through specialized software programs.

What is the underwriting process?

Underwriting is the mortgage lender's process of assessing the risk of lending money to you. The underwriter verifies your identification, checks your credit history, and assesses your financial situation including your income, cash reserves, equity investment, financial assets and other risk factors.

Can closing on a house be done electronically?

A. While the industry has yet to settle on a standard definition for closing, an eClosing is generally any real estate closing event or process in which the buyer, seller, borrower, notary or others use an electronic signature (signature) to sign some or all of the closing documents.

Who needs to be present at a house closing?

Who Attends the Closing of a House? Depending on where you live, those at your closing appointment might include you (the buyer), the seller, the escrow/closing agent, the attorney (who might also be the closing agent), a title company representative, the mortgage lender, and the real estate agents.

How do I close a house remotely?

Close Remotely You'll sign them using an electronic-signature system, which usually sends the signed forms back to the appropriate party. Attorneys still require physical signatures, so your agent will work with the closing attorney and FedEx all the necessary documents to you ahead of the closing, says Kaderabek.

Do all buyers have to be present at closing?

The seller does not have to be present at the buyers' closing. It is a common misconception that all the parties must sit around the table together at closing and exchange documents and keys. The closing attorney should explain to you when the closing date is set, and how you should receive your proceeds.

What is a remote closing?

A remote closing works exactly as the name describes. Before your closing date, your real estate agent would send you physical copies of the contract and addendums. You'd read through them and sign them, usually in the presence of a notary public.

Can you electronically sign closing documents?

Your real estate agent may email you a scanned copy of your closing documents, as a PDF attachment. You don't have to print the PDF to sign your refinancing or real estate documents. Make your life easier by electronically signing them even from your phone. Use the same process for electronically signing a Word document.

How do Underwriters verify documents?

Loan processors and underwriters use a variety of documents to verify your income. These include bank statements, paycheck stubs, W-2 forms and tax returns. Collectively, these documents show the mortgage lender how much money you earn today, and how much you've earned over the past couple of years.

Do lenders verify bank statements?

Understanding How Lenders Verify Bank Statements When buying a home, the mortgage lender may ask the borrower for proof of deposit. The borrower typically provides the bank or mortgage company two of the most recent bank statements in which the company will contact the borrower's bank to verify the information.

Do underwriters always ask for bank statements?

Lenders also take a look at your statements because it helps them avoid fraud and lessens their risk. Most lenders ask to see at least two months' worth of statements before they issue you a loan. Lenders use a process called underwriting to verify your income.

eSignature workflows made easy

Sign, send for signature, and track documents in real-time with signNow.