Account Opening Form Information

What is Account opening form information?

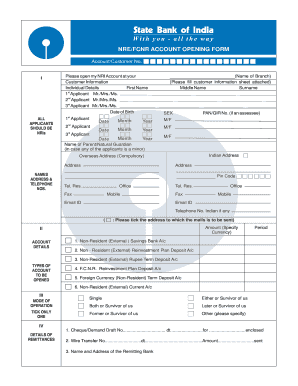

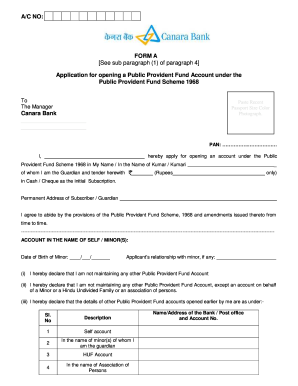

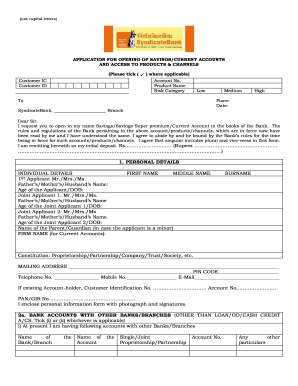

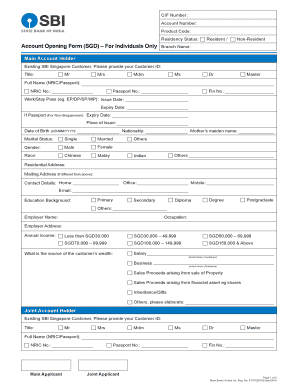

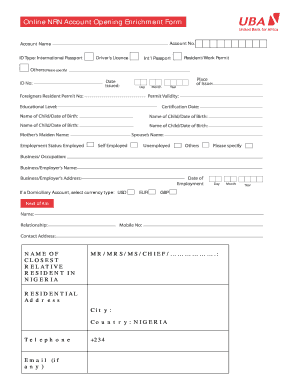

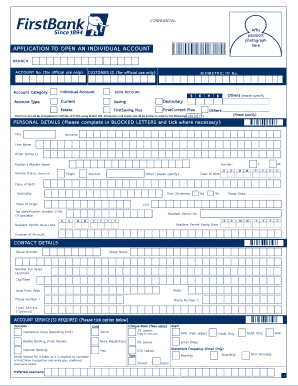

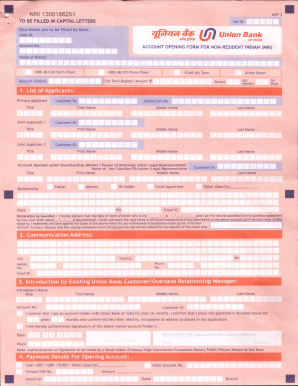

Account opening form information refers to the data and details required by a financial institution or organization when an individual or business is applying to open a new account. This information typically includes personal or business details, identification documents, contact information, and other relevant data needed to establish the account.

What are the types of Account opening form information?

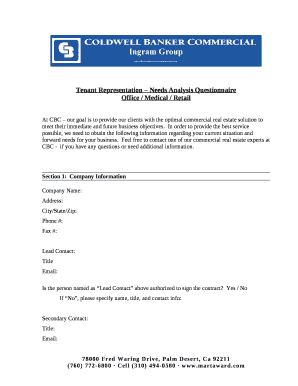

There are various types of information that may be required on an account opening form, including:

Personal details such as name, address, contact information, and occupation

Identification documents like a driver's license, passport, or social security number

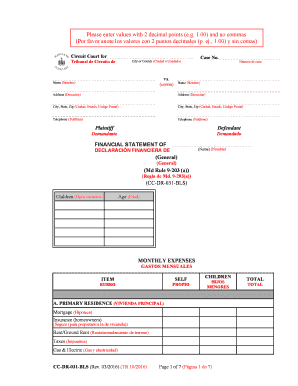

Financial information such as income, assets, and liabilities

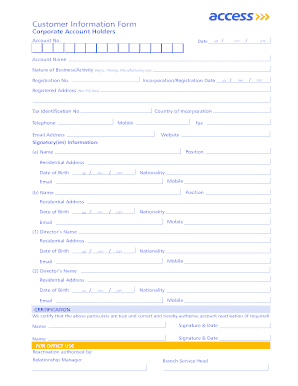

Business details for corporate accounts including business name, type, and tax ID number

How to complete Account opening form information

To successfully complete an account opening form, follow these steps:

01

Gather all necessary documents and information before starting the form

02

Fill out all sections accurately and completely

03

Double-check for any errors or missing information before submission

04

Submit the completed form along with any required identification documents or proofs

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Account opening form information

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What documents required for account opening form?

Passport, Driving Licence, Proof of possession of Aadhaar Number, Voter's Identity Card issued by Election Commission of India, Job card issued by NREGA duly signed by an officer of the State Government, Letter issued by the National Population Register containing details of name and address.

What documents required for bank account opening form?

Passport, Driving Licence, Proof of possession of Aadhaar Number, Voter's Identity Card issued by Election Commission of India, Job card issued by NREGA duly signed by an officer of the State Government, Letter issued by the National Population Register containing details of name and address.

What information must you receive when you open a bank account?

Information you must receive when you open a bank account the interest rate you'll earn (in the case of an interest bearing account) how any interest will be calculated. details of all charges related to the account.

How many documents required for account opening?

Bank account statement or passbook of the bank. Ration card. Aadhaar card. A letter stamped/signed/recognised from a gazetted officer or public authority to verify the address details of the applicant.

What is the purpose of account opening form?

An Account Opening Form or AOF is a document that is used by financial institutions to gather information about their customers when they open a new account. This form is an essential part of the account opening process as it helps the bank or financial institution to identify the customer and verify their details.

What is required when opening an account?

To open an account, you'll need to choose a bank and provide the bank with some necessary information, including your identification and proof of address. You'll usually need to be 18 to meet the bank's eligibility requirements. Finally, you might need to fund the account or have a minimum balance to avoid fees.

Related templates