How To Get A Tax Id Number

What is How to get a tax id number?

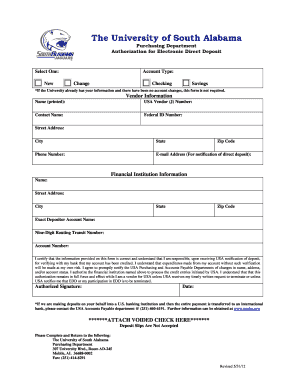

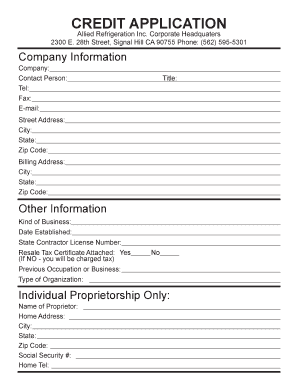

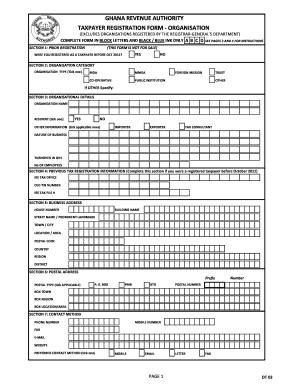

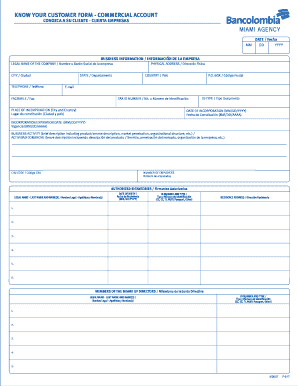

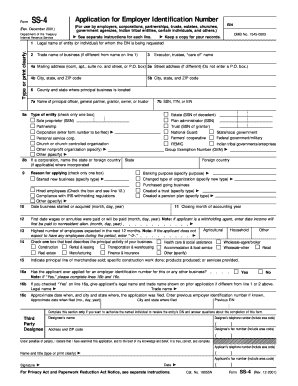

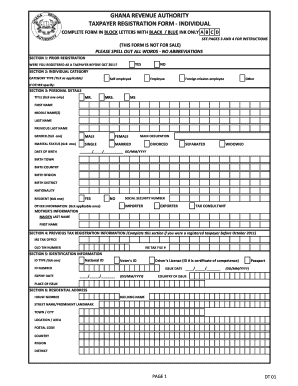

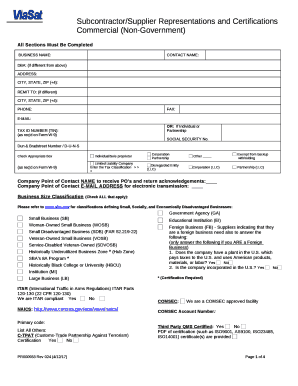

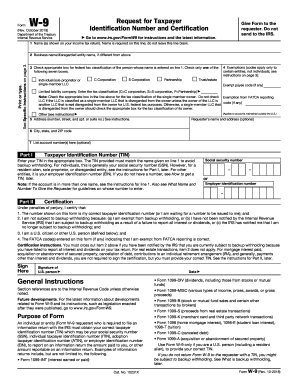

When it comes to getting a tax identification number, also known as a TIN or EIN, it is essential for businesses and individuals who need to report income to the IRS. This unique number helps to identify entities for tax purposes and is necessary for various financial transactions.

What are the types of How to get a tax id number?

There are primarily two types of tax identification numbers that individuals or businesses can obtain. The first is an Employer Identification Number (EIN), which is used by businesses for tax filing and reporting. The second is a Social Security Number (SSN), typically used by individuals for personal tax filing and identification.

How to complete How to get a tax id number

To complete the process of obtaining a tax identification number, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.