Fill out your Form W-9 online

The number of e-filed tax returns is increasing by the day. Today, you have the option of submitting completed forms directly to the IRS online in minutes. This option is especially convenient for self-employed individuals, freelancers, and independent contractors required to file IRS Form W-9.

This page is for informative purposes only and does not constitute tax or legal advice

What is IRS Form W-9?

The W-9 is also called the Request for Taxpayer Identification Number and Certification. It is one of the most frequently used tax reporting documents in the United States. The form itself doesn’t get sent to the IRS. Instead, it is sent to the individual or organization you’re providing professional services for. The information provided on the W-9 is used by your client to fill out another tax document known as Form 1099.

Form W-9 contains important information that regulates the relationship between hirers and independent contractors, including:

01

Name and business name of the self-employed person.

02

Type of business entity according to the federal tax classification.

03

Social Security Number (or Employer Identification Number).

By signing the completed Form W-9, a self-employed person certifies that all the information provided on the form is correct and that he or she is exempt from backup withholding.

Dates: There is no official deadline for filing Form W-9. However, it is mandatory to fill out a new W-9 every time your personal or business details (i.e., name, business name, address, tax ID number) change and have to be updated.

Extensions: You are required to fill out your W-9 as soon as you get one. If you fail to send a W-9 or send one with the wrong information, you may be subject to a $50 penalty.

Take into consideration: In some cases, an unscheduled form review may take place at the desire of the employer. If you provide professional services to more than one company or business, you may have to fill out several W-9’s.

How to fill out your W-9

Form W-9 is considered one of the easiest IRS forms to complete. Below is a step-by-step guide to filling out your W-9:

01

Provide your full name and make sure it’s spelled correctly (the spelling should be identical with other tax forms you’ve filled out).

02

Fill out the Business name section of the W-9 if you own a business and your business name is different from the one indicated in Line 1 of the form.

03

Indicate your tax status according to the IRS classification (i.e., sole proprietorship, partnership, C corporation, S corporation, trust/estate, limited liability company, etc.). Only one box has to be checked in this line.

04

If your entity is exempt from backup withholding, fill in the first line with your code. If you are exempt from reporting required by the FATCA, fill in the second line. Note that individuals do not fill out this section.

05

Enter your address so your employer could mail you information returns and notifications. Enter your state, city, and ZIP code.

06

List any additional account numbers your employer might need. If you don’t have any, leave this section blank.

The second part of the form contains all the necessary personal details used by your employer to report the earnings paid to you. This section has to be filled out as follows:

01

Provide your Social Security Number if you fill out the form as an individual or single-member LLC or the Employment Identification Number if you fill out the form as a corporation or partnership. In case you’re a sole proprietor, both numbers could be filled in.

02

Revise your document and make sure everything is correct, then sign your Form W-9 and insert the current date in the respective field.

E-file your tax forms directly to the IRS

According to new IRS rules, those that file their tax refund forms online will be the first to receive their refunds.

File your W-2, 1099-MISC, and 941 forms with the IRS online

Fill out your tax forms and submit them directly to the IRS with pdfFiller.

Submit your form to the IRS in a single click and email copies to your employees and independent contractors right from your pdfFiller account.

Experience simple, transparent, and stress-free filing from start to finish.

E-filing with pdfFiller is the absolute fastest and safest way to get your refund. All forms that are generated, completed, and sent using pdfFiller are securely stored in your personal account in the cloud, ensuring only you have access to them.

Pay taxes online

The most convenient and straightforward way to file a W-9 is to fill out a fillable sample online. If tax forms make you nervous, you can find the detailed instructions about how to correctly fill out your W-9 on pages 2-6 of the form.

Ability to file from anywhere

Ensured accuracy

Time and money savings

Avoid added interest and penalties

Welcome to the pdfFiller forms catalog

Browse Versions and Schedules for All Relevant Forms

IRS Forms with Versions and Schedules

Edit professional templates, download them in any text format or send via pdfFiller’s advanced sharing tools. See also Top Forms by user votes.

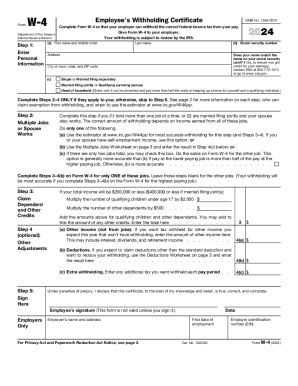

W4 form

Individual tax return information to the IRS

W9 form

If you are providing Form W-9 to an FFI to document a joint account each holder of the account...

1040-ES form

Department of the Treasury Internal Revenue Service Form 1040-ES Estimated Tax for Individuals...

How to fill out other forms

Find the form you need, fill it out, and sign faster than ever before.

1099-misc tax form

Reporting nonemployee types of compensation. For freelancers, independent contractors and self-em...

Read guide

W-2 tax form

Reporting earning from employment and taxes withheld from those earnings

Read guide

941 tax form

Employer’s Quarterly Federal Tax Return form. For all employers paying wages to employees

Read guide

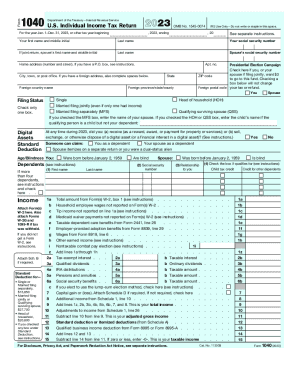

1040 tax form

The number of e-filed tax returns is increasing by the day. Today, you have the option of submitt...

Read guide

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.