What is non profit donation receipt requirements?

Non profit donation receipt requirements refer to the specific documentation that an organization must provide to donors in order to acknowledge and confirm their charitable contributions. These requirements may vary depending on the country or region and are usually enforced by tax authorities or regulatory agencies. The purpose of these requirements is to ensure transparency and accountability in the non profit sector.

What are the types of non profit donation receipt requirements?

There are several types of non profit donation receipt requirements that may apply depending on the circumstances and the donor's intent. Some common types include:

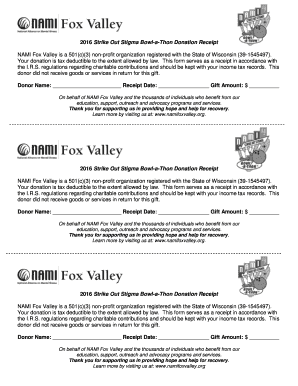

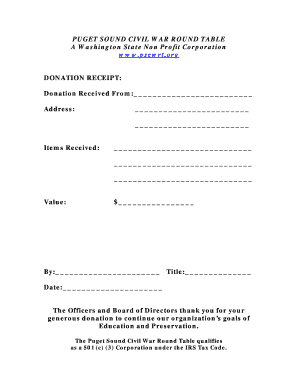

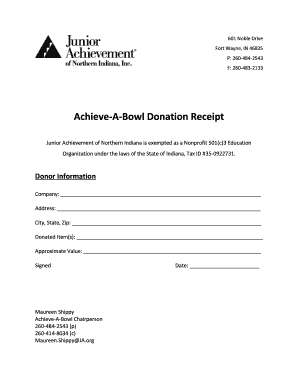

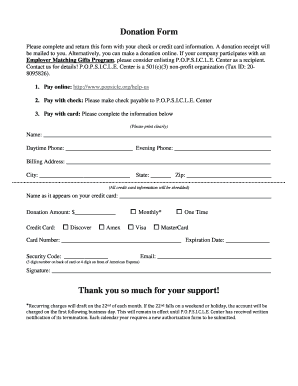

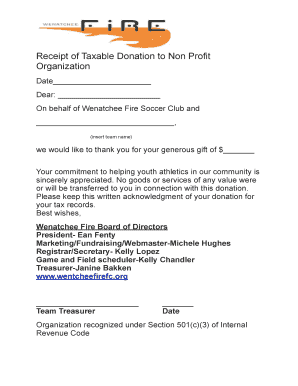

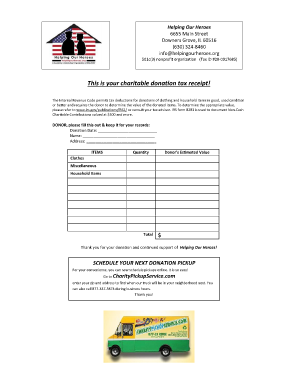

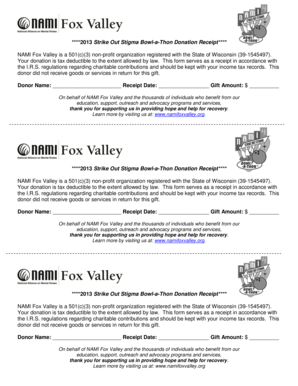

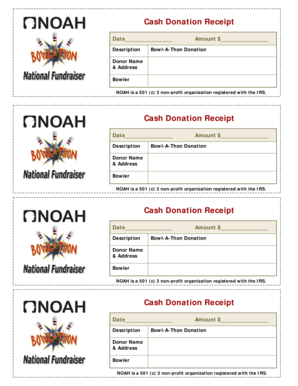

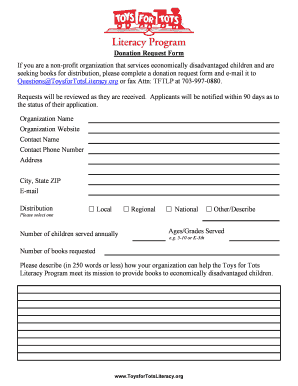

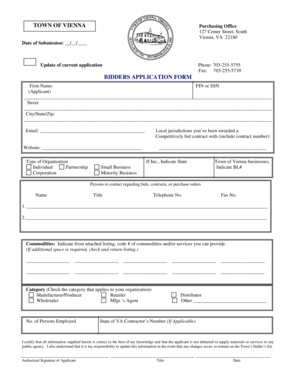

The receipt must include the organization's name, address, and contact information.

The receipt should clearly state that it is a tax-deductible donation receipt.

The receipt must indicate the date of the donation.

The receipt should describe the donated items or services, along with their estimated value if applicable.

The receipt should mention whether any goods or services were provided to the donor in exchange for the donation.

The receipt must bear the signature or electronic signature of an authorized representative of the organization.

The receipt should include the organization's charitable registration number or tax identification number.

The receipt must be issued within a certain timeframe from the date of the donation.

How to complete non profit donation receipt requirements

To ensure compliance with non profit donation receipt requirements, follow these steps:

01

Collect all necessary donor information, including their full name, address, and contact details.

02

Record the donation details accurately, including the date, description of the donation, and its value if applicable.

03

Include the required information on the receipt, such as the organization's name, address, and contact information.

04

Clearly state that the receipt is a tax-deductible donation receipt.

05

Indicate whether the donor received any goods or services in exchange for the donation.

06

Obtain the signature or electronic signature of an authorized representative of the organization.

07

Include the organization's charitable registration number or tax identification number on the receipt.

08

Issue the receipt to the donor within the specified timeframe.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.