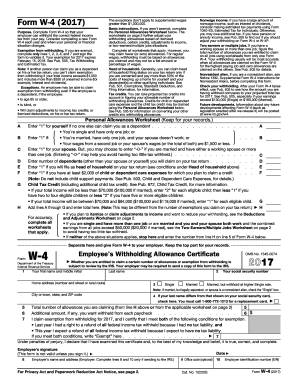

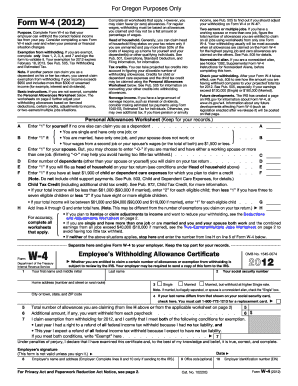

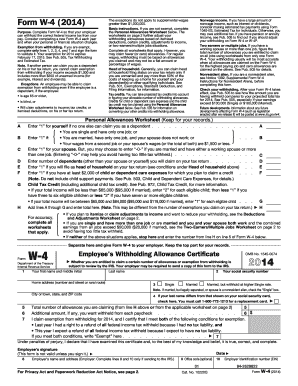

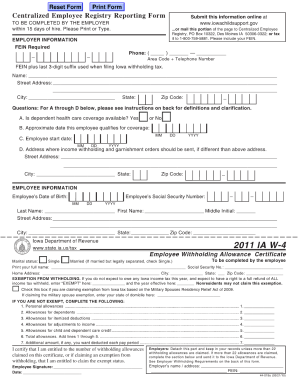

Form W-4

What is form w-4?

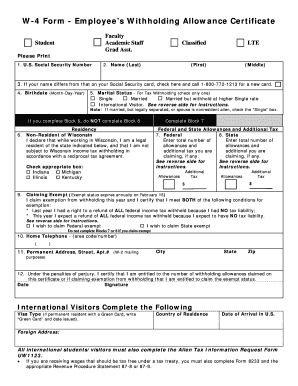

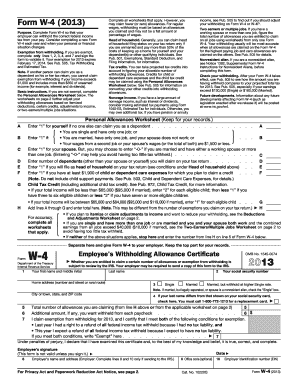

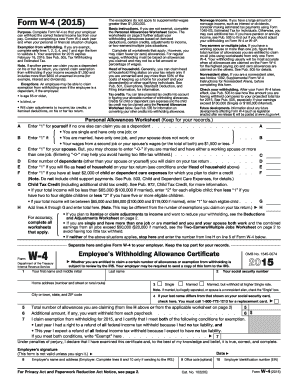

Form W-4 is a document used by employers to determine the amount of federal income tax to withhold from an employee's paycheck. It is a crucial form that must be filled out accurately to ensure proper tax withholding.

What are the types of form w-4?

There are two main types of Form W-4: 2020 Form W-4 and the previous year's version - 2019 Form W-4. The 2020 version has been updated to reflect changes made by the Tax Cuts and Jobs Act (TCJA) and aims to simplify the withholding process. Both versions allow employees to adjust their withholding allowances based on their personal and financial circumstances.

How to complete form w-4

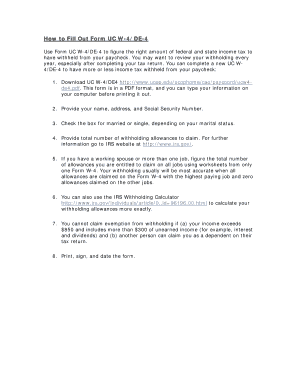

Completing Form W-4 is a simple process. Follow these steps to accurately fill out the form:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.