Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is california 540 form?

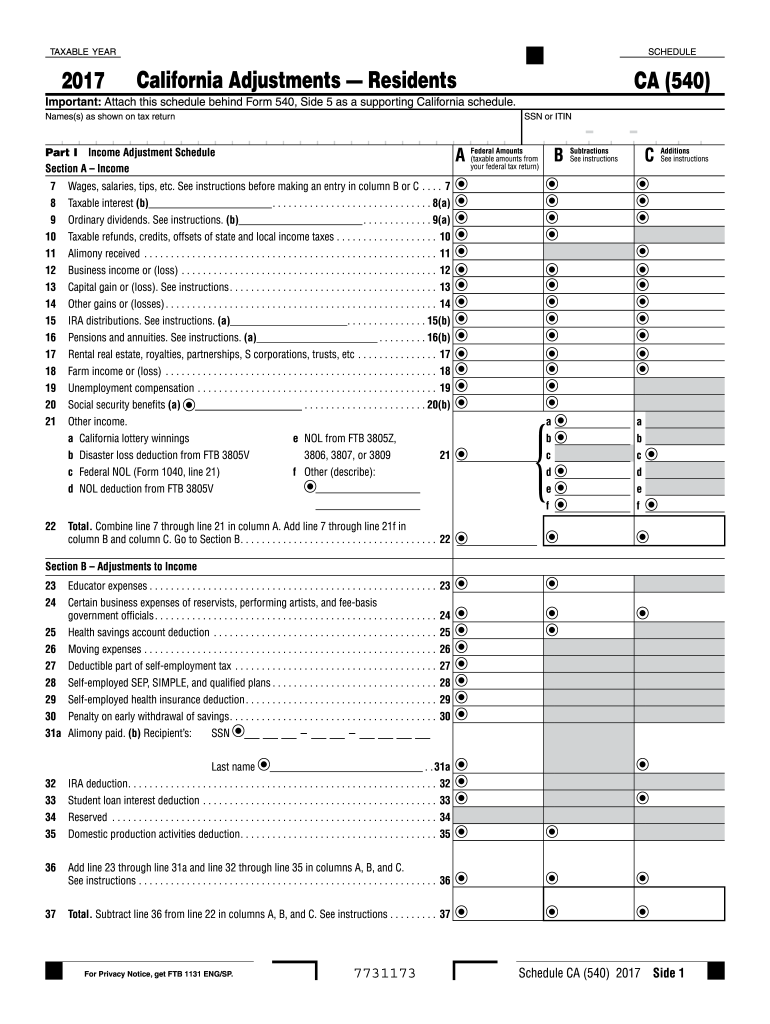

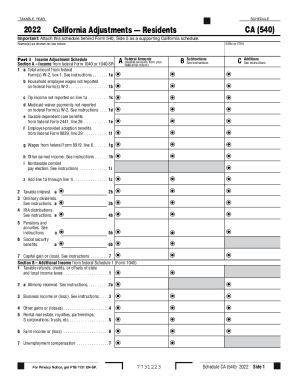

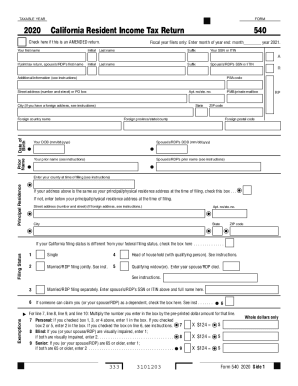

The California 540 Form is the individual income tax return form used by residents of California. It is used to report income earned in the state and calculate any tax owed or refund due. The form includes sections to report income, deductions, and credits, and provides instructions for completing the form correctly. It is filed annually by California residents with the state's Franchise Tax Board.

Who is required to file california 540 form?

In general, individuals who are residents of California or who earned income in California are required to file a California Form 540. This includes the following individuals:

1. California residents who earned any income regardless of the source.

2. Non-residents of California who earned income in California.

3. Part-year residents who moved into or out of California during the tax year.

However, there are some exceptions and specific situations that may affect whether or not an individual is required to file a California Form 540. It is recommended to consult with a tax professional or refer to the official California Franchise Tax Board website for more details and specific circumstances.

How to fill out california 540 form?

To fill out a California 540 form, follow these steps:

1. Obtain the necessary documents: You will need your W-2 forms, 1099 forms, and any other income-related documents you have received for the tax year.

2. Personal information: Enter your personal information, such as your name, Social Security number, and contact details, at the top of the form.

3. Filing status: Indicate your filing status, such as single, married filing jointly, head of household, etc.

4. Exemptions: Fill in the appropriate number of exemptions based on your situation.

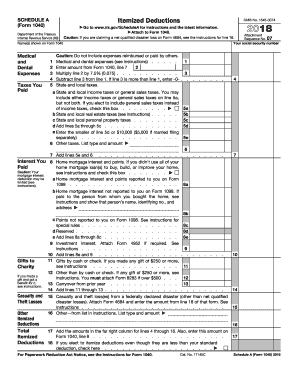

5. Income: Report your income in the corresponding sections of the form. This includes wages, salaries, self-employment income, interest, dividends, and other forms of taxable income. Use the provided schedules to report certain types of income if necessary.

6. Adjustments: If you have any adjustments, such as deductible IRA contributions or student loan interest, report them in this section.

7. Tax credits: Enter any tax credits you are eligible for, such as the Earned Income Credit or Child Tax Credit. Attach any required schedules if needed.

8. California tax: Use the provided tables or the tax rate schedules to calculate your California tax based on your taxable income.

9. Payments and refund: Report any tax withheld (found on your W-2 forms) and any estimated tax payments you made throughout the year. Calculate your refund or additional amount owed based on these payments.

10. Sign and date: Finally, sign and date the form to certify that the information provided is accurate.

Remember to carefully review your completed form for accuracy before submitting it to the California Franchise Tax Board. Consider consulting a tax professional or using tax software to ensure accurate completion and maximize your deductions.

What is the purpose of california 540 form?

The California 540 form is used for filing state income tax returns for individuals who are residents of California. Its purpose is to report the taxpayer's income, deductions, credits, and taxes owed or refunded. The form is provided by the California Franchise Tax Board (FTB) and is used to calculate and report state income tax liability.

When is the deadline to file california 540 form in 2023?

The deadline to file California Form 540 for the tax year 2023 is generally April 15, 2024. However, please note that tax deadlines can sometimes change, so it is always a good idea to double-check with the California Franchise Tax Board or consult a tax professional for the most up-to-date information.

What is the penalty for the late filing of california 540 form?

The penalty for the late filing of California Form 540, the state individual income tax return, varies depending on the taxpayer's circumstances. Generally, if your return is filed after the due date without obtaining a valid extension, you may face a late filing penalty of 5% of the tax due per month, or part of a month, up to a maximum of 25%. Additionally, interest is charged on any unpaid tax from the original due date until paid in full. It's important to note that penalties and interest may also vary depending on the specific situation, so it's recommended to consult the California Franchise Tax Board or a tax professional for more accurate information based on your circumstances.

What information must be reported on california 540 form?

The California 540 Form is the state individual income tax return form used by residents of California. The form collects various information related to a taxpayer's income, deductions, credits, and tax liability. The following information must be reported on the California 540 Form:

1. Personal Information: This includes the taxpayer's name, Social Security number (SSN), filing status (e.g., single, married filing jointly, etc.), and address.

2. Income: All sources of income must be reported, including wages, salaries, tips, business income, rental income, investment income, unemployment compensation, and any other taxable income received during the tax year. This information is reported on various parts of the form, such as wages on line 1, interest and dividends on line 2, business income or loss on Schedule CA, etc.

3. Adjustments to Income: Taxpayers can claim certain deductions or adjustments to their income, which can reduce their taxable income. These adjustments may include contributions to retirement accounts, self-employment tax deductions, health savings account deductions, etc. These adjustments are reported on California Schedule CA.

4. California Exemptions: Taxpayers can claim exemptions for themselves, their spouse, and each dependent claimed on their federal return. This information is reported on the form itself, on line 6.

5. California Tax Credits: Various tax credits are available in California, such as the California Earned Income Tax Credit (CalEITC), dependent care credit, property tax credit, etc. Any eligible tax credits can be claimed on the form, which can reduce the taxpayer's total tax liability.

6. California Withholding and Estimated Payments: Taxpayers need to report any California income tax that was withheld from their wages or other income sources throughout the year. They also need to report any estimated tax payments made during the year.

7. Tax Liability: The form calculates the taxpayer's total tax liability by taking into account the income, deductions, credits, and any other applicable tax calculations. The taxpayer should report their final tax liability on the form.

8. Refund or Amount Due: After calculating the tax liability, taxpayers will determine whether they owe additional taxes or are due a refund. This information is reported on the form, and if there is a balance due, they may need to include payment with their return.

It is important to note that the instructions and requirements for the California 540 Form may change from year to year, so it is advisable to refer to the most recent version of the form's instructions or consult a tax professional for accurate and updated information.

How can I manage my california 540 2017 form directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign california 540 2017 form and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit california 540 2017 form in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing california 540 2017 form and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I complete california 540 2017 form on an Android device?

On an Android device, use the pdfFiller mobile app to finish your california 540 2017 form. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.