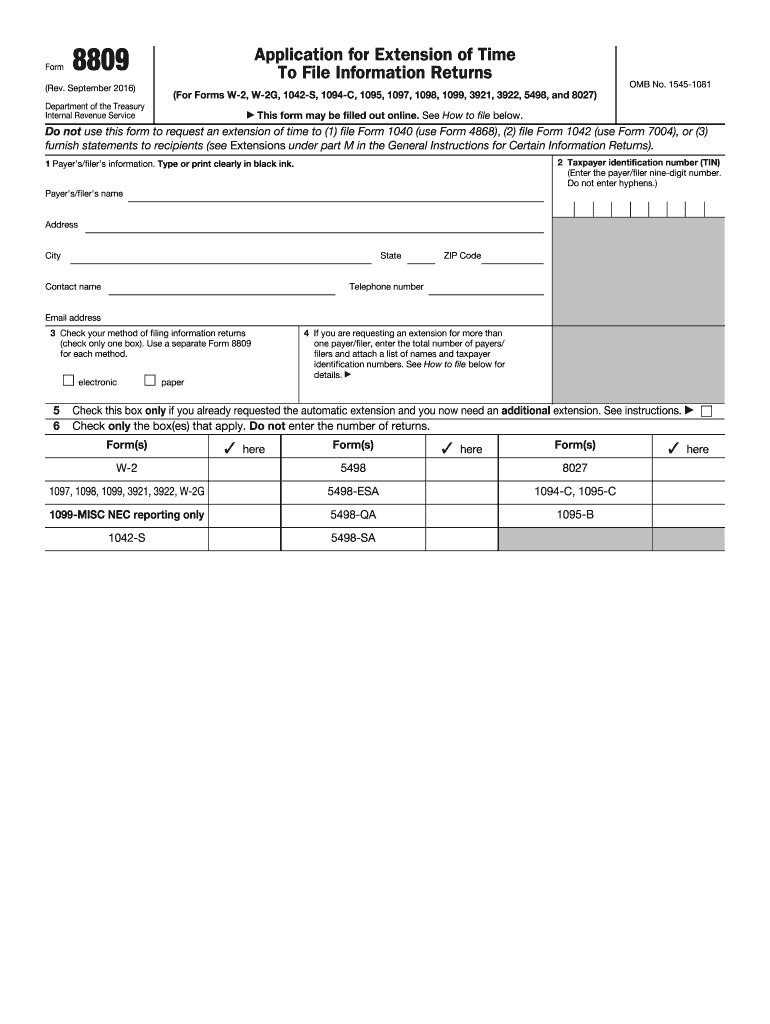

Who Can Use Form 8809?

All taxpayers who need to extend the duration of other separate forms may use template number 8809. It will assist in dealing with all necessary payments and complete deposits on time. If an individual notices that they require more time for processing documentation, it is easier to deal with this statement.

What is Form 8809 for?

Apply for Form 8809 if you want to obtain some more time to file the templates for the taxation year that will be enumerated in the following paragraphs. Be careful with the statements 1099-QA and 5498-QA (they both are required to be filed on paper).

What forms are Available for Application for Extension of Time?

There is a whole list of all possible statements that are compatible with the Form 8809. They are W-2, 8027, 1094-C, 1095-B, 1095-C, 5489-SA, 1097, 5498-ESA, 1089, 5489, 3921, 1042-S, 3922 and the last one is W-2G.

When is Form 8809 due?

According to the type of the attached form, the due date is different. Here are the due dates for every above-mentioned statement. The forms W-2G, 8827, 1094-C, 1095, 1097-1099, 3921, 3922 are due on March 31. The form 1042-s expires on March 15, 1099, MISC — on January 31 and 5598 on May 31.

How to File Form 8809

First, you will see empty boxes to tick the necessary form for the time extension. The filer should write their full name, address (city, state, zip code, etc.), telephone number if available, and e-mail address as well. Remember that you can fill in the template both in the electronic and paper forms.

Where to Send Form 8809

Here is an accurate address to send your ready Form 8809 for the extension of time to:

Internal Revenue Service Attn:

Extension of Time Coordinator

240 Mural Drive, Mail Stop 4360

Kernersville, WV 25430