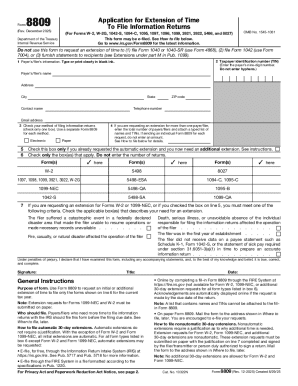

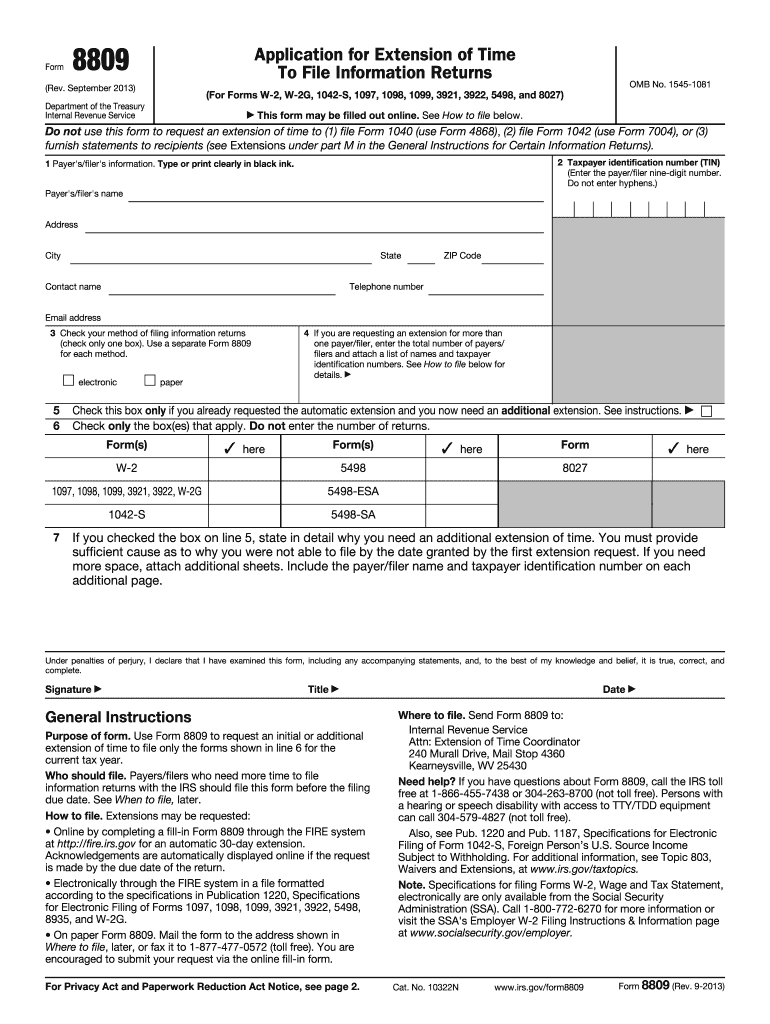

IRS 8809 2013 free printable template

Instructions and Help about IRS 8809

How to edit IRS 8809

How to fill out IRS 8809

About IRS 8 previous version

What is IRS 8809?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8809

What should I do if I discover an error after submitting the sample form 8809 2013?

If you find an error in your submitted sample form 8809 2013, it's essential to file an amended return as soon as possible. Ensure that you clearly indicate the changes you are making, and include any necessary explanations. The IRS allows corrections to be made, but prompt action helps mitigate penalties and issues.

How can I check the status of my submitted sample form 8809 2013?

To verify the status of your sample form 8809 2013, you can use the IRS online tools or contact their customer service. Be prepared with your submission details, as they may ask for information to authenticate your inquiry.

What common mistakes should I watch for when filing the sample form 8809 2013?

Common errors when filing the sample form 8809 2013 include missing signatures, incorrect identifying numbers, and failing to adhere to formatting guidelines. Reviewing your form thoroughly before submission is crucial for proper compliance and to avoid rejections.

Are there special considerations for filing the sample form 8809 2013 for non-residents?

When filing the sample form 8809 2013 for non-residents or foreign payees, ensure that you provide the correct taxpayer identification number and follow IRS guidelines specific to foreign filings. Consulting with a tax professional may be beneficial for unique cases.

What should I do if I receive an audit notice related to my sample form 8809 2013?

If you receive an audit notice regarding your sample form 8809 2013, promptly review your records and gather all necessary documentation that supports your filing. Responding to the letter with accurate information is critical, and consider seeking help from a tax advisor to ensure a proper response.

See what our users say