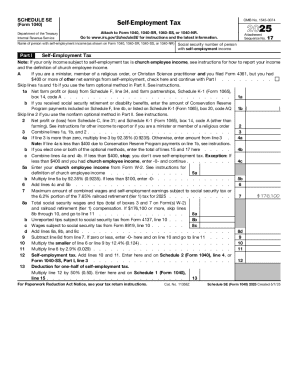

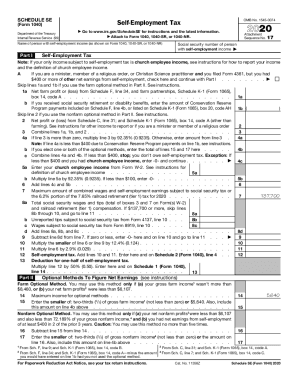

IRS 1040 - Schedule SE 2018 free printable template

Instructions and Help about IRS 1040 - Schedule SE

How to edit IRS 1040 - Schedule SE

How to fill out IRS 1040 - Schedule SE

About IRS 1040 - Schedule SE 2018 previous version

What is IRS 1040 - Schedule SE?

Who needs the form?

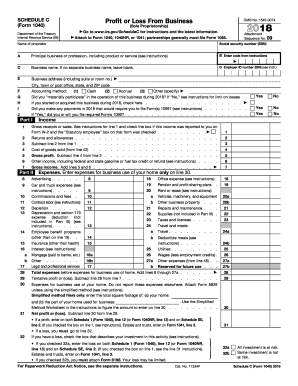

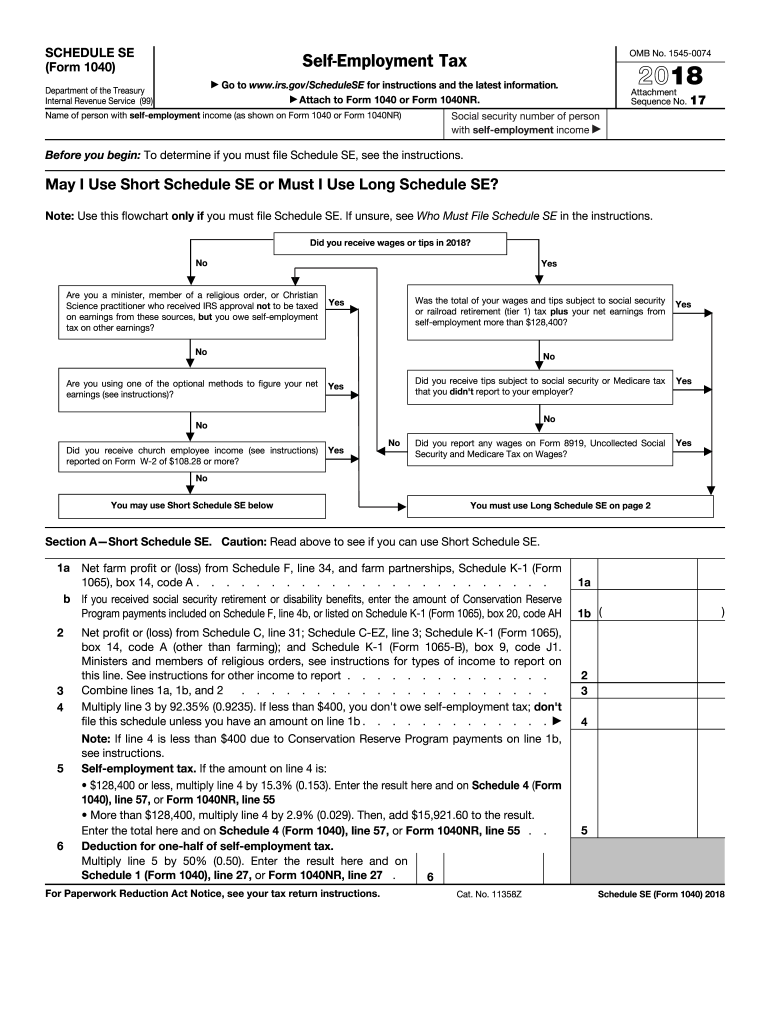

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

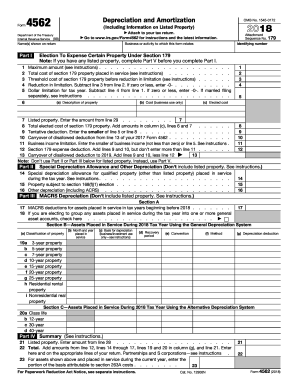

Is the form accompanied by other forms?

FAQ about IRS 1040 - Schedule SE

What should I do if I notice an error on my IRS 1040 - Schedule SE after submitting?

If you find an error after filing your IRS 1040 - Schedule SE, you should file an amended return using Form 1040-X. It's important to clearly indicate the changes being made, and include any necessary documentation to support those changes. This action helps ensure that your tax records are accurate and up to date.

How can I verify the status of my IRS 1040 - Schedule SE submission?

To check the status of your IRS 1040 - Schedule SE submission, you can use the IRS 'Where's My Refund?' tool or call the IRS directly. Keep in mind that you might need to provide personal information such as your Social Security number and filing status for verification.

What common mistakes should I watch out for when filing my IRS 1040 - Schedule SE?

Common mistakes when completing the IRS 1040 - Schedule SE include incorrectly calculating self-employment taxes or failing to report income accurately. Make sure you double-check all figures and ensure all income sources are reported to avoid potential audits or penalties.

Are there specific requirements for e-signatures on my IRS 1040 - Schedule SE?

Yes, e-signatures are acceptable when filing your IRS 1040 - Schedule SE electronically, as long as you use an IRS-approved e-filing software that meets their security standards. It’s crucial to follow the instructions provided by the software to ensure your submission is valid.

If my IRS 1040 - Schedule SE submission is rejected, what steps should I take?

If your IRS 1040 - Schedule SE is rejected, the e-filing software will typically provide the reason for the rejection. Correct the issues reported, and then resubmit your form as soon as possible to avoid delays in processing your tax return.

See what our users say