What are forms 940 and 941 used for?

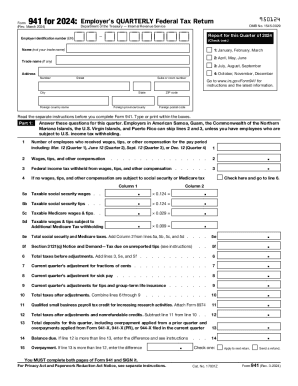

Form 940 is for federal unemployment, and 941 is for Medicare, Social Security, and federal income tax withholding. Form 940 is an annual form due every Jan. 31, and Form 941 is due quarterly, one month after the end of a quarter.

What is the difference between federal 940 and 941?

The two IRS forms are similar. However, Form 940 is filed annually and it only reports an employer's FUTA taxes. Form 941, on the other hand, reports federal income tax withholding and Federal Insurance (FICA) taxes—and it's filed every quarter.

Who needs to fill out form 941?

Who must file Form 941. Generally, any person or business that pays wages to an employee must file a Form 941 each quarter, and must continue to do so even if there are no employees during some of the quarters.

Generally, you must file Form 941, Employer's QUARTERLY Federal Tax Return or Form 944, Employer's ANNUAL Federal Tax Return to report wages you've paid and tips your employees have reported to you, as well as employment taxes (federal income tax withheld, social security and Medicare taxes withheld, and your share of

What is a form 941 used for and when must it be filed?

Generally, you must file Form 941, Employer's QUARTERLY Federal Tax Return or Form 944, Employer's ANNUAL Federal Tax Return to report wages you've paid and tips your employees have reported to you, as well as employment taxes (federal income tax withheld, social security and Medicare taxes withheld, and your share of

What is Form 941 used for?

Employers use Form 941 to: Report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks. Pay the employer's portion of Social Security or Medicare tax.

Do I have to file a 941 if I have no payroll?

Do I Have to File Form 941 If No Wages Were Paid? Most employers need to file Form 941 even if no wages were paid. However, there are a few exceptions, including employers of seasonal employees, household employees, or farm employees. However, other IRS forms may be required.

Do you have to file a 940 and a 941?

The Key Differences Between Forms 940 and 941 Additionally, form 940 is required to be filed annually, while business owners must file form 941 quarterly. Most owners are required to file form 941. There are a few exceptions, including: Those who hire employees seasonally.

Who needs to file Form 940?

If you paid any wages that are subject to the unemployment compensation laws of a credit reduction state, your credit against federal unemployment tax will be reduced based on the credit reduction rate for that credit reduction state. Use Schedule A (Form 940) to figure the credit reduction.

Who must file IRS Form 941?

File Schedule B (Form 941) if you are a semiweekly schedule depositor. You are a semiweekly depositor if you: Reported more than $50,000 of employment taxes in the lookback period. Accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year.

What is the difference between Form 940 and Form 941?

The two IRS forms are similar. However, Form 940 is filed annually and it only reports an employer's FUTA taxes. Form 941, on the other hand, reports federal income tax withholding and Federal Insurance (FICA) taxes—and it's filed every quarter.

Is Federal 940 annual or quarterly?

Under the general test, you're subject to FUTA tax on the wages you pay employees who aren't household or agricultural employees and must file Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return for 2021 if: You paid wages of $1,500 or more to employees in any calendar quarter during 2020 or 2021, or.

What is the 941 form used for?

Employers use Form 941 to: Report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks. Pay the employer's portion of Social Security or Medicare tax.

Do I need to file 940 and 941?

Additionally, form 940 is required to be filed annually, while business owners must file form 941 quarterly. Most owners are required to file form 941. There are a few exceptions, including: Those who hire employees seasonally.

Are 940 payments due quarterly?

While Form 940 is only due once per year, payments may be required throughout the year. Companies owing at least $500 per year in FUTA taxes must pay quarterly to avoid penalties. However, if they owe less than $500 in a quarter, the amount owed can be carried forward until they owe at least $500.

Who needs to fill out Form 941?

Who must file Form 941. Generally, any person or business that pays wages to an employee must file a Form 941 each quarter, and must continue to do so even if there are no employees during some of the quarters.

What happens if you don't file Form 941?

If you fail to File your Form 941 or Form 944 by the deadline: Your business will incur a penalty of 5% of the total tax amount due. You will continue to be charged an additional 5% each month the return is not submitted to the IRS up to 5 months.

Under which condition is an employer not required to file a quarterly Form 941?

Most businesses are required to file Form 941 quarterly, with a few exceptions. Seasonal businesses only need to file for the quarters in which they are operating. Businesses that hire farm workers or household employees, such as a maid, also don't need to file Form 941 (but do need to file Schedule H from Form 1040).

Do I need to file Form 941 if no wages were paid?

Do I Have to File Form 941 If No Wages Were Paid? Most employers need to file Form 941 even if no wages were paid. However, there are a few exceptions, including employers of seasonal employees, household employees, or farm employees. However, other IRS forms may be required.