Who needs a 720 form?

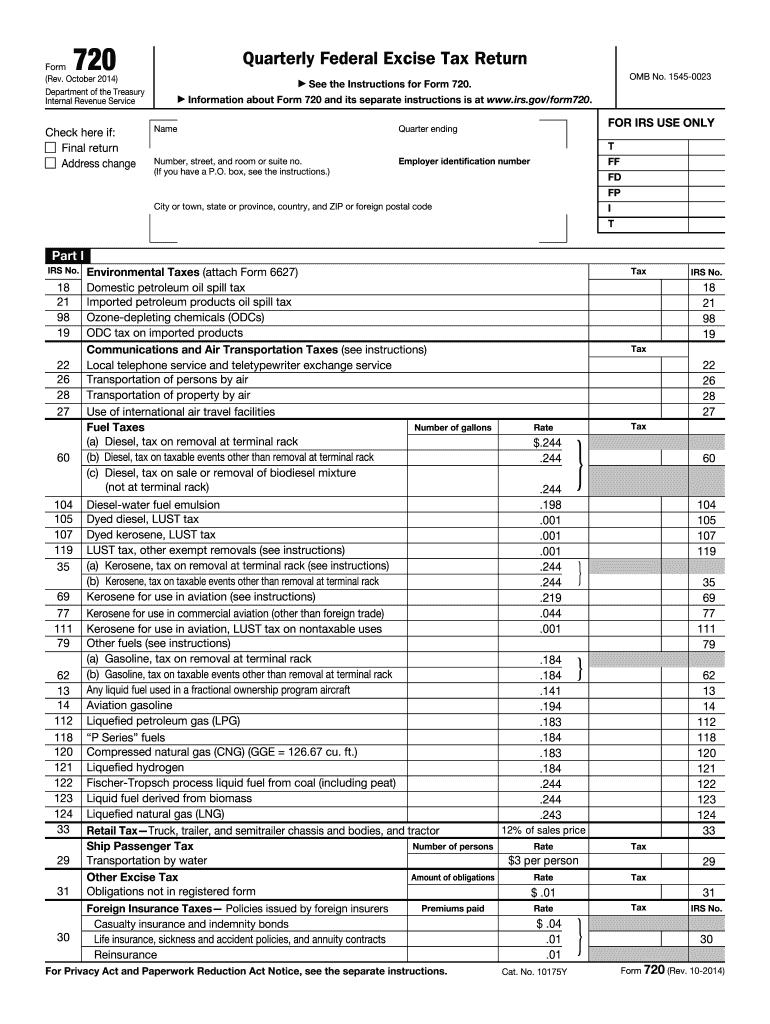

Form 720 is important for filing to all taxpayers, who were liable or responsible for collecting federal excise taxes. Parts 1 and 2 are extremely urgent for completing to prior quarter and current form wasn’t filed before. The same thing relates to taxpayers, who must inform IRS about condition to current quarter.

What is for 720 form?

Form and related attachments are needed for reporting to IRS about taxpayer’s liability to IRS by number and pay all needed taxes, which were mentioned in form. Completed form allows taxpayer to be eligible for claiming a credits by using Schedule C.

Failing or ignoring sending of this application may cause a penalty like full amount of unpaid taxes and lose trust from credit organizations.

Is 720 Form accompanied by other forms?

IRS form 720 is accompanied by 6627 Form and may contain attachments about paid taxes or financial condition of taxpayer.

When is 720 Form due?

720 form due: April 30, July 31, October 31, January 31.

How do I feel out 720 Form?

-

Check needed boxes (if they are common) and personal information of taxpayer (you)

-

Complete all parts and schedules.

If the way of tax reporting is not usual, place zero to the specific line in Parts 1 and 2. If there wasn’t tax report from your side, note “None” in part 3 and line 3. Filing is not required if you report patient-centered outcomes research fee.

In case, when you send some additional sheets with following form, you must sign them, write your name and write EIN on each sheet.

Where do I send 720 Form?

Completed 720 form must be sent to:

Department of the Treasury, IRS Cincinnati, OH 45999-0009