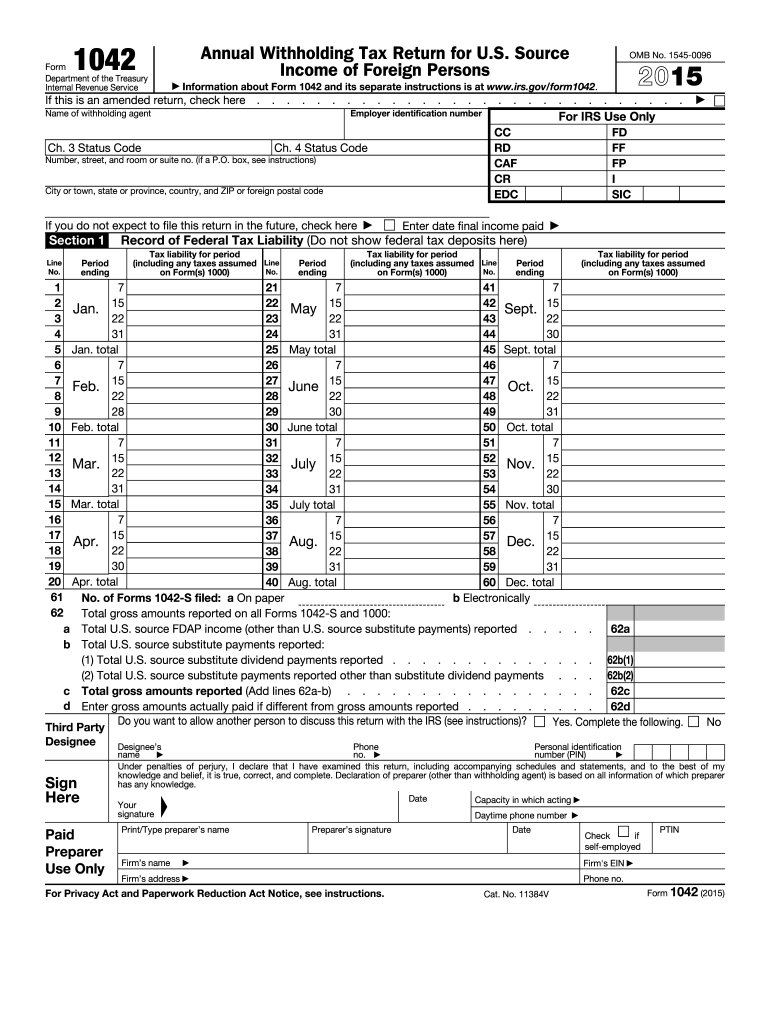

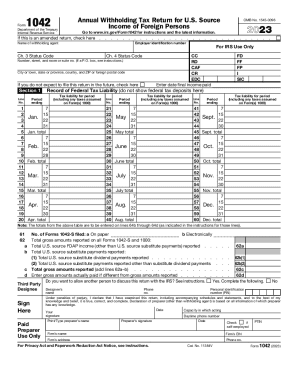

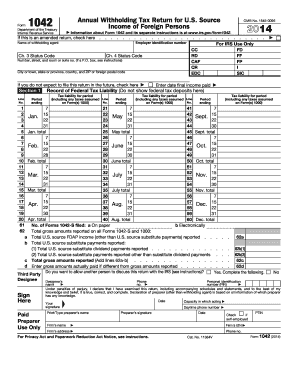

Who Files Form 1042?

Every withholding agent or intermediary who receives, controls, has custody of, disposes of, or pays a withholdable payment (to which chapter 4 withholding of the Internal Revenue Code applies) or an amount subject to withholding, must file an annual return for the preceding calendar year on Form 1042 unless an exception to filing applies. Also, any publicly traded partnership (PTP) or nominee making a distribution of the effectively connected income under section 1446, or any entity required to report a distribution on Form 1042-S that is subject to withholding under section 1445, must file Form 1042 for the preceding calendar year.

What is the Purpose of Form 1042?

The purpose of the form is to report the following.

- The tax withheld under chapter 3 of the Internal Revenue Code (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income of foreign persons, including nonresident aliens, foreign corporations, foreign partnerships, foreign trusts and foreign estates.

- The tax withheld under chapter 4 on withholdable payments of the Internal Revenue Code.

- The tax withheld pursuant to section 5000C on specified federal procurement payments.

- The tax withheld under section 877A on payments of eligible deferred compensation items or distributions from non-grantor trusts to a covered expatriate.

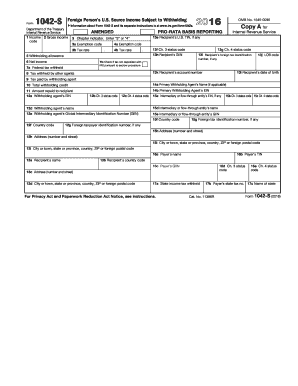

- Payments that are reported on Form 1042-S under chapter 3 or 4.

Is Form 1042 Accompanied by other Forms?

All withholding agents must verify entries on lines 67a and 67b by attaching supporting Forms 1042-S.

When is Form 1042 Due?

The form must be submitted by March 15th, 2017. If you need more time to file Form 1042, you may submit Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns. Form 7004 does not extend the time for payment of tax.

How do I Fill out Form 1042?

You can find the IRS instructions on how to fill the form at https://www.irs.gov/uac/about-form-1042

Where do I Send Form 1042?

Mail Form 1042 to:

Ogden Service Center

P.O. Box 409101

Ogden, UT 84409