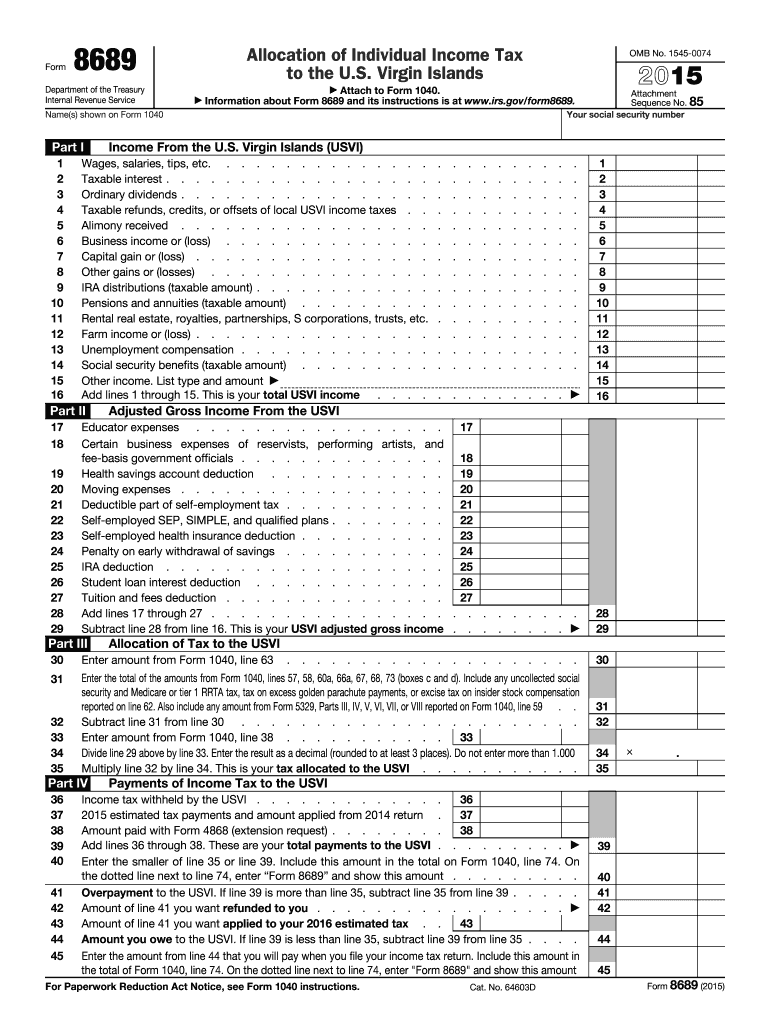

Who can Use Form 8689?

You can avail of Form 8689, in case you were a citizen of the United States or even a resident alien. It refers to the territory of the Virgin Islands (SVI) and income taxation considering businesses there. The liability of the SVI tax coincides with the U.S. one. The applicant is not to make use of this template if they are a bona fide resident of the U.S. Virgin Islands during the whole taxation year.

What is the Significance of the Form 8689?

A person is eligible to file Form 8689 for figuring out the total of the United States tax, which is distributed to the Virgin Islands as well.

What are the Time Frames for Form 8689?

Starting with the 31st of December 2004, the revenue gained on the location of the United States, which can be somehow connected with the trade conduction there, is no more considered as the income of the U.S. Virgin Islands.

Which Attachments Accompany Form 8689?

This statement is to be added to a 1040 template as a certain documentary supplement. Nonetheless, it can be filed independently, considering various occasions in businesses.

What is to be mentioned in Form 8689?

Initially, it is significant to fill in all four parts of Form 8689. The applicant signifies all income rates on the Virgin Islands (including wages and salaries, tips and interests, dividends, capital gains, losses, IRA distributions, social security benefits, etc.). Adjusted Gross Income is included in the second part of the template. The applicant notifies the educator, moving expenses, self-employment tax, deduction, health insurance and other points. The third part involves the Allocation of Tax to the Virgin Islands. Here you need to arrange some calculations to get the general result. And the last — fourth — section is devoted to the Payment of the Income Tax in the SVI.