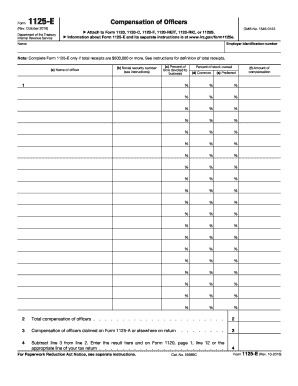

Compensation of Officers

The templates you get with the Compensation of Officers package

Get your paperwork done faster by managing documents in groups. Get the Compensation of Officers forms package to simplify the process of submitting these forms, working with them simultaneously.

Ditch searching for the tax document or application you need. Using pdfFiller, templates are carefully categorized and organized into packages. The Compensation of Officers package, like other deals available, offers a pack of templates you can submit and file for an unlimited number of times. Conveniently change the structure of your document and edit its content. There are various customizing features available, all of them grouped into separate convenient toolbars according to the cases they serve. Once finished, click Done and now you're ready to send the forms out.

The Compensation of Officers forms package, as well as the other form bundles by pdfFiller, allows you to find, fill out, and share required documents in no time, thanks to convenient search algorithms and categorizing. Special template bundles like the one listed above will come in use when you need to file various documents for a particular occasion, fast. Don't go another day to find your submissions rejected due to improper formatting or a single not completed form - get the Compensation of Officers forms package, fill out with the required information, put a digital signature and send out, all within a single platform.

More In Forms and Instructions Certain entities with total receipts of $500,000 or more use Form 1125-E to provide a detailed report of the deduction for compensation of officers.

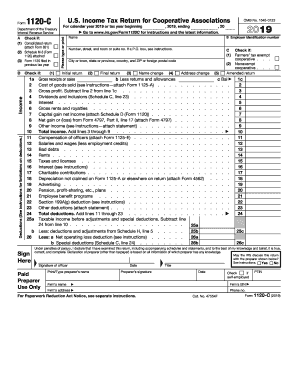

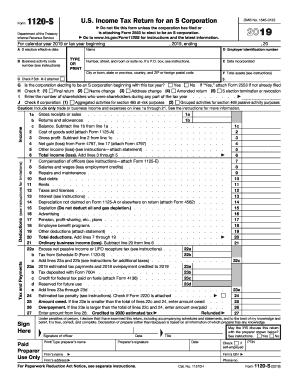

Corporations operating on a cooperative basis file this form to report their. income, gains, losses, deductions, credits, and. to figure their income tax liability.

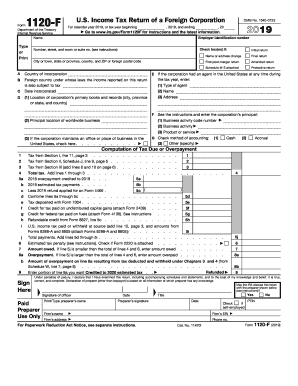

Use Form 1120-F to report the income, gains, losses, deductions, credits, and to figure the U.S. income tax liability of a foreign corporation.

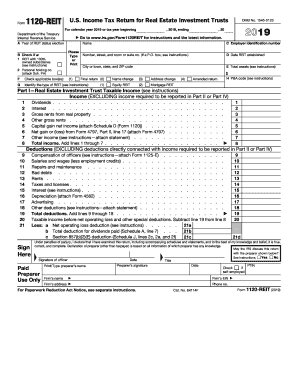

Use Form 1120-REIT, U.S. Income Tax Return for Real Estate Investment Trusts, to report the income, gains, losses, deductions, credits, certain penalties, and to figure the income tax liability of a REIT.

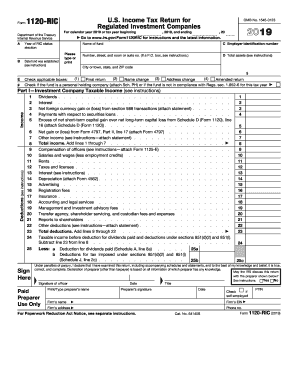

Use Form 1120-RIC, U.S. Income Tax Return for Regulated Investment Companies, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a regulated investment company (RIC) as defined in section 851.

Compensation of Officers FAQs