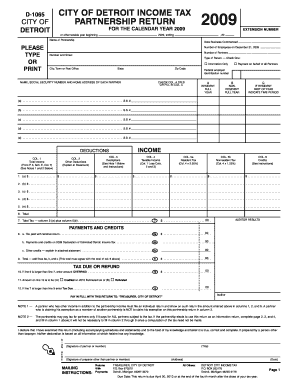

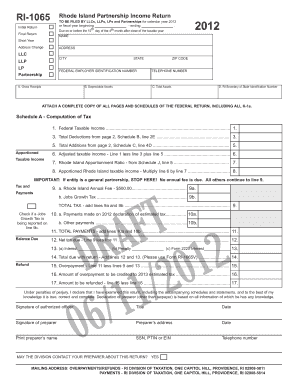

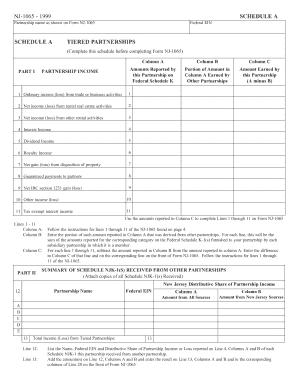

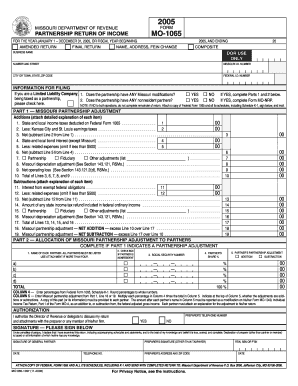

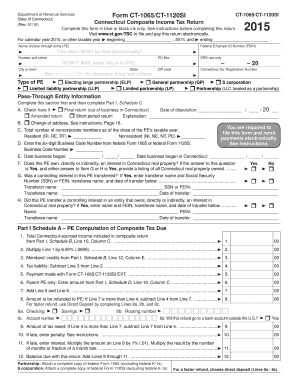

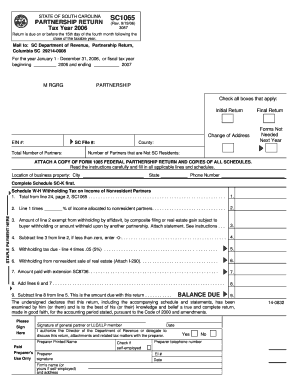

What is 1065 tax form?

The 1065 tax form, also known as the U.S. Return of Partnership Income, is a tax form used by partnerships to report their income, deductions, and tax liability to the Internal Revenue Service (IRS). It is filed annually and provides information about the partnership's financial activities.

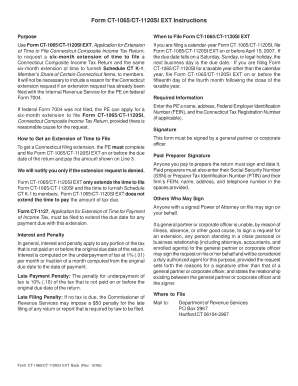

What are the types of 1065 tax form?

There are two main types of 1065 tax forms:

1. Form 1065: This is the standard form used by most partnerships to report their income, deductions, and tax liability.

2. Form 1065-B: This form is used by certain electing large partnerships to report their income, deductions, and tax liability. This form is filed by partnerships with more than 100 partners and gross receipts exceeding $500,000.

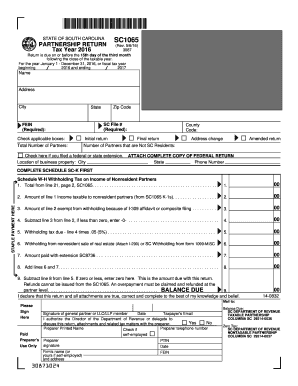

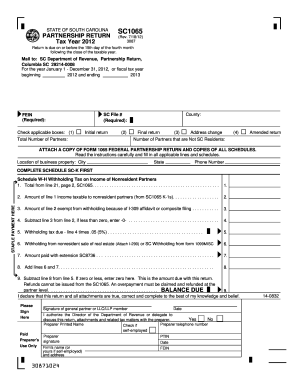

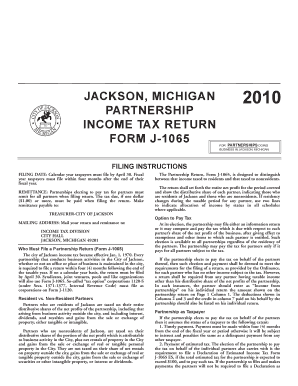

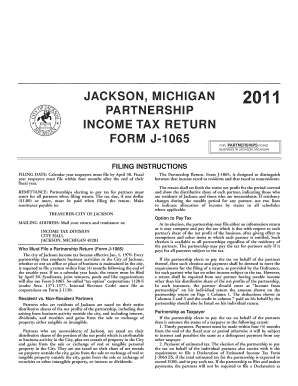

How to complete 1065 tax form

Completing the 1065 tax form may seem daunting, but with the right preparation, it can be done effectively. Here are the steps to complete the form:

01

Gather all necessary information: Collect all the financial information related to your partnership, including income and expenses, employee wages, capital contributions, and any other relevant details.

02

Fill out the general information: Provide the partnership's name, address, Employer Identification Number (EIN), and the tax year for which the form is being filed.

03

Report income and deductions: Enter the partnership's total income and deductions according to the instructions provided. Make sure to report any specific types of income or deductions required by the IRS.

04

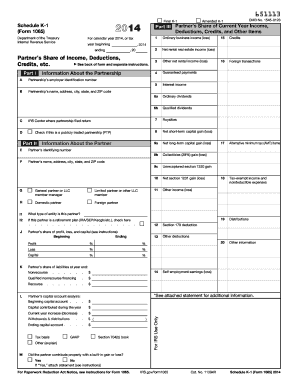

Allocate income, deductions, and credits: If the partnership has multiple partners, allocate the income, deductions, and credits to each partner based on their ownership percentage.

05

File Schedule K-Prepare and file Schedule K-1 for each partner, showing their share of the partnership's income, deductions, and credits. Provide a copy of Schedule K-1 to each partner.

06

Sign and submit the form: Sign the 1065 tax form and submit it to the IRS before the deadline. Keep a copy for your records.

07

Review and double-check: Take the time to review the completed form for accuracy and ensure that all required information has been provided.

08

pdfFiller simplifies the process: Remember that you can use pdfFiller, an online PDF editor, to streamline the completion and submission of your 1065 tax form. With its unlimited fillable templates and powerful editing tools, pdfFiller empowers you to efficiently create, edit, and share your documents online.

Completing the 1065 tax form may require careful attention to detail, but by following these steps and utilizing pdfFiller's resources, you can confidently navigate the process and ensure accurate reporting of your partnership's financial information.