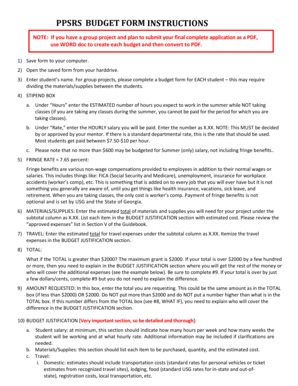

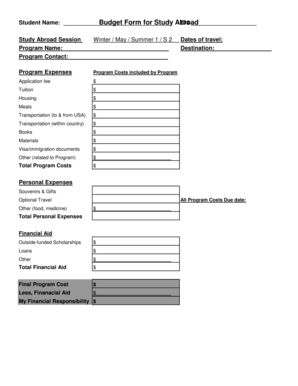

College Student Budget Template

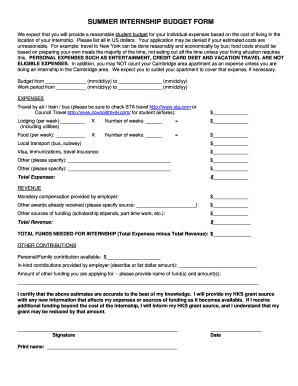

What is College Student Budget Template?

A College Student Budget Template is a tool that helps college students keep track of their income, expenses, and savings. It provides a framework for managing finances and ensuring financial stability during the college years.

What are the types of College Student Budget Template?

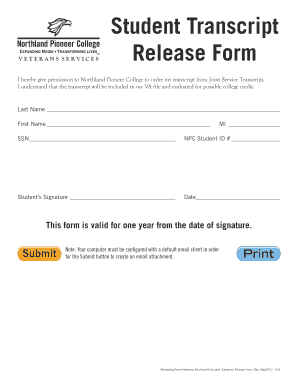

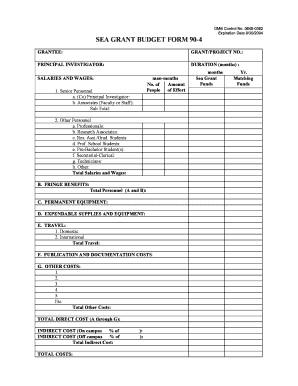

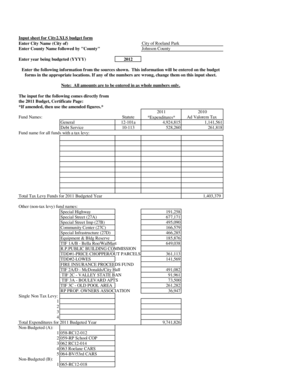

There are several types of College Student Budget Templates available to cater to different needs and preferences. Some common types include:

How to complete College Student Budget Template

Completing a College Student Budget Template is a straightforward process. Here are the steps to follow:

By following these steps, you can effectively manage your finances and achieve your financial goals while in college. Remember that pdfFiller is here to assist you in creating, editing, and sharing your College Student Budget Template online. With unlimited fillable templates and powerful editing tools, pdfFiller is your all-in-one PDF editor.