Dave Ramsey Budget Forms

Why are Dave Ramsey Budget forms useful?

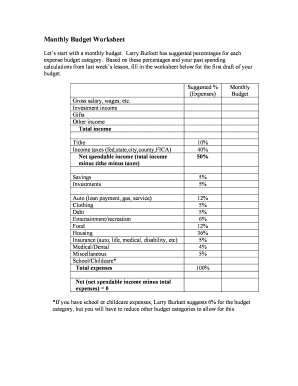

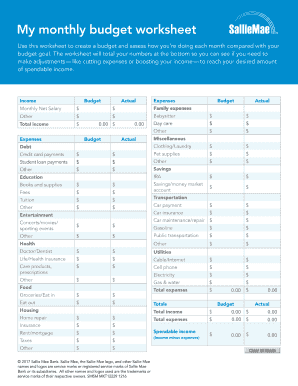

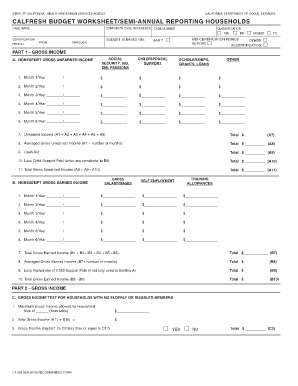

If you are eager to have your funds under control, the usage of templates, created by Dave Ramsey — is one of the best choices for you. Do you want to save money for Christmas gifts or college? Be clever and armed to do that in the best way. Careful planning and audit will help a person not to worry about bad days in his or her life. As a result, everyone will know what family spends money for and how it is better to save and collect the sum you would like to have. Undoubtedly, the best way to arrange a budget — is to do it on your computer without any paper. In addition to that, you may use Dave Ramsey budget forms to analyze all the risks you may have. All criteria in templates are balanced and taken into consideration for all expenditures to be comprised.