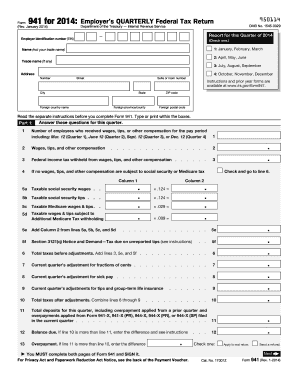

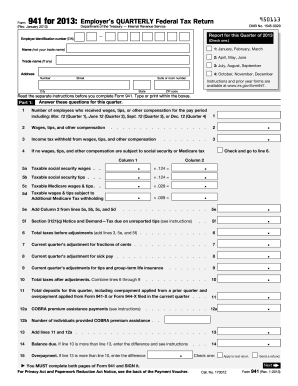

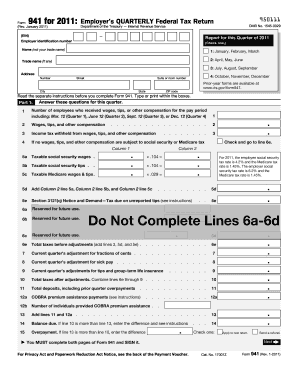

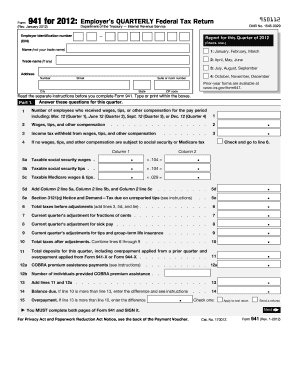

941 Form

What is 941 Form?

The 941 Form is a quarterly tax form used by employers to report wages paid to employees and taxes withheld from those wages. It is also used to calculate and report the employer's share of FICA taxes.

What are the types of 941 Form?

There are three main types of 941 Form: 941, 941-PR (for use in Puerto Rico), and 941-SS (for use in the U.S. Virgin Islands). Each form is used to report employment taxes for different regions.

How to complete 941 Form

Completing the 941 Form is essential for every employer to ensure accurate reporting of wages and taxes. Here are some steps to help you complete the form:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.