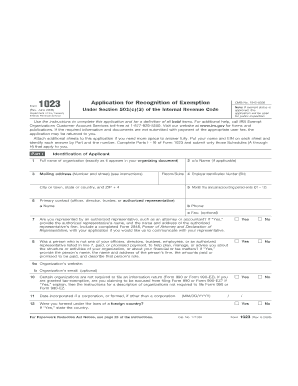

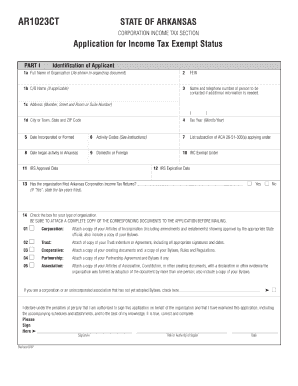

What is form 1023 filing fee?

Form 1023 filing fee refers to the fee that an organization must pay when submitting their application for tax exemption under section 501(c)(3) of the Internal Revenue Code. This fee is required by the IRS to process the application and determine if the organization is eligible for tax-exempt status.

What are the types of form 1023 filing fee?

There are different types of form 1023 filing fees, depending on the size and nature of the organization:

Standard Filing Fee: This is the most common filing fee and is applicable to most organizations. The current standard filing fee for Form 1023 is $600.

Reduced Filing Fee: Certain small organizations may qualify for a reduced filing fee of $275 if their gross receipts for each of the past 4 years have been $10,000 or less.

Group Exemption Letter Fee: If an organization is applying for a group exemption letter, the filing fee is $2,000.

User Fee for Expedited Handling: If an organization requires expedited handling of its application, an additional user fee of $850 is required.

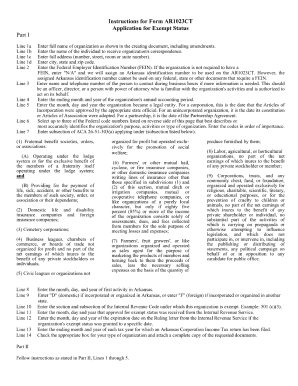

How to complete form 1023 filing fee

Completing form 1023 filing fee can be a complex process, but with the right guidance, it can be done effectively. Here are the steps to complete the form:

01

Gather all necessary information and documents, including the organization's financial statements, bylaws, and articles of incorporation.

02

Review the instructions provided by the IRS for Form 1023 to understand the requirements and ensure accurate completion of the form.

03

Fill out the form, providing all requested information, such as the organization's name, purpose, activities, and financial details.

04

Pay the applicable filing fee online or by mail, following the IRS guidelines and using the appropriate payment method.

05

Submit the completed form and all supporting documents to the IRS for review.

06

Monitor the status of the application and respond promptly to any requests for additional information or clarification.

07

Once the application is approved, the organization will receive a determination letter from the IRS confirming its tax-exempt status.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.