What is form 1120 instructions?

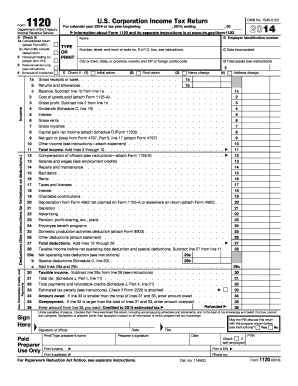

Form 1120 instructions are guidelines provided by the Internal Revenue Service (IRS) to help businesses complete and file their Form 1120, also known as the U.S. Corporation Income Tax Return. These instructions outline the necessary steps and requirements for accurately reporting income, deductions, credits, and tax liability on this form.

What are the types of form 1120 instructions?

There are several types of form 1120 instructions that businesses may need to reference depending on their specific circumstances. The types of Form 1120 instructions include:

General instructions: These instructions provide an overview of the form and explain the general requirements for completing it.

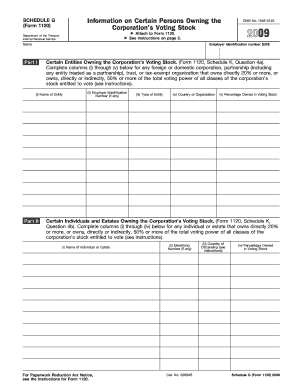

Specific instructions for certain schedules: These instructions provide detailed information on completing specific schedules that may be required based on the business's activities or characteristics.

Instructions for Form 1120 filing requirements: These instructions outline the filing requirements and deadlines for Form 1120, including information on electronic filing options.

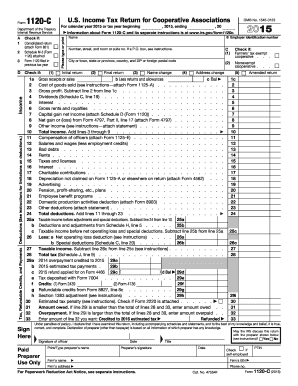

Instructions for Form 1120-A: These instructions are specific to Form 1120-A, which is a simplified version of Form 1120 for certain small businesses.

How to complete form 1120 instructions

Completing Form 1120 can seem daunting, but with careful attention to detail and following the instructions provided by the IRS, it can be done efficiently. Here's a step-by-step guide to completing Form 1120:

01

Gather all necessary financial records and supporting documentation, such as income statements, balance sheets, and documentation of deductions and credits.

02

Fill in the required basic information about your business, including its name, address, and EIN (Employer Identification Number).

03

Carefully enter your business's income and deductions, following the guidelines provided in the Form 1120 instructions.

04

If applicable, complete and attach any required schedules based on your business's activities or characteristics, as outlined in the Form 1120 instructions.

05

Calculate your tax liability using the provided worksheets or the IRS's online tax calculation tools.

06

Double-check all entered information for accuracy and completeness, making sure to include all required signatures and attachments.

07

Submit your completed Form 1120 to the appropriate IRS address by the specified deadline, keeping a copy for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.