Free Fillable 1099 Misc Form 2013

What is free fillable 1099 misc form 2013?

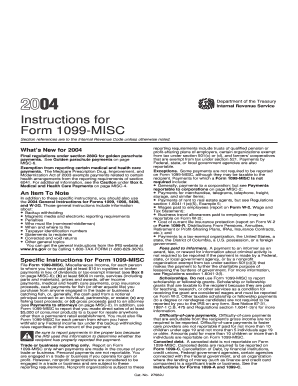

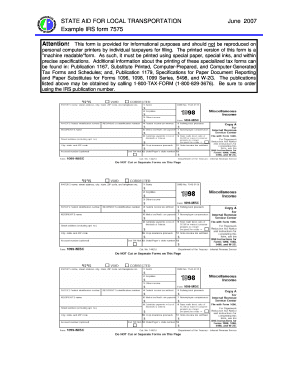

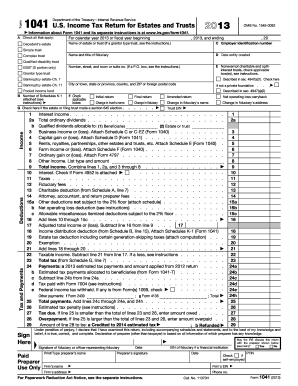

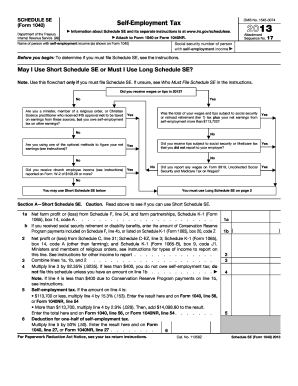

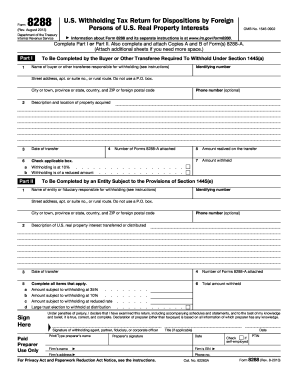

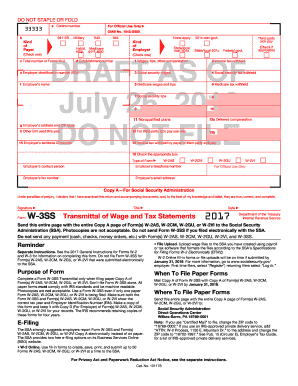

The free fillable 1099 misc form 2013 is a tax form used by businesses to report miscellaneous income for the year 2013. It is specifically designed for independent contractors and freelancers to report their earnings and expenses. The form includes information such as the recipient's name, address, and social security number, as well as details of the income and any applicable deductions. By completing this form accurately, businesses can fulfill their tax obligations and avoid any penalties or fines.

What are the types of free fillable 1099 misc form 2013?

There are different types of free fillable 1099 misc form 2013, depending on the type of income being reported. Some common types include: 1. Nonemployee compensation 2. Rents 3. Royalties 4. Other income These types of forms allow businesses to accurately report their income and ensure compliance with the IRS regulations.

How to complete free fillable 1099 misc form 2013

Completing the free fillable 1099 misc form 2013 is a straightforward process. Here are the steps you need to follow: 1. Gather all the necessary information, including the recipient's details, income amounts, and any applicable deductions. 2. Access a reliable platform or software that offers fillable templates for the form. 3. Open the form and enter the required information in the respective fields, ensuring its accuracy. 4. Double-check all the entered information to avoid any errors or omissions. 5. Save the completed form and share it with the recipient or the relevant tax authorities as required.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.