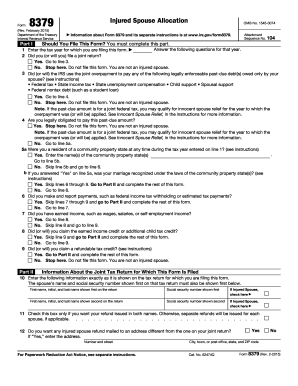

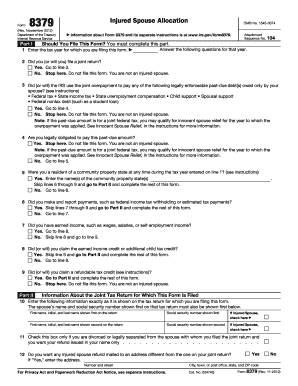

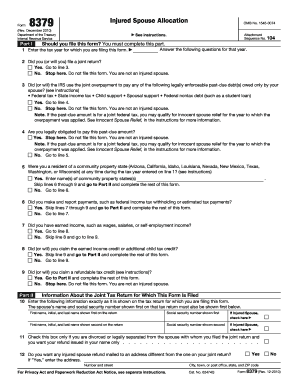

8379 Form

What is 8379 Form?

The 8379 Form is an Internal Revenue Service (IRS) form used by taxpayers who wish to claim their portion of a tax refund that was intercepted due to their spouse's legally owed debt. It allows innocent spouses to request their share of the refund by filing this specific form.

What are the types of 8379 Form?

There are two types of 8379 Forms that individuals can use: 1. Injured Spouse Allocation: This form is used when a taxpayer wants to claim their share of a tax refund that has been seized to cover their spouse's debts. 2. Injured Spouse Election: This form is used to request the allocation of the refund based on the taxpayer's share of the income and expenses reported on the joint tax return.

How to complete 8379 Form

Completing the 8379 Form is a straightforward process. Here are the steps to fill it out correctly:

If you need assistance or a convenient way to fill out the 8379 Form, consider using pdfFiller. With pdfFiller, you can easily create, edit, and share your documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done effortlessly.