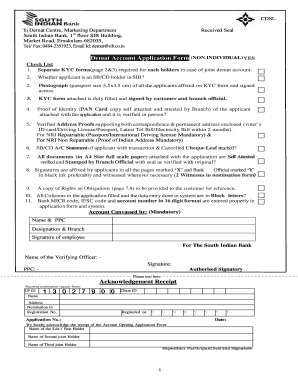

Kyc Form For Pf

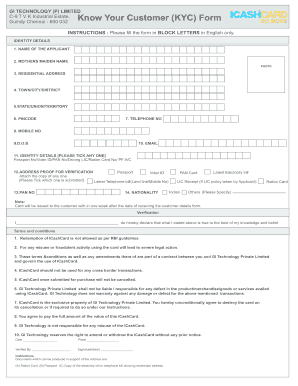

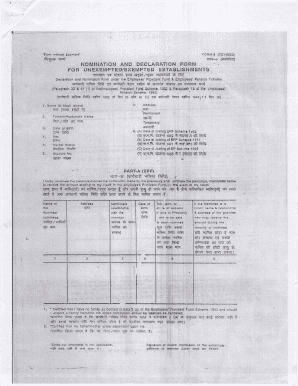

What is kyc form for pf?

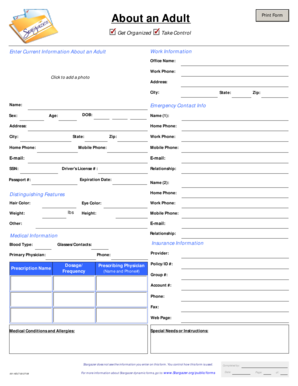

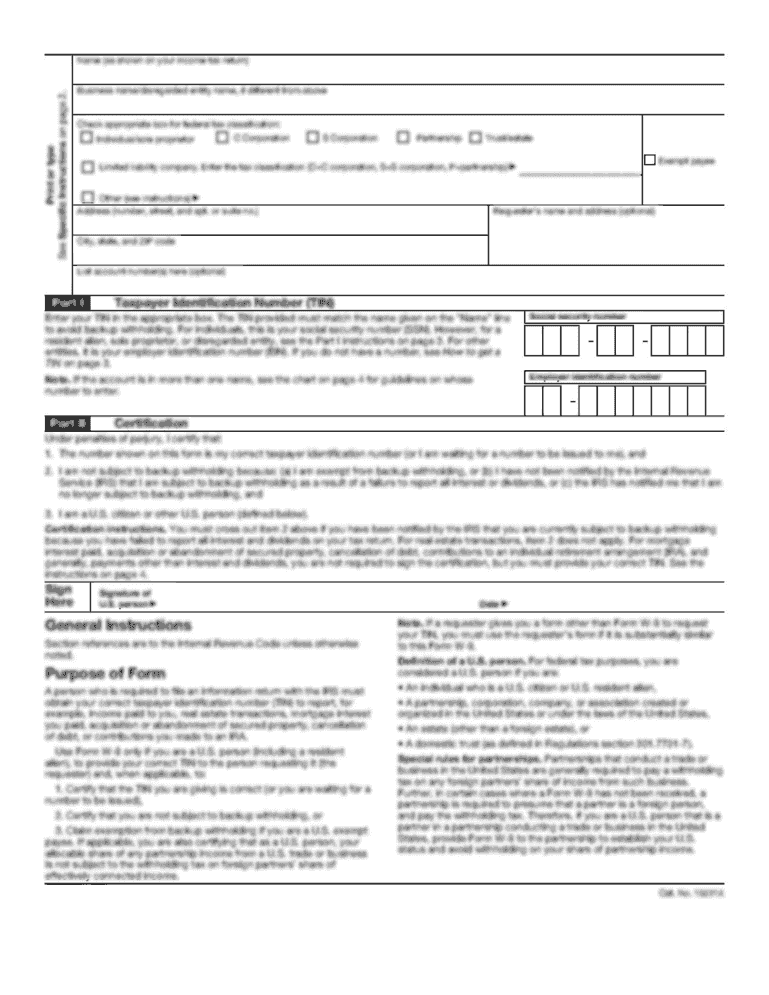

The KYC form for PF, which stands for Know Your Customer form for Provident Fund, is a document that serves as an identity proof for PF account holders. This form helps in verifying the identity and address details of the account holder. It is an essential document required to manage and authenticate PF accounts.

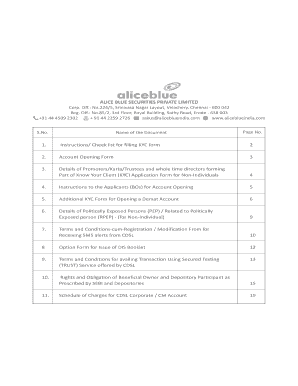

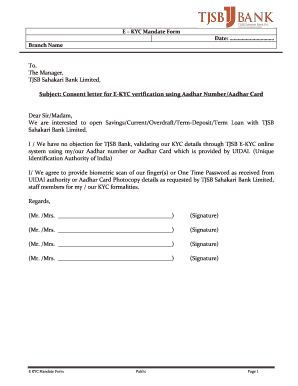

What are the types of kyc form for pf?

There are two types of KYC forms for PF that differ based on the purpose and details required. These forms are:

How to complete kyc form for pf

Completing the KYC form for PF is a simple process, and here are the steps you need to follow:

pdfFiller is an exceptional online platform that enables users to effortlessly create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the go-to PDF editor you need to efficiently complete your documents.