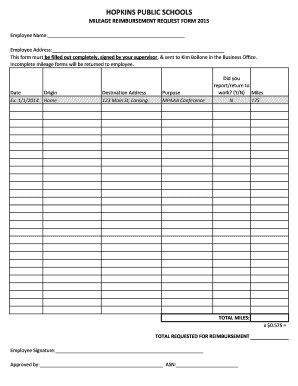

What is Mileage Reimbursement Form?

A Mileage Reimbursement Form is a document used by employers to compensate employees for any mileage expenses incurred during work-related travel. It allows employees to request reimbursement for the use of their personal vehicle for business purposes. Employers use this form to track and document the reimbursement process.

What are the types of Mileage Reimbursement Form?

There are several types of Mileage Reimbursement Forms, depending on the specific needs of the organization. The most common types include:

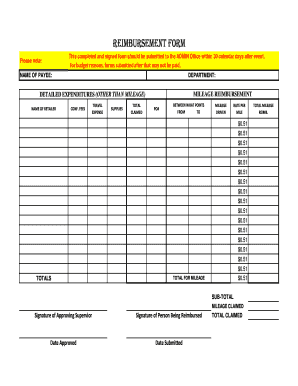

Standard Mileage Reimbursement Form: This form is used to reimburse employees based on the standard mileage rate set by the IRS.

Actual Expense Reimbursement Form: This form is used to reimburse employees based on the actual expenses incurred during business travel, such as fuel, maintenance, and repairs.

Fixed Rate Reimbursement Form: This form is used to reimburse employees a fixed rate per mile traveled, regardless of the actual expenses.

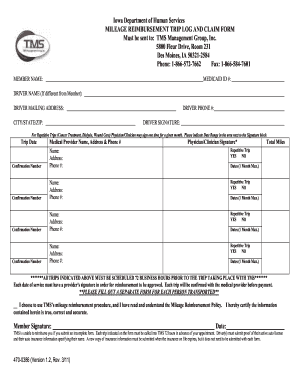

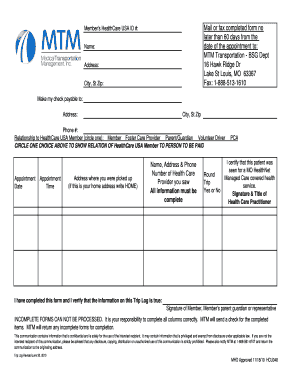

Enterprise-Specific Reimbursement Form: Some organizations may have their own customized mileage reimbursement form tailored to their specific business needs.

How to complete Mileage Reimbursement Form

Completing a Mileage Reimbursement Form is a straightforward process. Here are the steps to follow:

01

Write the name of the employee requesting reimbursement.

02

Provide the employee's identification number or employee ID.

03

Date the form with the date of travel.

04

Specify the purpose of the travel and the destination.

05

Record the starting and ending mileage of the trip.

06

Calculate the total miles traveled for reimbursement.

07

If applicable, note any non-reimbursable expenses.

08

Attach supporting documents such as receipts or a travel log.

09

Submit the completed form to the appropriate department for processing.

pdfFiller is an excellent tool that empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the go-to PDF editor for getting documents done efficiently.