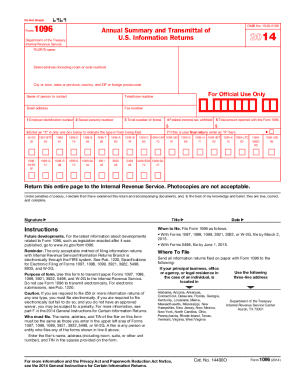

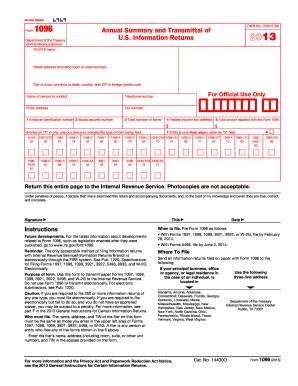

1096 Form

What is 1096 Form?

The 1096 Form, also known as Annual Summary and Transmittal of U.S. Information Returns, is a document used by businesses to report the summary of information returns filed with the IRS. It is necessary for businesses to complete this form if they have filed any of the following forms: 1097, 1098, 1099, 3921, 3922, 5498, 8935, or W-2G.

What are the types of 1096 Form?

There are various types of information returns that require a 1096 Form. These include:

Form 1097:-BTC, Bond Tax Credits

Form Mortgage Interest Statement

Form Miscellaneous Income

Form Exercise of an Incentive Stock Option

Form Transfer of Stock Acquired Through an Employee Stock Purchase Plan

Form IRA Contribution Information

Form Airline Career Longevity Award

Form W-2G: Certain Gambling Winnings

How to complete 1096 Form

Completing the 1096 Form is a straightforward process. Here is a step-by-step guide:

01

Obtain the correct version of Form 1096 from the IRS website or an authorized vendor.

02

Fill in your business name, address, and employer identification number (EIN) at the top of the form.

03

Enter the total number of forms being transmitted in Box 3.

04

Provide the total amount reported on the attached forms in Box 4.

05

Review the form for accuracy and ensure all required fields are filled.

06

Sign and date the form.

07

Keep a copy for your records and submit the form to the IRS as instructed.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 1096 Form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I file a 1099 NEC electronically?

How to efile 1099 NEC form: Sign up on our website for free. Fill in the payer, payee information. Fill in the 1099 NEC form which is in the electronic format. Submit the completed 1099 NEC form to the IRS and that's it.

How do I electronically file Form 1096?

Technically there is no such thing as 1096 e-File or efiling 1096 forms. Form 1096 is used to transmit paper Forms 1099 to the Internal Revenue Service. Do not use Form 1096 to transmit electronically.

Can Form 1096 be filled out by hand?

Upload complete! A: Yes, it is permissible to submit handwritten forms.

Can I hand write Form 1096?

A: Yes, it is permissible to submit handwritten forms.

Do I need to file 1096 if I file 1099 Electronically?

According to the IRS, individuals filing 1099s electronically do not need to submit an accompanying 1096. If you're e-filing any of the other forms associated with Form 1096, you must use the IRS's FIRE system to do so. (See Publication 1220 for more information about e-filing Form 1096.)

Can you file a 1096 electronically?

Information returns may also be filed electronically. To file electronically, you must have software, or a service provider, that will create the file in the proper format.

Related templates