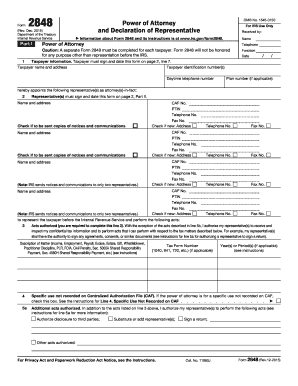

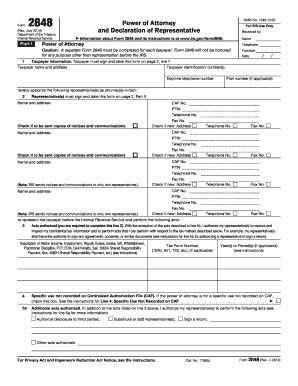

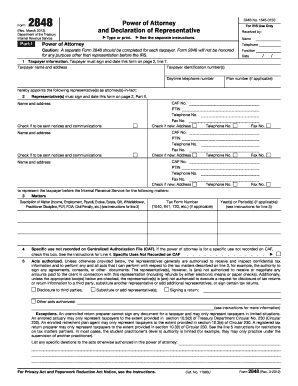

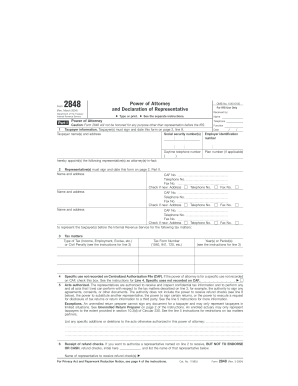

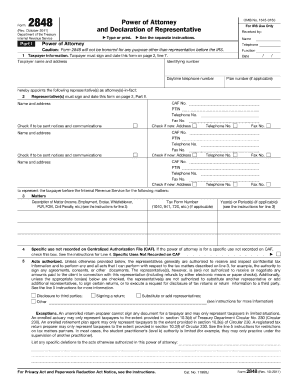

2848 Form

What is 2848 Form?

The 2848 form, also known as the Power of Attorney and Declaration of Representative, is a document issued by the Internal Revenue Service (IRS) in the United States. It allows an individual or entity to designate another person to act on their behalf in matters related to tax filing and representation before the IRS.

What are the types of 2848 Form?

There are two main types of Form 2848: individual and business. The individual form is used by individuals to authorize someone to represent them in tax matters personally. The business form, on the other hand, is used by entities such as corporations, partnerships, and trusts to authorize a representative to act on their behalf.

How to complete 2848 Form

Completing the 2848 Form is a straightforward process. Here is a step-by-step guide to help you:

By using pdfFiller, you can easily complete the Form 2848 online. pdfFiller provides unlimited access to fillable templates and powerful editing tools, making it the only PDF editor you need to get your documents done.