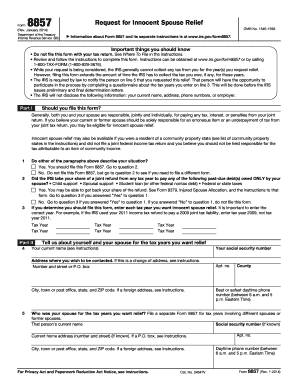

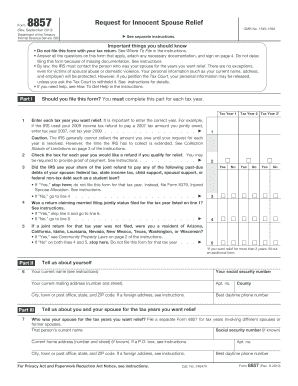

8857 Form

What is 8857 Form?

The 8857 Form, also known as the Request for Innocent Spouse Relief, is a document used by taxpayers who want to be relieved of responsibility for the tax liability that should be paid by their spouse or former spouse.

What are the types of 8857 Form?

There are three types of 8857 Form that taxpayers can use to request innocent spouse relief: 1. Form 8857 - Innocent Spouse Relief 2. Form 8857 - Separation of Liability Relief 3. Form 8857 - Equitable Relief

How to complete 8857 Form

Completing the 8857 Form is simple and straightforward. Here are the steps you need to follow: 1. Gather all the necessary information, including your personal details, your spouse's details, and the reasons why you believe you qualify for innocent spouse relief. 2. Fill in your personal information in section 1 of the form. This includes your name, address, and Social Security number. 3. Provide your spouse's information in section 2 of the form. Include their name, address, and Social Security number. 4. Indicate the tax years for which you are requesting relief in section 3 of the form. 5. Clearly explain in section 4 why you believe you should be granted innocent spouse relief. 6. Sign and date the form. Once you have completed the form, you should submit it to the IRS along with any supporting documentation.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.