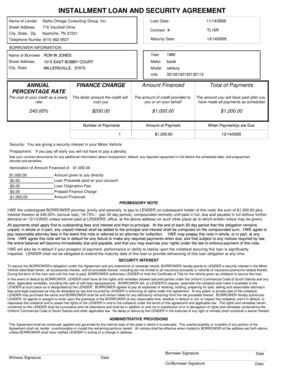

Security Agreement Format

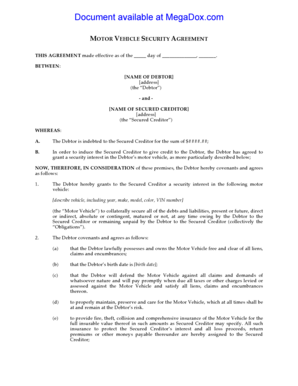

What is security agreement format?

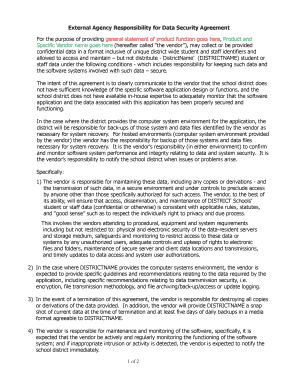

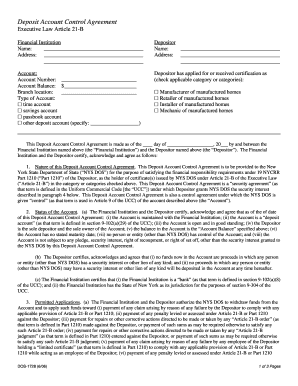

A security agreement format is a legally binding contract that outlines the terms and conditions agreed upon between a borrower and a lender regarding the collateral provided to secure a loan or financial obligation. This document ensures that the lender has a legal right to repossess the collateral in the event of default by the borrower.

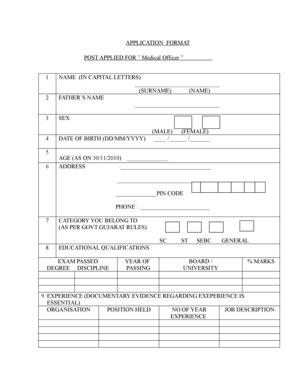

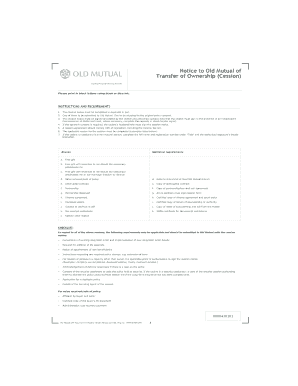

What are the types of security agreement format?

There are different types of security agreement formats based on the nature of the collateral involved. Some common types include:

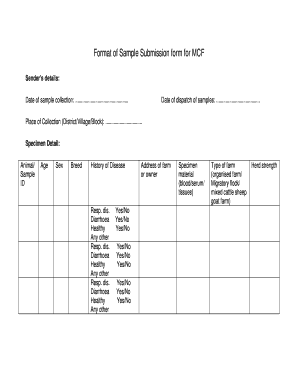

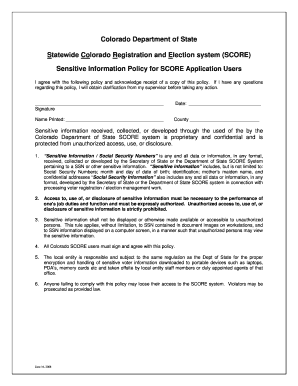

How to complete security agreement format

Completing a security agreement format requires attention to detail and thorough understanding of the terms involved. Here are some steps to guide you through the process:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.