Simple College Budget

What is Simple College Budget?

Simple College Budget is a budgeting tool specifically designed for college students to help them manage their finances effectively while they are pursuing their studies. It provides a systematic approach to tracking and controlling expenses, ensuring that students stay within their budget and prioritize their spending.

What are the types of Simple College Budget?

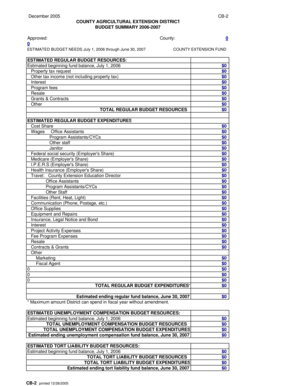

There are two main types of Simple College Budget: basic budget and detailed budget. 1. Basic Budget: This type of budget focuses on the essential expenses such as tuition fees, accommodation, textbooks, and basic living costs. It provides a simple overview of income and expenses without going into too much detail. 2. Detailed Budget: This type of budget takes a more comprehensive approach and includes all the necessary expenses as well as discretionary spending. It breaks down expenses into categories like food, transportation, entertainment, and personal care, allowing students to have a detailed understanding of where their money is going.

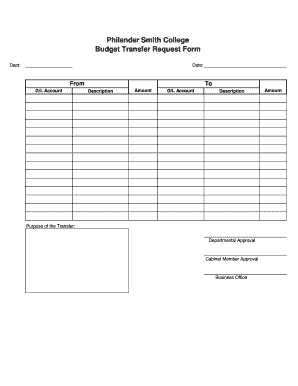

How to complete Simple College Budget?

Completing a Simple College Budget is easy and straightforward. Here are the steps to follow:

By following these steps, you can effectively complete a Simple College Budget and take control of your finances while studying. Remember, pdfFiller provides a convenient platform for creating, editing, and sharing your budget online, making the process even simpler and more efficient.