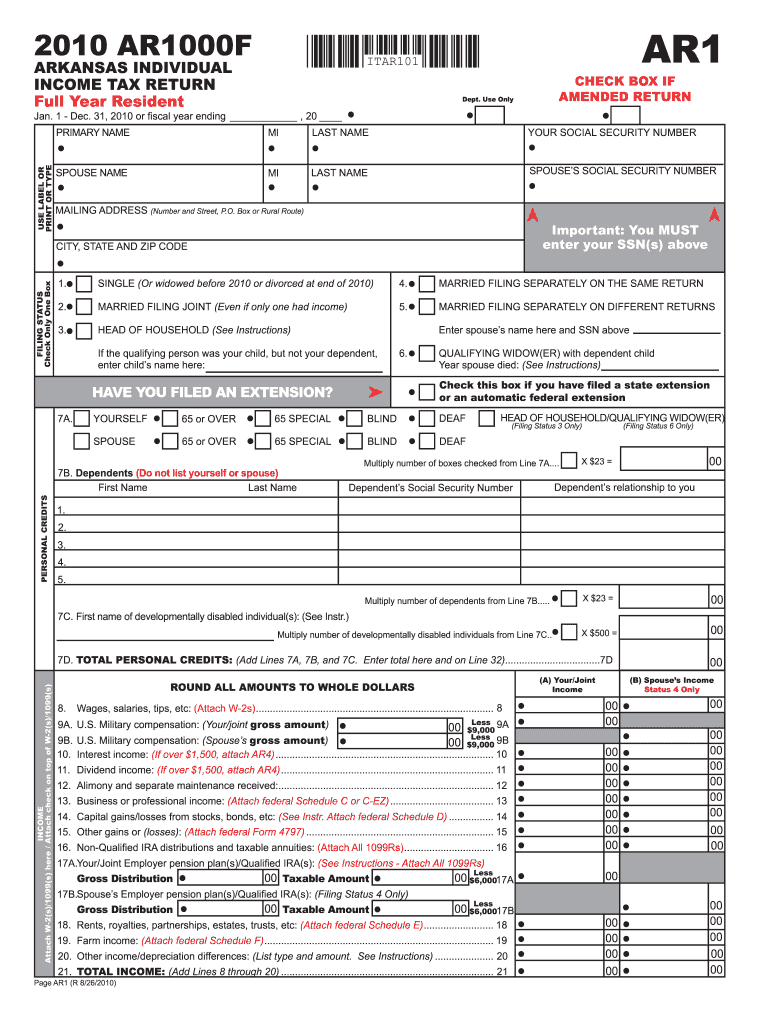

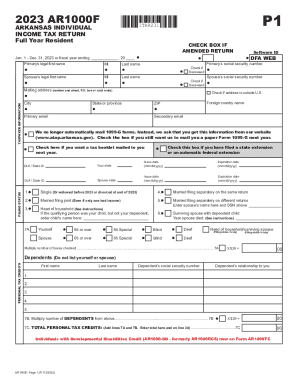

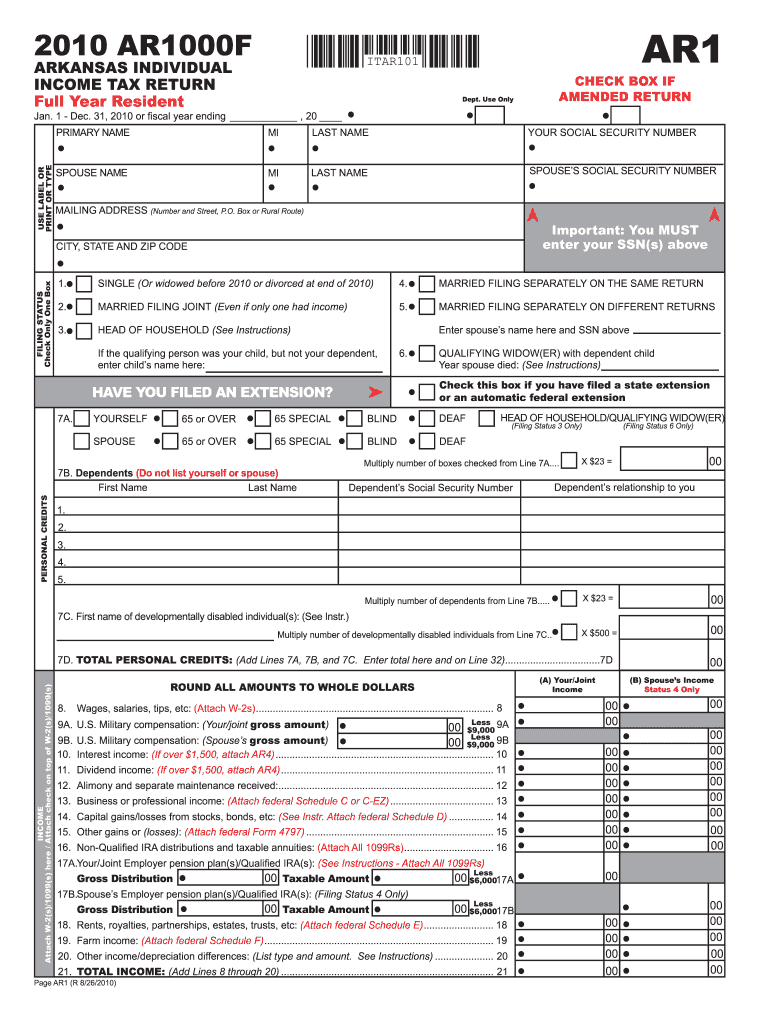

AR DFA AR1000F 2010 free printable template

Get, Create, Make and Sign

Editing arkansas state income tax online

AR DFA AR1000F Form Versions

How to fill out arkansas state income tax

How to fill out Arkansas state income tax:

Who needs Arkansas state income tax:

Instructions and Help about arkansas state income tax

When DOT engineer rich gazer watched the deadly mudslides on highway 24 last year he was in all oh my god debris washed down from the Waldo Canyon burn scar clogging this 72-inch Culver that sent mud and rocks onto the roadway causing many to get stuck in claiming one life that's when we decided we had to do something there we don't want to have any more deaths or serious accident somewhere what they decided was to replace the old metal culvert with this new 10-foot by 24 foot concrete one very much larger to put it in perspective I can barely crouch in the old culvert now it's about six times as wide which means about six times the debris to be able to flow through here and avoid flooding the highway they're just still going to be at as much water as ever in Fountain Creek but least it won't be going across the highway and down the ramp diverting this water will save money on the reconstruction MIDADE had to do since the slides we have to repair the ramp coming up out of MANA to last year because it is moist out, and they say it will cut back on flood patrols that have since shut down the highway each time it rains

Fill form : Try Risk Free

People Also Ask about arkansas state income tax

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your arkansas state income tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.