Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

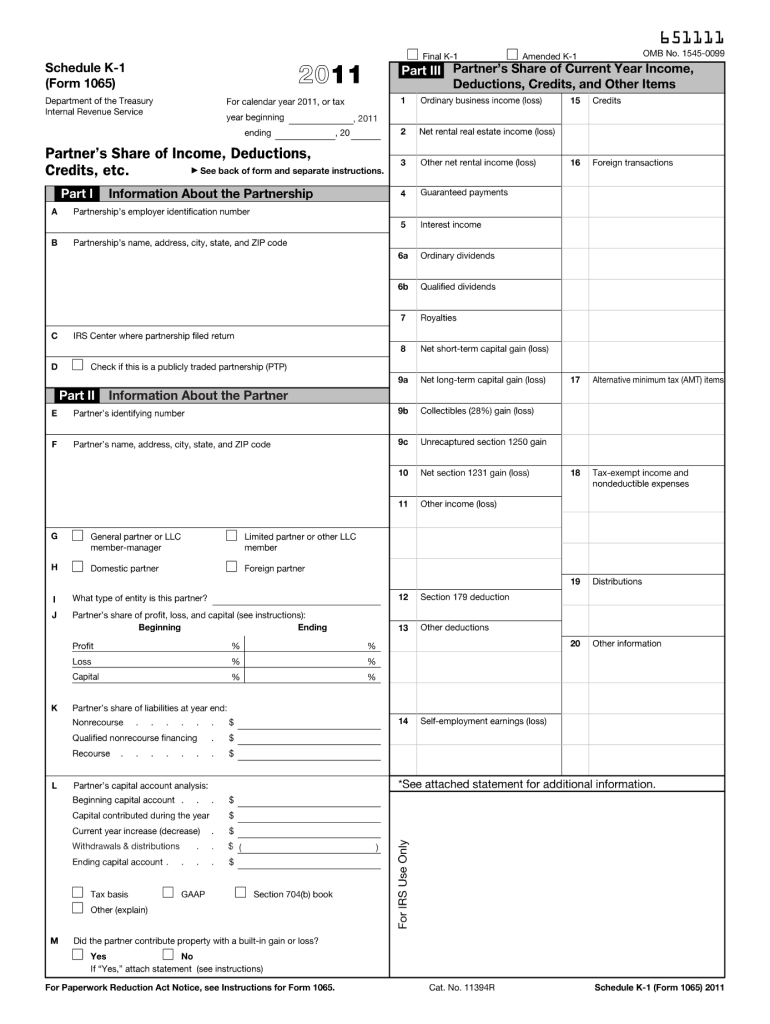

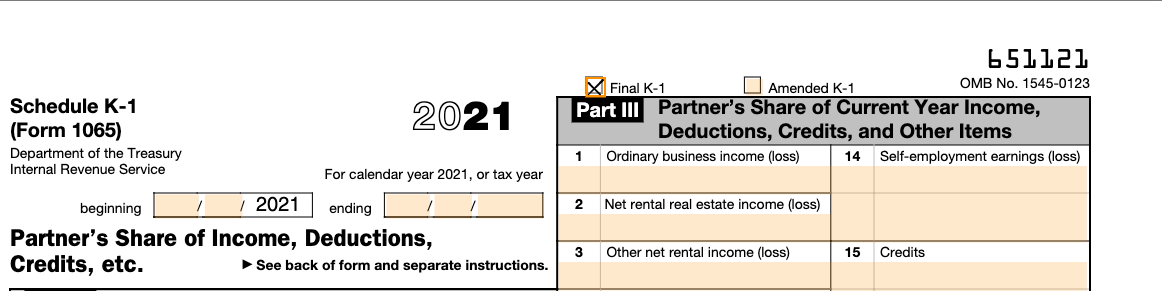

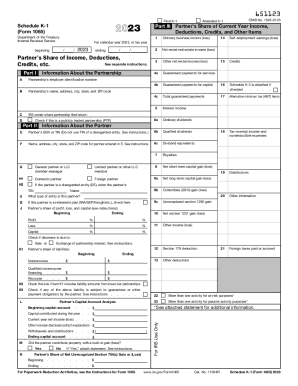

Form 1065 K-1 is a tax form used by partnerships to report the individual partner's share of the partnership's income, deductions, credits, etc. It is used to report the partner's share of the partnership's earnings and losses, as well as their share of any credits and deductions. The information from the K-1 is then used by the individual partner to complete their own personal tax return.

Who is required to file form 1065 k 1?

Form 1065 K-1 is filed by partners in a partnership or members of a limited liability company (LLC) that is treated as a partnership for tax purposes. Each partner or member will receive a K-1 form which reports their share of the partnership's income, deductions, and credits. They are required to report this information on their personal tax returns.

How to fill out form 1065 k 1?

Filling out Form 1065 Schedule K-1 involves several steps. Here is a general guide to help you with the process:

1. Obtain and review the partnership's Schedule K-1 instructions: The instructions provided by the Internal Revenue Service (IRS) will provide guidance on each specific line item and how to properly report income, deductions, and credits.

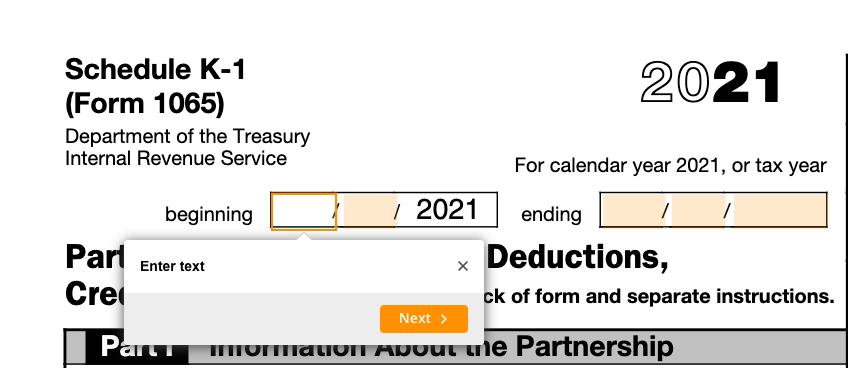

2. Gather relevant information: Collect the necessary financial and tax-related information, such as the partnership's legal name, tax identification number (TIN), and the tax year for which you are filing.

3. Enter Partnership Information: Complete the header section of Form 1065 Schedule K-1 by identifying the partnership's name, address, TIN, and tax year.

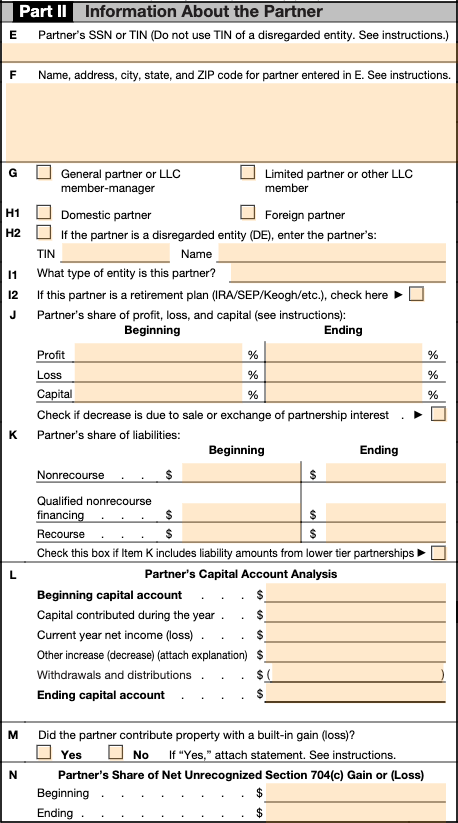

4. Complete Schedule K-1: Schedule K-1 consists of several parts. Each partner's share of income, deductions, and credits is reported in Part III, while information related to partner's capital accounts is reported in Part II.

a) Partner Information: Fill in the identification information for each partner, including name, address, and TIN.

b) Distributive Share of Income and Deductions: Allocate and report each partner's share of partnership income, deductions, and credits, such as ordinary business income, rental real estate income, self-employment earnings, interest income, capital gains, charitable contributions, etc.

c) Partner's Capital Account Analysis: Provide information about each partner's beginning and ending capital balances, as well as any changes during the tax year, including capital contributions, withdrawals, partnership share of liabilities, and share of partnership income or loss.

d) Self-Employment Earnings: If a partner is subject to self-employment tax, report the allocated share of net earnings from self-employment on Schedule SE.

5. Review and Submit: Ensure that all the information provided in Schedule K-1 is accurate and complete. Once you have reviewed the form, attach it to the partnership's Form 1065 and submit it to the IRS by the tax filing deadline.

Note: It is recommended to consult a tax professional or CPA when filling out complex forms like Form 1065 Schedule K-1, especially if you are unsure about specific tax regulations or have complex partnership arrangements.

What is the purpose of form 1065 k 1?

Form 1065 Schedule K-1 is used to report the individual partner's share of income, deductions, and credits for a partnership. It is a tax form that provides detailed information about the partner's share of the partnership's business activities and is used to report this information on the partner's personal tax return. By completing Schedule K-1, a partner can accurately report their share of the partnership's income and deductions in order to calculate their own tax liability.

What information must be reported on form 1065 k 1?

Form 1065 Schedule K-1 is used by partnerships to report each partner's share of income, deductions, and credits. The following information must be reported on Form 1065 Schedule K-1:

1. Partner's identifying information: The name, address, and taxpayer identification number (TIN) of each partner.

2. Partnership Information: The name, address, and employer identification number (EIN) of the partnership.

3. Distributive Share of Income, Deductions, and Credits: Each partner's share of income, deductions, and credits for each specific line item as reported on the partnership's Schedule K-1.

4. Self-employment earnings: If a partner is subject to self-employment tax, their distributive share of partnership income subject to self-employment tax needs to be reported.

5. Ordinary Business Income (Loss): The net profit or loss from the partnership's ordinary business activities.

6. Other Information: Any additional information or disclosures required by the IRS.

It's important to note that the specific details to be reported on Form 1065 Schedule K-1 depend on the partnership's activities, and the IRS provides instructions for completing the form accurately. Therefore, it is recommended to consult the instructions or a tax professional for more specific guidance.

When is the deadline to file form 1065 k 1 in 2023?

The deadline to file Form 1065 Schedule K-1 for the tax year 2022 is March 15, 2023. However, it's important to note that the deadline for filing tax returns can change, so it's always a good idea to check with the IRS or a tax professional for the most up-to-date information.

What is the penalty for the late filing of form 1065 k 1?

The penalty for late filing of Form 1065 K-1 can vary depending on the circumstances. As of 2020, the penalty for each month or part of a month the form is late can be $210 per partner, up to a maximum of 12 months. If the partnership can provide a reasonable cause for the delay, they may be able to avoid the penalty. It is recommended to consult the IRS instructions or a tax professional for specific penalty amounts and information related to your situation.

How do I edit form 1065 k 1 online?

With pdfFiller, the editing process is straightforward. Open your form 1065 k 1 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for the form 1065 k 1 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your form 1065 k 1 in minutes.

How do I fill out form 1065 k 1 using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign form 1065 k 1 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.